- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- CA Corp tax 2020

CA Corp tax 2020

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

First I have seen this. Did CA make an adjustment to the minimum Corp tax if the income was lower than the 1.5%?

So I have searched the FTB website, as well as the internet. I have a return that only earned 890- for the 2020 tax year. Instead of calculating the min. fee of 800-, it is calculating the 1.5% of 890-, $13- tax. Is this for real? Anyone have an article on this?

Thanx!

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is this a first year return?

A corporation that incorporated or qualified through the California SOS to do business in California, is not subject to the minimum franchise tax for its first taxable year and will compute its tax liability by multiplying its state net income by the appropriate tax rate. The corporation will become subject to minimum franchise tax beginning in its second taxable year. This does not apply to corporations that are not qualified by the California SOS, or reorganize solely to avoid payment of their minimum franchise tax.

There is no minimum franchise tax for the following entities:

Corporations that are not incorporated in California, not qualified under the laws of California, and are not doing business in California even though they derive income from California sources. However, if corporations meet the sale, property, or payroll threshold for “doing business” under R&TC Section 23101(b), corporations may be subject to the minimum franchise tax. For more information regarding “doing business,” see General Information A, Franchise or Income Tax; refer to R&TC Section 23101(b); get FTB Pub. 1050, Application and Interpretation of Public Law 86-272; or FTB Pub. 1060, Guide for Corporations Starting Business in California.

Corporations that are not incorporated under the laws of California; whose sole activities in this state are engaging in convention and trade show activities for seven or fewer days during the taxable year; and that do not derive more than $10,000 of gross income reportable to California during the taxable year. These corporations are not “doing business” in California. For more information, get FTB Pub. 1060.

Newly formed or qualified corporations filing an initial return.

Qualified non-profit farm cooperative associations.

Credit unions.

Unincorporated homeowners’ associations.

Exempt homeowners’ associations.

Exempt political organizations.

Exempt organizations.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

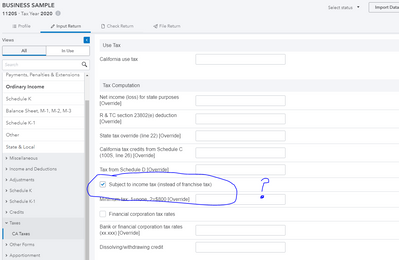

It is not their 1st year, and yes, I have scoured all sources. It is a standard S Corp, 3rd year filing. They have very low income, but was still expecting the 800- minimum fee. My client said they heard something about the CA government giving a tax break for Covid, but I cannot find ANYTHING that confirms that. It is calculating a 13- fee, 1.5% of net earnings of 890-.

Any other ideas?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!