- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Other Subtractions: "MD - Ref #2696" Critical Diagnostics

Other Subtractions: "MD - Ref #2696" Critical Diagnostics

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you can't figure out where that number is I would back up the return. Then I would delete the entire W-2 and start again. Enter everything exactly as it appears on the W-2. If there is a state pickup it will show in box 14. But before I would enter that W-2 I would go to the MD return and see if that subtraction is still there. If it isn't then you know there was something quirky with the W-2. If it is gone, then it was the input of the W-2.

Don't check any boxes unless they are checked on the W-2.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is a worksheet called "Other Subtractions". Do you have anything on this worksheet? Did you override any numbers? Sometimes half the battle is finding where to put the input. What is it you are trying to subtract?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is a long list of MD subtractions and each one has a corresponding letter or double letter. Your subtraction needs to fit one of those or you can't efile.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for your response! The subtraction amount matches the MD college fund and filer's ESPP amount from his W-2. I cannot think of anything else. How can I resolve it please?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What kind of subtraction is "filer's ESPP amount from his W-2"?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What are you referring to? Are you talking about the taxpayer's contribution to his 403b? If so you need to scroll down between q and r and there is a worksheet to keep track of the employee's contribution to the plan. It is called the "pickup contribution amount "smart" worksheet". (all of these worksheets think they are so smart!). Usually you would do this in the first year. Then eventually you will see the 1099R says ESP used which means it is all taxable from that point forward.

I hope this is what you are referring to. Otherwise delete the response.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sometimes you need to go back to the taxpayer and ask him what the code is. Usually I find that it relates to a contribution to a state retirement program. I have never seen that code relate to a 529 contribution. I think you might need some more information to determine if it is indeed a subtraction. If it is related to a state retirement program then it might be a state pickup amount and that addition is determined on the W-2 worksheet in the federal program.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi, it is employee stock purchase plan (ESPP). Thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The code on the worksheet is "xb".

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't usually see an employee stock purchase plan subtraction and I don't think it would go to "xb". So not sure if you are now asking two separate questions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So why do you think Employee Stock Purchase Plan is a MD subtraction item?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@DebiHCPA I think OP is saying there are 2 MD subtractions- one for 529 Plan and one for ESPP.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I usually find on a W-2 that the State Pickup is the only item affected as a modification on the MD return. Otherwise, I am not sure why there would be an adjustment for ESSP.

Maybe we have to start back at the beginning. What is the question?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

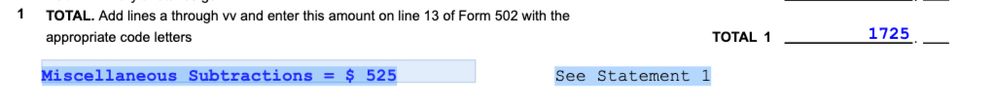

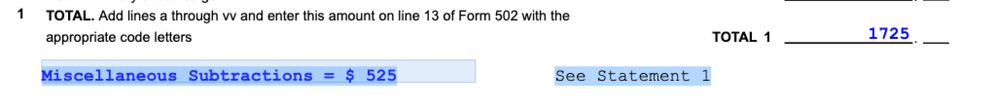

Hi, the MD 502SU is showing subtraction for xb (Maryland College Investment Plan) - I don't think this is the issue - and Miscellaneous Subtractions of $ 525. I cannot seem to figure out where the $525 generated from. I thought it was from the W-2 because I had the same amount in box 14 (ESPP) but I purposely deleted the amount on the W-2 and the Miscellaneous Subtractions of $ 525 still appeared on the MD 502SU.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What line on the MD SU is showing the subtraction?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The amount is showing on 502SU as "Miscellaneous Subtractions", and on the Statement 1as "Taxpayer: Wage Adjustment" on the MS statement - please find attachments.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Check your W-2 entry. Do you have an amount in state wages that is different than Box1 wages? If yes, delete it. MD doesn't work that way. Any adjustment to MD wages, such as the state pickup amount, gets its own code on the SU.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you can't figure out where that number is I would back up the return. Then I would delete the entire W-2 and start again. Enter everything exactly as it appears on the W-2. If there is a state pickup it will show in box 14. But before I would enter that W-2 I would go to the MD return and see if that subtraction is still there. If it isn't then you know there was something quirky with the W-2. If it is gone, then it was the input of the W-2.

Don't check any boxes unless they are checked on the W-2.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

RESOLVED!!!😁😁😁

Thanks to you guys!

I deleted one of the W-2 and the error was resolved. I then reentered it and discover that the error was generated because the state wages (box 16) was lower than the wages in box 1. It was the reduced wage all along...

Thanks again for your guidances!