- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: 2022 AZ Form 309 Not Found

2022 AZ Form 309 Not Found

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am trying to enter the credit for taxes paid to another state or country. I am only able to find a place to override the amount on AZ Form 301. I have searched for the form and nothing shows up. When I check the form status in ProConnect it says "The form is final and watermarked E-File Only. This form is available to be E-Filed"

Do I need to paper file this return or is there some secret to finding the form in the software?

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

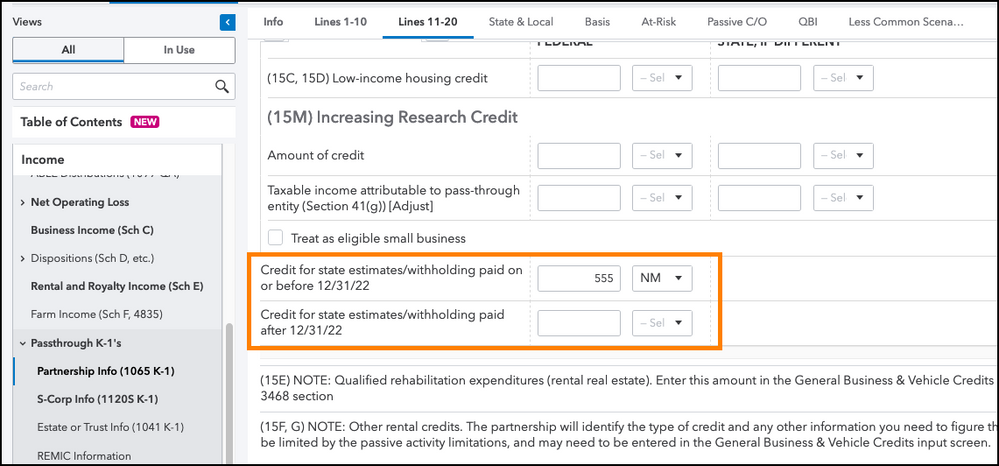

ProConnect will usually generate the other state tax credit for state returns whenever you enter taxes withheld or paid to another state anywhere on the return. The taxes are usually entered on the income screen they're related to (like a W-2 or a K-1) with the appropriate state identifier selected, like these fields for a partnership K-1:

The 309 in particular looks like it will only generate when there's both income taxed to another state and taxes paid. You can go to Check Return, click Forms on the left, and select AZ. Then choose "All" right above the search bar. That will allow you to view the 309 if it's not generating with your return, and help you determine what's missing or why the program doesn't think it's applicable yet.

- Rebecca

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

ProConnect will usually generate the other state tax credit for state returns whenever you enter taxes withheld or paid to another state anywhere on the return. The taxes are usually entered on the income screen they're related to (like a W-2 or a K-1) with the appropriate state identifier selected, like these fields for a partnership K-1:

The 309 in particular looks like it will only generate when there's both income taxed to another state and taxes paid. You can go to Check Return, click Forms on the left, and select AZ. Then choose "All" right above the search bar. That will allow you to view the 309 if it's not generating with your return, and help you determine what's missing or why the program doesn't think it's applicable yet.

- Rebecca

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"ProConnect will usually generate the other state tax credit for state returns whenever you enter taxes withheld or paid to another state anywhere on the return. The taxes are usually entered on the income screen they're related to (like a W-2 or a K-1) with the appropriate state identifier selected, like these fields for a partnership K-1:"

I hope that is not how it works since that would be wrong.

Just because I have withholding on my W-2 for a nonresident state does not mean I paid tax to that state. I could get it all back by filing a nonresident return. Or I could get some of it back.

"The 309 in particular looks like it will only generate when there's both income taxed to another state and taxes paid"

This is correct.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you, I found the form and was able to get it to populate with the correct information to e-file.