- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Oklahoma Depreciation showing more than Federal with no explanation

Oklahoma Depreciation showing more than Federal with no explanation

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

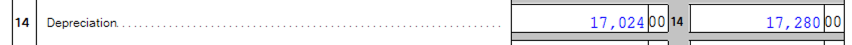

I am working on a S-Corp return, and Oklahoma Form 512-S, Part II, Line 4 Depreciation, has the Total Applicable to Oklahoma $256 more than the amount applicable to Federal. There is no statements or notes supporting this difference, and I cannot seem to figure it out. I agree with the amount in the Federal column and **bleep** it.

There was one new asset this year and because of the Section 179 deduction, it was fully depreciated this year on the federal return. Other than that new asset, there are only two other assets, both leasehold improvements, that still have current depreciation.

I have looked through all the assets and none of them have anything in the State, if different column, and I don't see anything wrong about the way I entered the new asset. So if anyone has a suggestion on things I can check before I just override the amount, I would appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I cannot seem to find such a thing in the forms.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Multi-state return? Apportionment or specific accounting? If you take 100% bonus depreciation rather than 179, does that fix it? If you mark each depreciable asset as 1= delete this year, you can identify which the problem child is.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you! Marking the assets with 1 = delete this year helped me find the one causing the issue, and then I noticed a number that did not seem to transfer correctly.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I use 1=delete this year all the time, trying to identify what the problematic item is. Glad it worked for you!