Flexible eSignature Knowledge-Based Authentication (KBA) for individual module in Lacerte

by Intuit•2• Updated 1 year ago

NOTE: This method is only available for Lacerte 2022 and 2023

What is Flexible eSignature Authentication?

Flexible Authentication is when we have determined whether a taxpayer is a returning taxpayer for the accountant and then give the accountant the option to send the eSignature request with or without the Knowledge-Based Authentication (KBA) method.

How does Lacerte determine if the taxpayer is a returning client for the accountant?

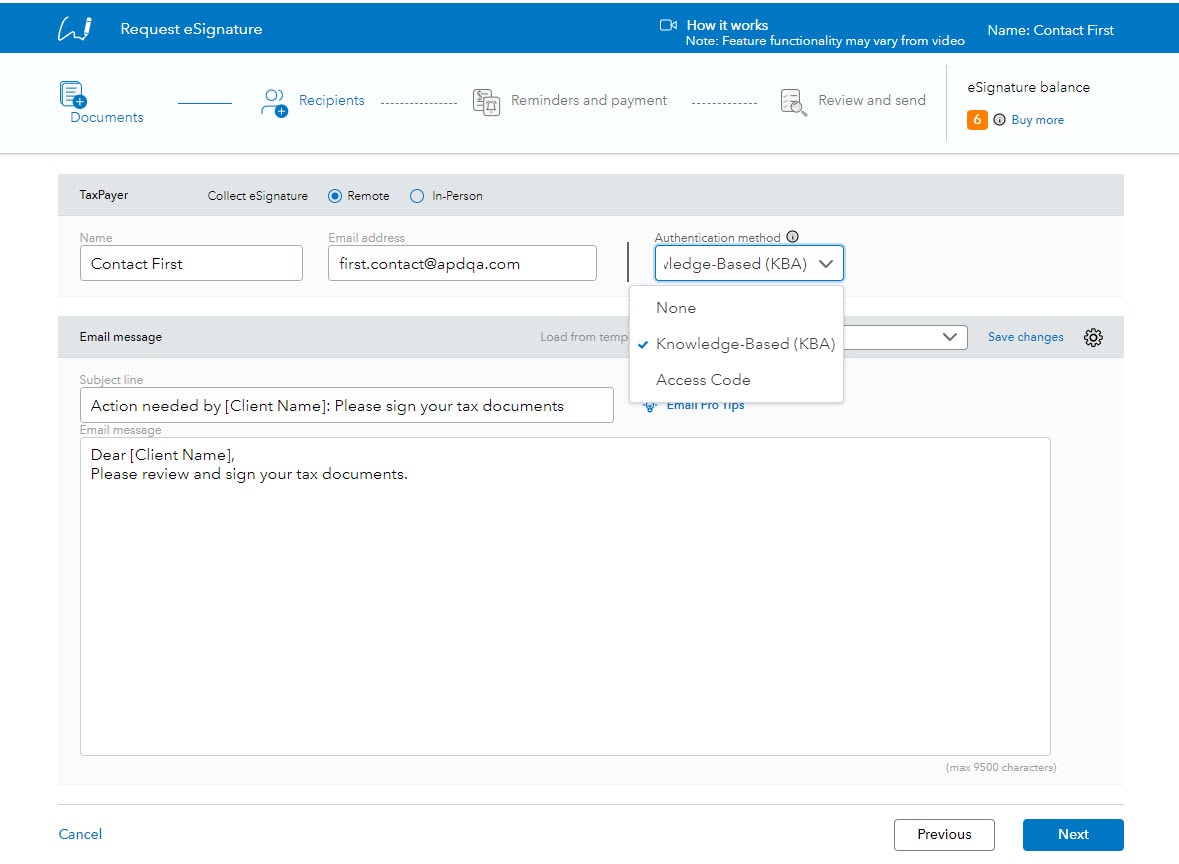

When the eSignature Request wizard is started, the program will check back-end e-filing system for the CAN and primary taxpayers SSN. If an Accepted TY21 return is found, the Authentication Method drop-down selection will be active in Lacerte so accountants can set the desired authentication method. The accountant can select None (No authentication method), Knowledge-Based (KBA), or Access Code.

