- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: 1065 K-1 Part II H2 & I1

1065 K-1 Part II H2 & I1

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do you code 1065 K-1 Part II I1 as Disregarded Entity

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I believe both sections should be reviewed. There are issues where the activities of a general partner should be considered passive. Partner information is always needed. Misc only sometimes.

You may want to contact support to be certain. Contact Support EITHER https://proconnect.intuit.com/community/proconnect-tax-news-updates/discussion/proconnect-tax-assist... OR https://proconnect.intuit.com/support/en-us/help-article/intuit-account-settings/contact-proconnect-...

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

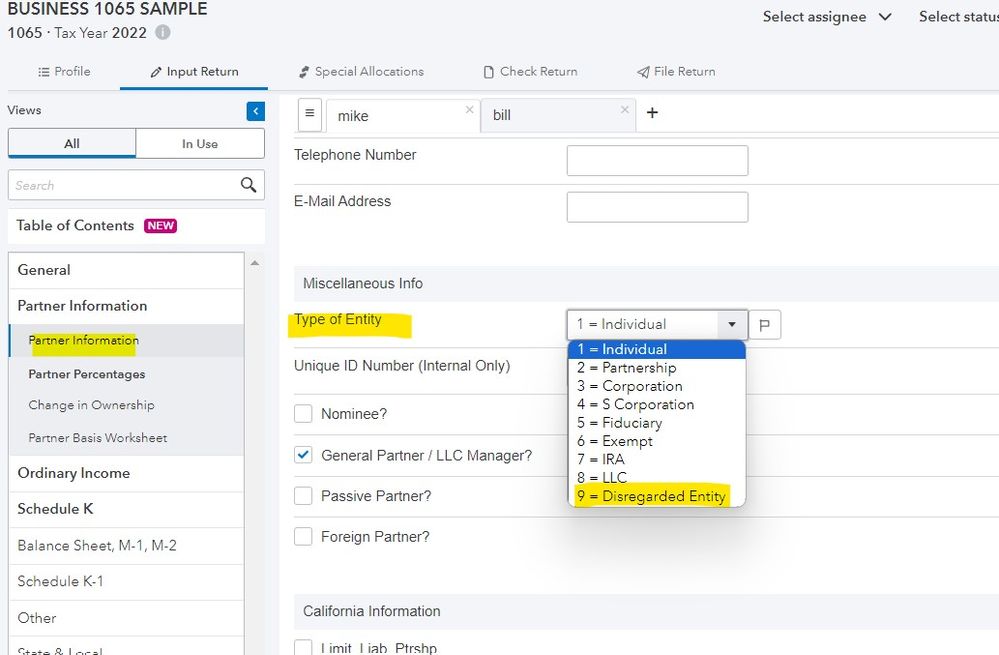

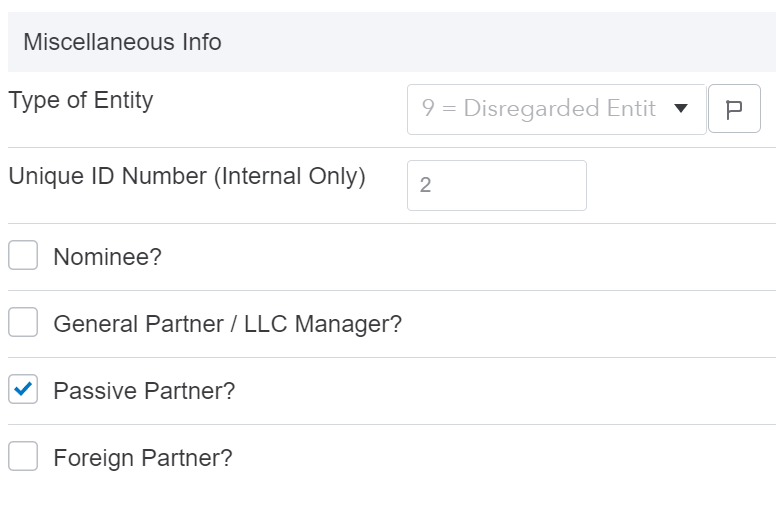

When you set up the Partner Information, you select from 9 choices, #9 is disregarded entity.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

