- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- How to allocate unemployment income in a community property state

How to allocate unemployment income in a community property state

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is there an easy way in Lacerte to allocate unemployment income between spouses in a community property state to get the maximum $20,400 exclusion even if one spouses UI is under $10,000 or only one spouse has UI?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Specifically CA? Since I don't think any of the other community property states have opined on this treatment.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In a different forum ... there's a long discussion about this; basically says there ISN'T an easy way to do so in Lacerte, for CA purposes.

I have one to *play* with one this weekend that has the same scenario. I'll try to remember to report back if/when I figure anything out. And you, please do the same?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You can read the prior similar topic here:

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Calhoun v. Commissioner (1992) 64 TC 222 establishes that UI is community property in CA.

I've seen a post on another board that indicated that Lacerte is working on updating for this split.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That would be awesome. I tried unsuccessfully to fake out the software.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It looks that Lacerte has fixed this UI split for MFS yesterday.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you referring to splitting the income on MFS returns, or splitting the income on a MFJ return? And how could you tell that they fixed it?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I do see that on the MFS comparison they have split it and excluded it. But I don't see how on a MFJ return to allocate the unemployment between spouses.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It show split UI in both MFS returns (for CA taxpayers).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I see that, thanks. But for those who don't need to file MFS, but still need to allocate the unemployment between spouses in order to get the full $20,400 excluded, I don't see how there has been anything added to do that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does anyone know if Lacerte has fixed this so that unemployment income can be allocated between spouses when filing a joint return to get the full $10,200 exclusion for each spouse when only one spouse has unemployment income?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, the have fixed this, at least for CA residents. But they have to file MFS, not MFJ.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So you can't get the exclusion for both on a joint return, or they just haven't programmed it yet?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You cannot get the exclusion of $10,200 for each spouse when only one has unemployment income on a joint return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is there any tax citation you can refer me to? I haven't been able to find anything in regards to that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I should qualify my prior comment, it has to be MFS if the MFJ AGI is over $150K. I'm still hunting for an answer under $150K.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks. That is my issue, the ones under $150K MFJ

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Spidell came out with a notice about this. The unemployment should be split between the two spouses on a MFJ return so each are eligible for the $10.2 (total of $20.4) but I can't get an answer from Lacerte tech about how to do it. As of a couple of weeks ago this wasn't even on their radar. Sitting on 3 returns waiting for an update or answer.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, I talked to a programmer a week or so ago and he told me they were schedule to come out with an update for this on 4/8, but he emphasized scheduled. And I have not heard a word about it since.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Well, at least they are addressing it. Hopefully soon!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Definitely. Although it would be nice if we had some indication when they hope to have it out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Has anyone heard an update from Lacerte about this?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just spoke with them again and....drum roll......they are working on it.

"Hopefully, within the next couple of updates, can't give you a time frame, though."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I did a split on 4/8 and it worked fine. Unemployment was for spouse. No entry =2 to allocate, as that is reserved for state refunds. Either leave blank for taxpayer or enter 1 for spouse.

It split everything except pension, so I cheated and created duplicate entries for 1/2 and attached a statement.

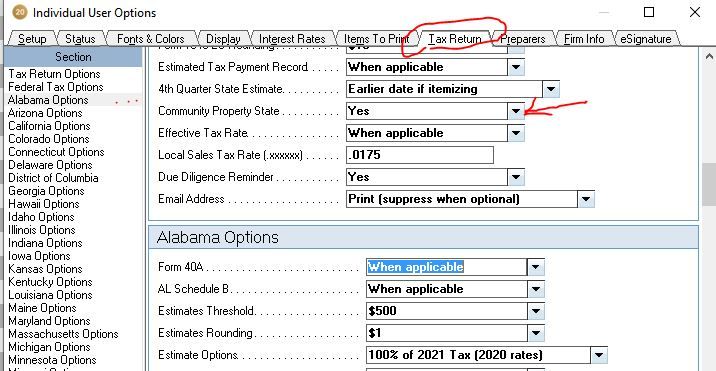

BE SURE you have indicated a community property state in Settings

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for the feedback. However, it sounds like you are filing MFS returns which both generate the exclusion of $10,200. We are waiting for an update that will split the unemployment income between spouses on a MFJ return with combined AGI under $150K so that they get the maximum exclusion of $20,400 on the joint return when only one had unemployment income.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You have, of course, given your client the option on this as a risk as the semantics of the law could lead to interpret the $10,200 break for only whom the 1099 name is on it, yes? We are sitting on 12 already filed joint returns waiting to do superseded returns and 28 other yet to file. Waiting 1 more week and then giving the client the option.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This problem only seems to concern CA returns in which the preparer wants to adopt the position promoted by Spidell that UI can be split between spouses due to community property laws. Simply make two entries, one for taxpayer and one for spouse, reporting 50% of the total UI for each. The program will then allow the total MFJ exclusion of up to $20,400, No program update needed.