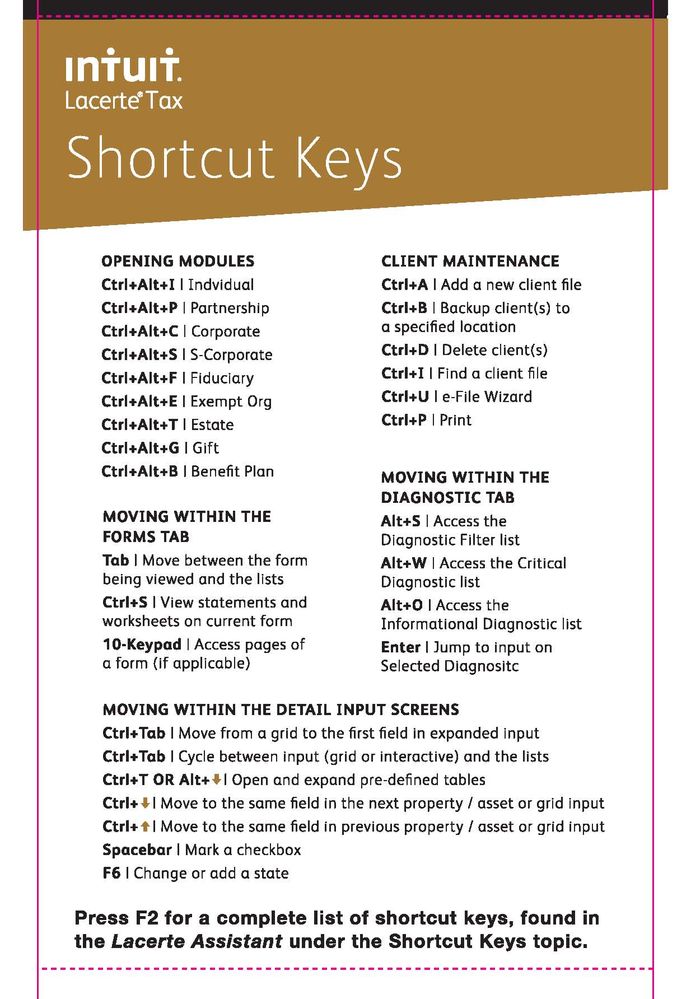

| Press | To |

|---|---|

| Alt+C | access the Clients tab |

| Alt+D | access the Detail tab |

| Alt+F | access the Forms tab |

| Alt+I | access the Diagnostics tab |

| Alt+Left or Right Arrow | move between tabs |

| Ctrl+H | open the Calendar |

| Ctrl+L | open Lacerte Email |

| Ctrl+O | open User Options |

| Ctrl+P | open Print Tax Return dialogue box |

| Ctrl+U | open the E-file Wizard |

| Ctrl+F5 | open the Lacerte Appointment Manager |

| F1 | open the in-product Help window |

| F2 | open the in-product Help Center |

| F4 | open the Client Status window |

| F5 | open the REP window |

| F10 | open the Technical Support window |

| Ctrl+Alt+I | switch to the Individual Module |

| Ctrl+Alt+P | switch to the Partnership Module |

| Ctrl+Alt+C | switch to the Corporate Module |

| Ctrl+Alt+S | switch to the S-Corporate Module |

| Ctrl+Alt+F | switch to the Fiduciary Module |

| Ctrl+Alt+E | switch to the Exempt Module |

| Ctrl+Alt+T | switch to the Estate Module |

| Ctrl+Alt+G | switch to the Gift Module |

| Ctrl+Alt+B | switch to the Benefit Module |

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Apportioning K-1 between states

Apportioning K-1 between states

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get loss from K-1 to flow through to one state return and not another? I have a client that is Florida resident with K-1 from passive GA business. They also have a schedule F that does business substantial business in California. I cannot get K-1 income (and carryforward loss) to show up in federal return and GA return and exclude CA return.

If have tried every combination of "N" "S" and US/States. I tried to put in a "State, if different" amount of $0 but it still shows up on state return (but oddly it recalculates if I put a dollar in the box instead of a zero, but I need it to be a $0). I don't understand. Please help me understand whats going wrong here...

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes that’s it! Thank you! I new to using lacerate and didn’t realize that!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

