- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Contribution Carryover Worksheet

Contribution Carryover Worksheet

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

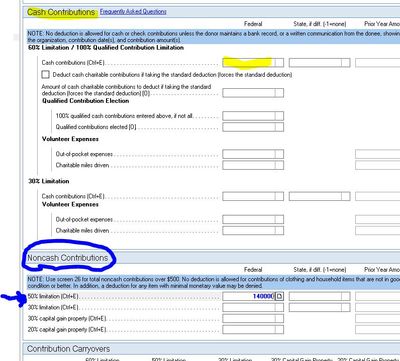

I have client whom donates lots of cash only to charitable organizations. Why then on the Worksheet for Limit on Charitable Contributions do I see entries on line 9 and 15 which refer to non-cash contributions?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This article answers the question on the carry forward and 2020 amounts. Read through and see if you entered correctly. If not you may have to amend to get the desired treatment or adjust to the correct amount.

https://www.thetaxadviser.com/issues/2020/dec/changes-charitable-giving-rules-2020.html

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sounds like you entered them under the 50% limitation on sc 25.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks Pat but I made no entries at all, these were cash donations carryovers from 2017 and it appears that the carryover amount was put on the wrong "Non-cash" line by the software and carried as such to the worksheet. Has never been an issue as the proper amount of carry over was being used. However, at this point the IRS changed the return and disallowed all the carryovers as well as the current 2020 $150,000 cash donations and the recalculated the return using the standard deduction? Been trying to get through to IRS but impossible even on the Hot Line. Thanks for your input at least I was able to verify that wasn't the issue.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree with @pat but I like pictures to show where we think you went wrong in the input.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Appreciate your faith, but again, I made zero entries all carryover from year 2017 to 2018 and forward from proforma and in right place on carryover input below your point of interest. Just appears as non-cash on worksheet?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What are the entries for prior year carryovers? Are they in the 50% limitation? I think I see what you are encountering.

I suggest you use Ctrl + L to send the return to Lacerte for them to review and get back to you with whether they feel the worksheets are correct or not. I have not run into this and digging through all the worksheets and pub 526 is not something I feel I want to do on my day off. Maybe @IntuitBettyJo could get someone at Lacerte to join in.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK this was a trick(y) question. The cash AGI limit was 50% in 2017. TCJA changed it for contributions made after 12/31/2017. Not crazy. Not wrong. Just too many law changes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is possible that Lacerte proformad as non cash due to the AGI limit change. To better understand the IRS issue with the claim for the contribution tell us on what line the carry forward amount was reported on the 2020 schedule A. The 2020 cash contribution should be deductible up to 100% of AGI. Not sure how to combine that amount with any carry forward amount. George do you know off the top of your head?

Are you trying to get through on the Practitioner line?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This article answers the question on the carry forward and 2020 amounts. Read through and see if you entered correctly. If not you may have to amend to get the desired treatment or adjust to the correct amount.

https://www.thetaxadviser.com/issues/2020/dec/changes-charitable-giving-rules-2020.html

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks to all for your guidance in the matter. Yes, I am on the phone every morning with finger set to speed dial help line upon opening on West Coast. Immediately I'm told call volume to high. I will purse this matter and because of your help will educate myself even further.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Go back and review the 2018 and 2019 returns Sch A and charitable carryover worksheets to see how this carried forward after the 2017 change in AGI Limit. Make a copy of the 2019 and proforma to 2020 and see how it is brought forward. You may get info you will need to share with IRS when you do get through.