- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Extended Payment Due Date

Extended Payment Due Date

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Why is the default client letter changing the Payment due date to the extended due date of the return. The extension is an extension of time to file and not of time to pay. Shouldn't the payment due date still be the original due date and not the extended due date. Has the program always done this, and we are just noticing it now?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You can make some adjustments to get things to be right. You can even have the system compute penalties and interest up to a specific date, but you can not control when the client will send the return, or when they will pay. I always just give them verbal warnings that they will be billed for any extra P&I after the agency gets the returns.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When you say you can make adjustments - this is on the individual return - correct? I was hoping that there was something that would indicate to pay ASAP for all returns filed after the original due date. I guess I just never noticed it before. Thank you for your response.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In any return, in the Notes section you can add an opening or closing paragraph for the client letter. You could put the message there.

Add notes to a tax return

-

Click the Detail tab.

-

At the Contents tab, click the Notes screen.

-

To create a new note, select the type of note under Print As, and then click Add.

Worksheet Notes print before the tax return in Supplemental Information.

Statement Notes print after the tax return in Supplemental Information.

Letter Misc 1 and 2 Notes print as opening and closing paragraphs on the Client Letter. The program assigns the text you type to the [MISC1] and [MISC2] keywords.

(1065, 1120S, 1041) Schedule K-1 Notes print as supplemental information for each partner's, shareholder's, or beneficiary's Schedule K-1. The program assigns the text you type to the [SCHK1] keyword for the Client Letter.

To edit an existing note, click the note in the list on the left.

-

Click the Spell Check button to check the spelling of the note.

NOTES:

If you add a note for Letter Misc 1 and Misc 2, you can format the font and alignment of the note text using the toolbar at the top of the note.

Use the font lists and the buttons on the toolbar to format the notes.

See Also: Adding Notes to Input Fields / Adding Notes to a Client or the Tax Program / Print notes for a tax return / Delete notes from a tax return

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

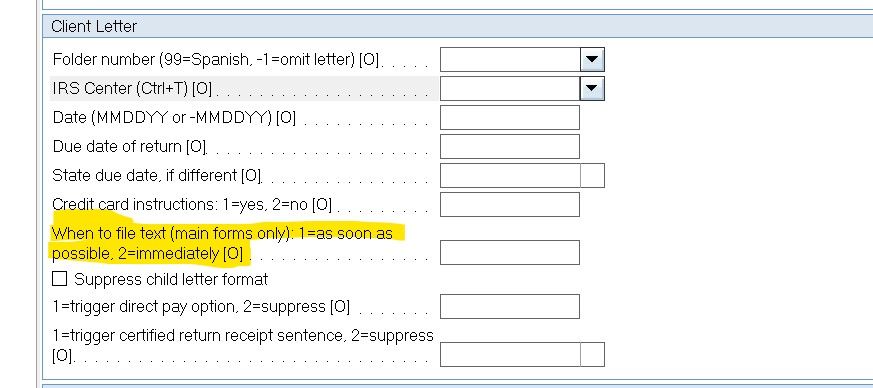

In the 1040 you can find this:

I have not check the other modules, but I think it may also be there

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That screen says ASAP for everything then, even if it's before the deadline. I agree, this is one of the more idiotic things Lacerte does. Why in the world would we tell our clients to hold off payment until the extended due date???