- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: CA HSA problem

CA HSA problem

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

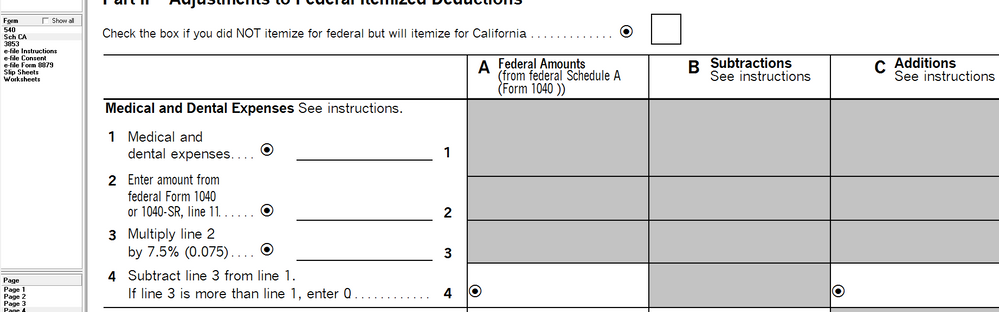

The 2021 HSA distribution for prior years medical expenses (2018-2020) are automatically included as current year medical expenses for CA itemized deductions. There doesn't seem to be anywhere to override this.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where are you inputting that these are 2018-2020 medical expenses? I don't see Lacerte asking whether HSA-reimbursements are for CY or PY.

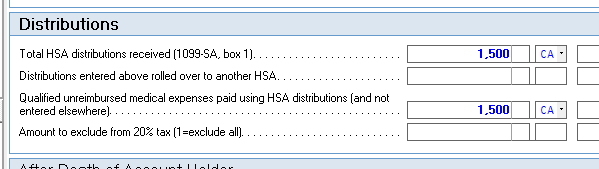

This is how I input HSA distributions, and nothing is showing up on CA540.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have input my HSA distributions the same way you have, but mine are 15,000 which exceeds the 7.5% of AGI, thereby triggering medical expenses for itemization purposes. Because Lacerte does not allow you to enter which years the HSA distributions are related to, it automatically assumes the current year.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Wow, I upped mine to $15K and see what you're talking about now. I tried negative entries on Screen 25, no luck. I even tried adding a non-income-tax state like TX and sourcing the distribution there, but it still didn't take it off.

I think you'll need to call support and see if they can submit it for fixing.

I can see why it's flowing that why, like you said, the software presumes you'd submit for reimbursement from your HSA right away. But that's not ideal HSA tax optimization. Let it grow, invested tax free! 🙂

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I will talk to technical support at some point. In the meantime, since I only get the standard deduction for federal and I know I should only get the standard deduction for CA, I reduced my property tax amount to bring the state itemized amount to below the standard deduction. You can check a box to only use the standard deduction for CA, but it still calculates and looks really weird when the calculated amount exceeds the standard deduction, but the end result is only the standardized amount.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good call, I think that's the best workaround you've got at this point. I was actually starting to hypothesize a similar workaround while I was eating dinner, just reduce on of the other deductions to bring it back in line. I had been thinking the Misc 2% deductions so it wouldn't mess up the federal return (before I knew you were taking the std deduction), but that could get difficult because of that 2% threshold.

Please do call them. I personally want it fixed before I retire and start withdrawing from my HSA in about 25 years for all of this year's medical expenses. 😜