- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: On 1041 the diagnostics is "a financial Institution EIN is required for this return" but there is not a financial institution fiduciary?

On 1041 the diagnostics is "a financial Institution EIN is required for this return" but there is not a financial institution fiduciary?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you trying to file a 1041 with a SSN?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you trying to file a 1041 with a SSN?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't see the solution to this question. What is the solution?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There appears to be a bogus critical diagnostic "a financial Institution EIN is required for this return" that appeared for me when I added a second state, Arizona, to a California based Trust. After digging for answers for a while, I concluded that mine is a bug in PTO/Lacerte, clicked ignore to bypass the bug, e-filed all of the returns, and all have been accepted now for several days without a problem.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do you "Ignore" and bypass the diagnostic?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

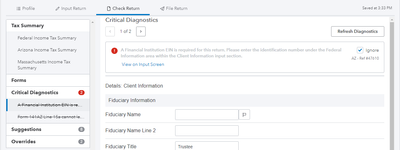

You click the Ignore checkbox in the top right as shown when you have the diagnostic selected.

Note: The post was from last year, but the problem still exists this year, I ran into it again this with an unrelated trust, and successfully bypassed and submitted the return again. I also ran into a new critical diagnostic for Arizona which makes no sense and is also bogus, related to capital gains over 3k. Was planning on posting about that separately when I get the chance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I get this every year when filing 1041s for AZ and usually just paper-file. Did you just check off the "Form 141AZ Line 15a cannot be less than -3000" diagnostic and try to efile it instead?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Another year's gone by since that post, but looking back real quick for you, I'm seeing only the original critical diagnostic bypassed for institutional EIN still present, however the critical diagnostic for having more than $3,000 in capital gains is no longer present (so presumably they fixed it). It sounds like your issue though is with capital losses, which is what I expect the diagnostic was originally suppose to be for. As a result I have no experience to share, I've only passed through positive capital gains over 3k in Arizona. Best of luck!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The error that a financial institution EIN is required is STILL an issue and it has nothing to do with capital gains or losses. It is strictly a Fiduciary issue and the same work around is needed this year. You ignore it, check off the diagnostic and it should not prevent you from filing. However, I have also used the Estate/Trust EIN in that section along with the Trustee name and SS#. Either of them resolve the issue.

The Arizona $3,000 issue is unrelated to the EIN number. If the Trust or Estate has losses exceeding $3,000 you must file a paper return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have tried the bypass diagnostic for the financial institution EIN and the return is still rejected. This is a real problem that seems like it should be easy to fix. There is a field to put in a SSN for the trustee but it is grayed out. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Only suggestion would be to double check the rejection message you are getting is from AZ, not Intuit, and what exactly the text of the rejection message says.