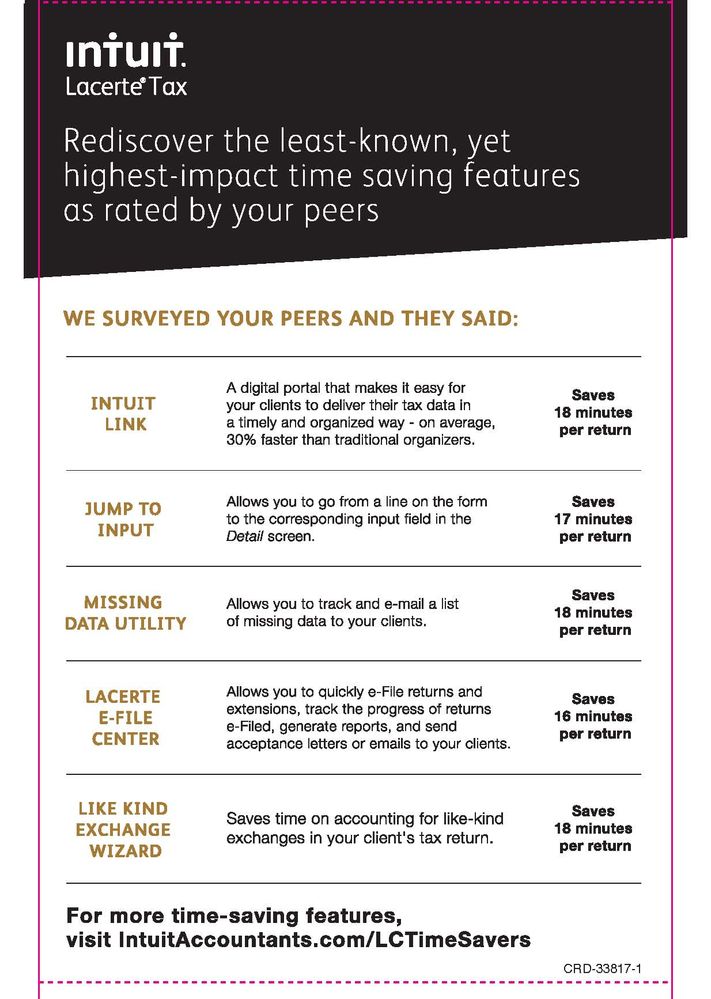

Lacerte has lots of oddities, er cool tricks. Come back often we might be able to teach you a few. There used to be a useful link to shortcuts. Maybe @IntuitBettyJo could find a new link. In the mean time you could print these and put them by your desk.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for that! It will be extremely helpful!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

We don't have an active article at this time, but here is what I could find:

The following tables identify the keyboard shortcuts within Lacerte - Click to Expand

Want to learn more? Visit our online portal.

Shortcuts Available in the Clients, Detail, Forms, and Diagnostics Screens

Shortcuts Available in the Interactive Detail Input

| Press | To |

|---|---|

| Delete | delete the selected text or the character to the right of the cursor if no input is selected |

| Esc | (once) move from the detail window to the Section list. (twice) save and exit the Detail screen. |

| + | access the calculator if the cursor is in an amount field. |

| PgUp PgDn | scroll the screen a page at a time |

| Ctrl+Tab | move among the lists and the Detail screen |

| Up Arrow Tab | move among input fields or selections |

| Down Arrow | move among input fields or selections -or- add a new property if the cursor is on the last property at a grid screen |

| Ctrl+A | add a new screen/property |

| Ctrl+C | copy a property (Active in the list panel only) |

| Ctrl+D | delete a property or all entries on the screen |

| Ctrl+E | open expanded detail for the current field |

| Ctrl+V | paste a property (Active in the list panel only) |

| Ctrl+X | cut a property (Active in the list panel only) |

| Ctrl+Z | undo the last action |

| Ctrl+Left Arrow Ctrl+Right Arrow | select the previous or next tab along the bottom of the screen |

| Ctrl+PgUp Ctrl+PgDn | move to the next input section on the screen |

| Ctrl+Up Arrow Ctrl+Down Arrow | move to the same input field for a different property |

| Shift+F6 | insert the last number displayed in the calculator into the current input field. |

Shortcuts Available in Batch Input

| Press | To |

|---|---|

| Delete | delete the selected text or the character to the right of the cursor if no input is selected |

| Esc | (once) move from the detail window to the Screen list. (twice) save and exit the Detail screen |

| Ctrl+Tab | move among the lists and the Detail screen |

| Up Arrow Down Arrow Tab | move among input fields or selections |

| Ctrl+A | add a new screen/property |

| Ctrl+D | delete a full line of input |

| Ctrl+R | reset the page and cumulative hash totals to zero |

| Ctrl+Home Ctrl+End | move to the first or last item of the current screen |

| Ctrl+Left Arrow Ctrl+Right Arrow | select the previous or next tab along the bottom of the screen |

| Ctrl+Up Arrow Ctrl+Down Arrow | move to the next or prior property of the current screen |

| PgUp PgDn | move a page at a time |

| + | open the Calculator if the cursor is in an amount field. |

| Shift+F6 | insert the last number displayed in the calculator into the current input field. |

Shortcuts Available in the Client List

| Press | To |

|---|---|

| Up and down arrows | scroll one client at a time in the direction of the arrow |

| Home / End | go to the first or last client on the screen, respectively |

| Type the client number, name, SSN, or status | scroll the client list as you type (based on the current category). The current search characters display in the Status bar at the bottom of the screen, in the Search box. |

| Alt | activate the menu bar. You can press Alt + the highlighted letter in a menu or feature to access that menu or feature quickly. |

| Spacebar | select or unselect the highlighted client |

| Ctrl+Up Arrow or Ctrl+Down Arrow | scroll through the Client list without moving the cursor from the highlighted client |

| Shift+Up Arrow or Shift+Down Arrow | select one client at a time in the direction of the arrow |

Shortcuts Available in the Letter Editor

| Press | To |

|---|---|

| Arrow keys | move cursor a character at a time, or a line at a time, in the direction of the arrow key. |

| Ctrl+Left Arrow | move to the previous word. |

| Ctrl+Right Arrow | move to the next word. |

| Shift+Insert | paste text that has been cut or copied |

| Home | move to the first character of the line |

| End | move to the last character of the line |

| Pg Up | move up one page or to the top of a subsection |

| Pg Dn | move down one page or to the bottom of a subsection |

| Shift+Right Arrow Shift+Left Arrow | mark text in the direction of the arrow |

| Shift+Up Arrow Shift+Down Arrow | mark a column of text in direction of the arrow |

| Shift+Delete | cut the selected text |

| Backspace | delete a character to the left of the cursor |

| Delete | delete the selected text or one character to the right cursor |

| Ctrl+P | print the current document |

| Insert | toggle insert/overstrike |

| Ctrl+Z | undo the last change |

| Ctrl+B | make selected text bold |

| Ctrl+I | make selected text italics |

| Ctrl+U | underline selected text |

| Ctrl+F | find text |

| F3 | find the next instance of text |

| Ctrl+A | select all text in a section |

| F7 | check spelling |