- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: How do I get the disregarded entity information to show up in Item H2, Sch K-1, Form 1065? I enter it on Scr 32.1, but it doesn't flow to the K-1.

How do I get the disregarded entity information to show up in Item H2, Sch K-1, Form 1065? I enter it on Scr 32.1, but it doesn't flow to the K-1.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Screen 7 > Miscellaneous information > Sele type of entity > DE

Screen 32.1 (for that same partner) input Partner's TIN, Name and Type

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The partner of the partnership return is a DE SMLLC, that owns 50% of partnership. 100% Beneficial Owner of "DE SMLLC" partner is a Limited Partnership that files a 1065 as a partnership.

My question is with Form 1065, Page 5, Analysis of Net Income, when I do as you have suggested, The K-1 works. However, it shifts the Net income of the Beneficial Owner / DE partner to the Nominee / Other Column, and not the Partnership column. Do you know any way to fix? Is there an override?

Also the B-1 does not automatically report the either the 50% DE SMLLC Partner or it's 100% Beneficial Owner in Part I, ther's an override for that one, but these two things give me pause.

The partner of the partnership is a DE SMLLC, that owns 50% of partnership. 100% Beneficial Owner of "DE SMLLC" partner is a Limited Partnersip

Your suggestion fixed the K-1, but the B-1 did not automatically report either the de OR

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lacerte also asks in the disregarded entity partner information for the partner type, would this be Fiduciary?

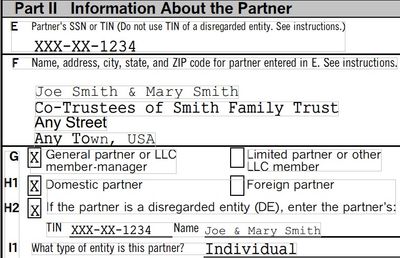

And then Lacerte asks the beneficial owner partner type, if different. this is the question of what type of entity is this partner on the K-1 Part II Question I1. Should this be answered as Individual?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Need some more facts.

We can't tell if fiduciary is the correct answer.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi sjrcpa! You answered a question for me in TaxProTalk regarding revocable trusts blowing the CPAR elect out.

So now I'm trying to complete the H-2 section. I had another CPA tell me that if the taxpayer has a revocable trust that part of the K-1 needs to be completed.

Not sure if I'm doing this area correctly. The forms view doesn't say anything about Fiduciary but it asks for this in the input. Then in the input it asks for beneficial owner partner type so I put Individual and that fed to the forms view of the K-1. This is what I have after doing the input:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Anybody have an suggestions as to whether I'm doing this right nor not?