Authentication methods for eSignature in ProConnect Tax

by Intuit•5• Updated 1 month ago

Table of contents:

What is Knowledge-based authentication?

Knowledge-based authentication (KBA) is the most secure authentication method. When you send an eSignature request with KBA, your client has to answer a series of questions about themselves based on publicly available data to verify their identity.

If the client has already filed and was accepted with the same firm in the previous year, then they may not need to use KBA. They may be able to use Flexible KBA.

Beginning in tax year 2022 - Flexible KBA

Now you can send eSignatures to your returning 1040 clients without KBA.

How does ProConnect Tax determine who's a returning client?

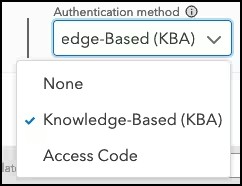

When you select Start a request from a 2025 return, we'll check our e-filing system for your account number and the primary taxpayer's SSN. If we find an Accepted tax year 2024 individual return, the Authentication method dropdown will be active and let you choose from KBA, an access code, or no authentication.

Flexible authentication isn't available for 1-Click requests.

For more information about identity verification requirements, see the IRS frequently asked questions.

When is knowledge-based authentication required?

Knowledge-based authentication is required when your program automatically attaches a signature form to the eSignature request, like Form 8879, 8878, or a state equivalent. When you send a request with one of these documents, the authentication method will default to KBA and cannot be changed, unless the program can determine your taxpayer is a returning client. See the IRS guidance for details.

Access code authentication

Access code authentication allows you to enter a private code when sending the eSignature request. Next, you'll need to communicate the code to your client via phone, email, text message, or verbally — however you like. Your client will be prompted to enter the access code in order to view and sign the documents you sent.

This option won't be available if knowledge-based authentication is required for your request.

No authentication

When you send an eSignature request with no authentication, whoever receives the request email will be able to view the documents without additional verification. Don't use this option if any of the documents you're sending contain personally identifiable information.

This option won't be available if knowledge-based authentication is required for your request.