If an Accepted TY21 tax return is NOT found for the taxpayer and CAN, the authentication method selection will default to Knowledge-Based Authentication (KBA) and drop-down menu will be disabled. The eSignature request can still be sent to the taxpayer but the KBA authentication will be enforced for this return.

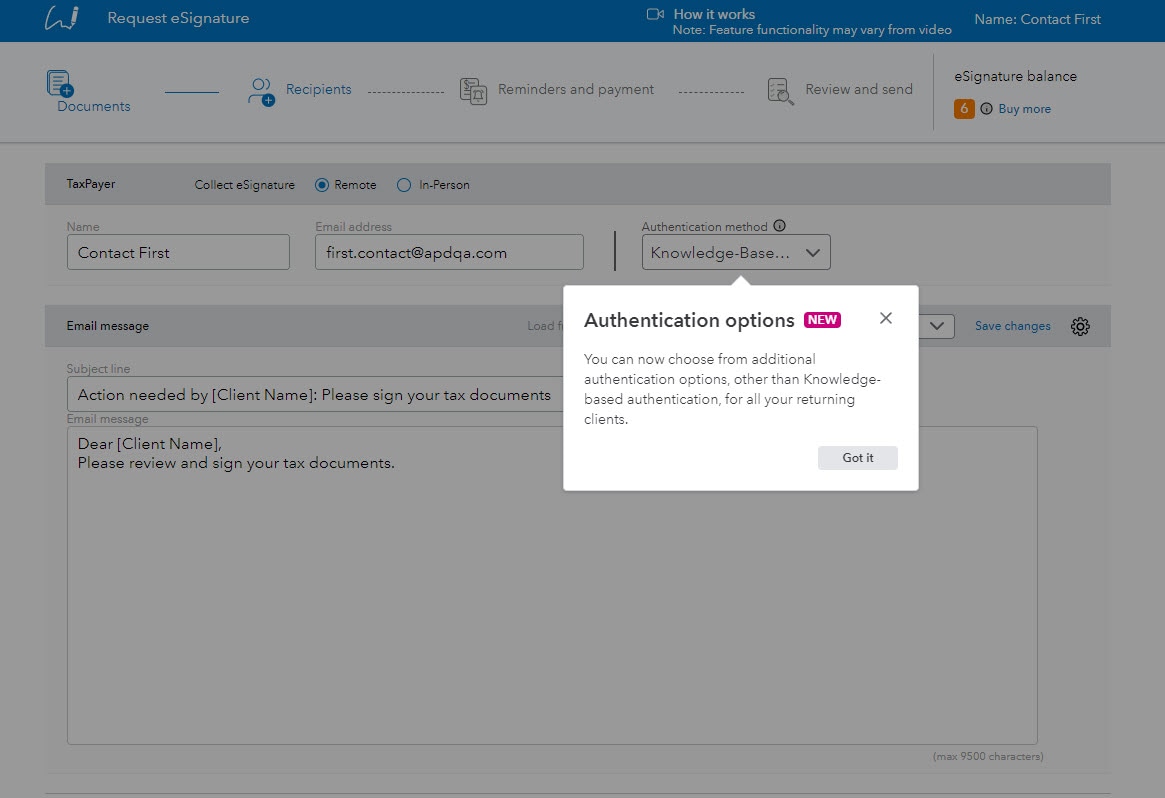

If available, users will see a pop-up message when launching the eSignature request widget for the first time informing them of the authentication options for returning taxpayers. It will only appear once per user.

Multi-prep Firms:

Firms with multiple prep files installed will only be able to take advantage of the Flexible Authentication on returns that were e-filed under the first prep (Prep - 0) in the 2021 Lacerte program. This is because when the e-file check is performed in the 2022 or 2023 Lacerte program, the program will only look for an accepted return on the first Prep file that is installed (Prep-0).

If the return was assigned to a firm/prep that is anything other than Prep-0 in Screen 1 when it was e-filed, the program will not be able verify if the e-filed return was accepted. This is something we are researching to looking to solve in a future release.

This change is in the 2022 and 2023 Lacerte individual module only. Prior year Lacerte programs will not have the Flexible Authentication changes in the individual module.

Flexible Authentication is not available when requesting eSignatures via 1-Click e-signature Request widget. It will be available only through regular eSignature request widget by clicking on the Request link on the eSig Status column on the Clients grid or by going to E-file menu ⮕ Intuit eSignature ⮕ Request eSignature.