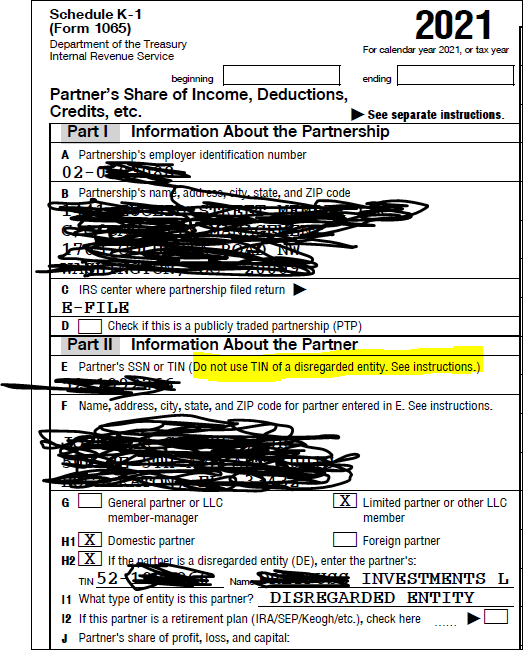

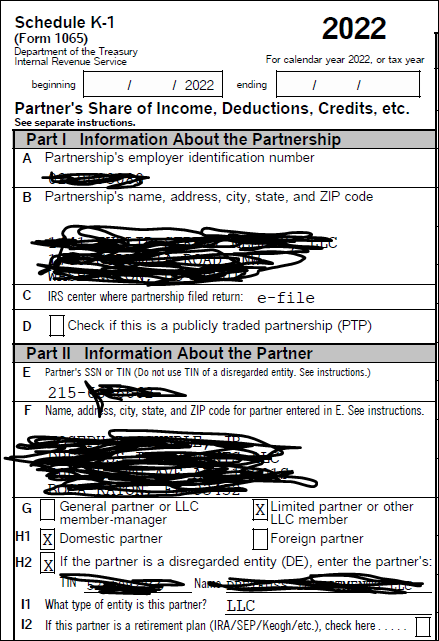

Prosystem in past years has populated I1 as DE. The ProConnect drop-down for that field does not offer DE as option. While the beneficiary of DE is an individual, the DE itself is not an Individual. What is I1 looking for? The Beneficiary or the DE? IRS instruction for the field is not clear.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

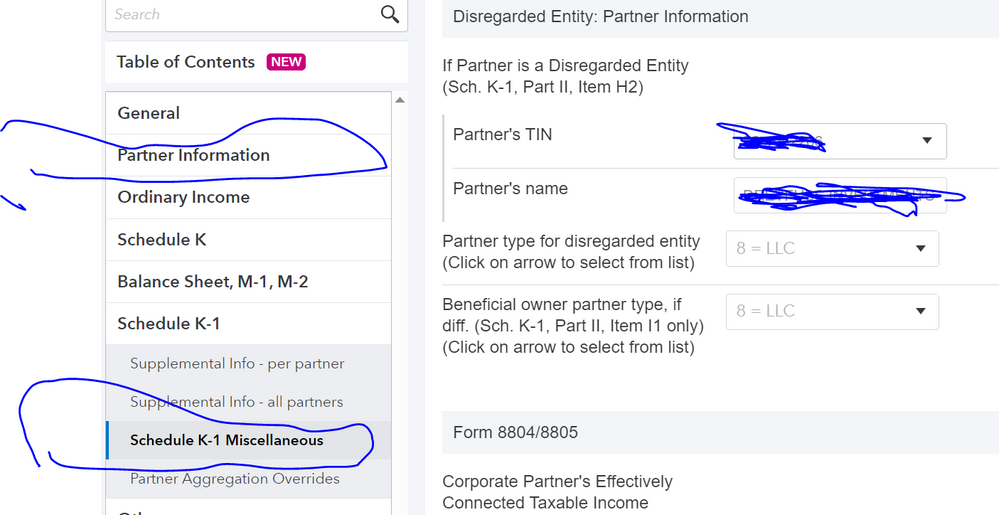

This should get you the result H2 will be the EIN and name of the DE and I1 will have the wording Disregarded Entity (Not drop down for ID Number to select EIN)

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are the two partnership input areas both supposed to be completed or only the Miscellaneous Information? The return is locked now, and I cannot edit but this DE is in 40 K-1's

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I believe both sections should be reviewed. There are issues where the activities of a general partner should be considered passive. Partner information is always needed. Misc only sometimes.

You may want to contact support to be certain. Contact Support EITHER https://proconnect.intuit.com/community/proconnect-tax-news-updates/discussion/proconnect-tax-assist... OR https://proconnect.intuit.com/support/en-us/help-article/intuit-account-settings/contact-proconnect-...

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for your direction.