- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Form 2441 Part II does not function I have everything filled in and nothing seems to be working. I can provide screenshots

Form 2441 Part II does not function I have everything filled in and nothing seems to be working. I can provide screenshots

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

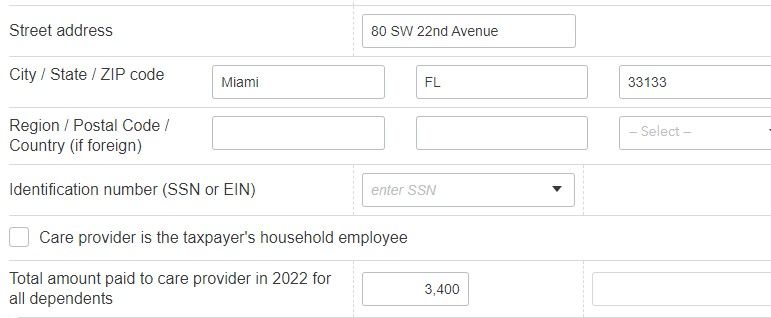

In ProSeries, you have to put the amount paid for each child in the column in the Dependent area on the Federal Worksheet. Then it should flow to the 2441.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Screen shot or more information would be helpful. Line 12 would be automatic from W-2 input. The rest is computed based on your input to make page 1 work correctly.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have done as you have suggested and it does not work

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

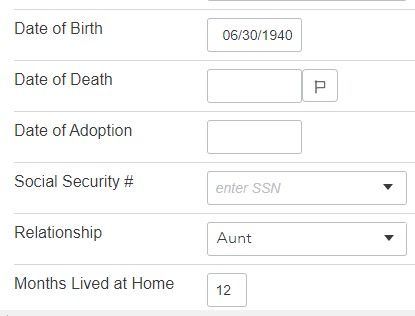

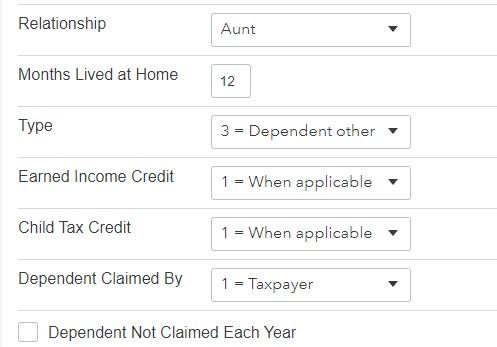

Are you trying to claim child care for an 82 year old aunt?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

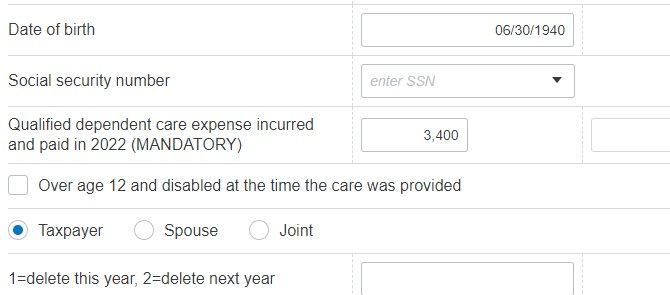

The date of birth is the dependent's, not the taxpayer's DOB.

If the DOB is correct and the Aunt is being cared for by the taxpayer, the Aunt must be disabled, unable to care for herself and the eligible costs only includes care and protection, not food, lodging etc.

You would have to check the "Over 12 and disabled box" for it to work.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So even though the individual is not disabled, you are saying to get ProConnect to calculate correctly I need to enter her as disabled.

Since this is not the Tax Code, I find this unacceptable. I can use it to make it work, but it is an incorrect solution

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Your idea that you can claim a dependent care credit for a nondisabled adult is unacceptable.

Show us where in the Code it says this can be done.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm saying the only way to be eligible to claim the credit, as a taxpayer, is if the Aunt is disabled.

Correct solution - If she's not disabled, no credit.

Review the instructions for Form 2441 at IRS.gov, before you declare what the Tax code states.

Forcing the software to create a credit that the taxpayer is not eligible to claim is fraud, and truly unacceptable to the IRS.

All tax credits have specific eligibility requirements which must be met in order to claim them.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

To be eligible for the child and dependent care credit, the dependent must either be under the age of 13 or be a dependent or spouse of any age who is incapable of self-care. There is no stipulation the individual has to be disabled.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From the Form 2441 instructions: "Any disabled person who wasn't physically or mentally able to care for himself or herself who lived with you for more than half the year and whom you can claim as a dependent or could claim as a dependent except:"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Then Publication 503 must be incorrect. Obviously there is a discrepancy between Publication 503 and your instructions for Form 2441.

The only solution is to make the ProConnect do what is required or utilize another program. This is an area where Pro/connect could certainly improve.

For example, ProConnect does a poor job of collating information that could be used in a variety of ways when dealing with dependents, especially non-child dependents.

Since the individual may need care but is not disabled (can you say Joe Biden) ProConnect requires a user to enter false information to make the program do what it should be doing. However, if the user does that, they are committing a felony.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What does the stipulation "incapable of self-care" mean?

You're wrong in your continued effort to blame the software for not allowing you to commit fraud.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

thanks. input qualified expenses under the dependent worksheet and it does flow to form 2441. you saved me from pulling the rest of my hair out of my scalp!