- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Will the estimated tax payments split in the 2020 MFS federal and CA returns?

Will the estimated tax payments split in the 2020 MFS federal and CA returns?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Client was single in 2019 and applied 2019 overpayment to 2020 for both Federal and CA. Client also use the 2020 1040ES 540ES (showing only his SSN) to make 2020 estimated tax payments.

Client married in Jan 2020. He and his wife are filing MFS for 2020, splitting everything 50/50. They have an agreement to treat full year income as community property.

Question:

1. For the estimated tax applied from 2019, can they split 50/50 on their 2020 federal and CA MFS returns? Or, must he claim them all on his?

2. Same question for the estimated tax paid with the 2020 Form 1040ES and 540ES under his SSN.

Form 8958 shows only the splitting of income (W-2, Sch C, Sch E) but NOT the withholdings or estimated taxes. I imagine the withholdings would be automatically split in the IRS & FTB records because the wages are split.

Don't know the mechanism for splitting the estimated taxes.

Thanks!

I come here for kudos and IRonMaN's jokes.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For simplicity purposes, I would use a piece of paper to keep track of the estimated tax allocation. Have each spouse claim what was paid under their SSN and have one of them cut a check to the other for any difference. I would not try to get the government(s) involved in that allocation. I am not sure how the program does that. It should split withholding.

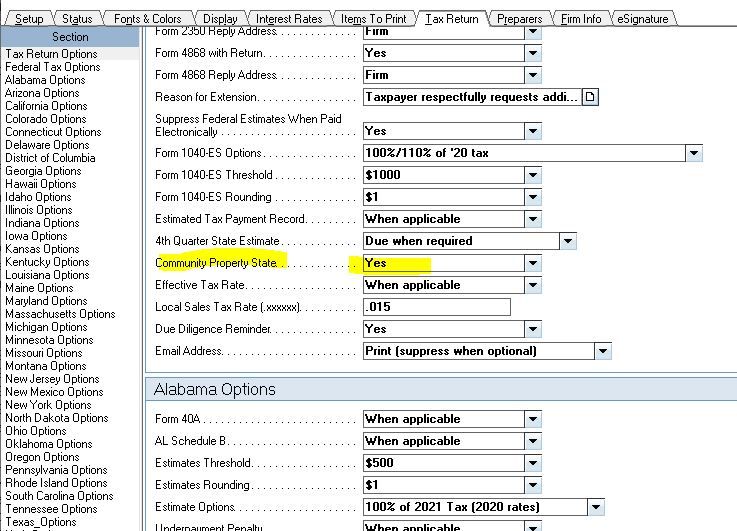

In Settings > Options, did you set Community Property State to Yes?

Wages and withholding should be split equally. Generally MFS is not advantageous and definitely more work. I did my first in many years for 2020 because of Unemployment.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For simplicity purposes, I would use a piece of paper to keep track of the estimated tax allocation. Have each spouse claim what was paid under their SSN and have one of them cut a check to the other for any difference. I would not try to get the government(s) involved in that allocation. I am not sure how the program does that. It should split withholding.

In Settings > Options, did you set Community Property State to Yes?

Wages and withholding should be split equally. Generally MFS is not advantageous and definitely more work. I did my first in many years for 2020 because of Unemployment.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

These days I assume when I see an MFS question, especially with community property involved, that it's from California and has to do with some weird law they have about paying a higher tax if AGI exceeds a million, or something like that.

But regardless of the reason, in this case the 2019 credit-elect is the husband's separate property and there's no legal reason to put some of it on the wife's return, any more than some of your estimated payments can go on my return. (Why would you want to do that, other than being a nice guy? Well, maybe I'm handing you some cash under the table, and you're trying to avoid a refund because you know it will be seized because of those other taxes you owe.)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@George4Tacks and @BobKamman:

Thanks for the feedback. All points well taken.

Due to the UCE , I'm filing more MFS returns in one year than the past ten, perhaps 20.

In the filing I'm working on, Husband's MFS return will have a balance (in October! - think penalties, yikes) and the W's a refund. The overall tax saving is over $5K, and unless I'm sure it's a sure thing to get the split, I agree with George that I should NOT rely on the IRS to do the sharing of the 1040ES paid by the Wife. Paying the penalty would be better than dealing with two CP24's...

Lacerte's MFS splitting function makes the job quite easier. I've found it very handy.

Thanks for your input.

I come here for kudos and IRonMaN's jokes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes! To me, a spiffy part of Lacerte's MFJ/MFS function

I come here for kudos and IRonMaN's jokes.