How to send your preparer tax documents securely in Intuit Link

by Intuit•7• Updated 11 months ago

For more Intuit Link resources, check out our Learning more about Intuit Link in Lacerte page where you'll find answers to the most commonly asked questions.

What is Intuit Link?

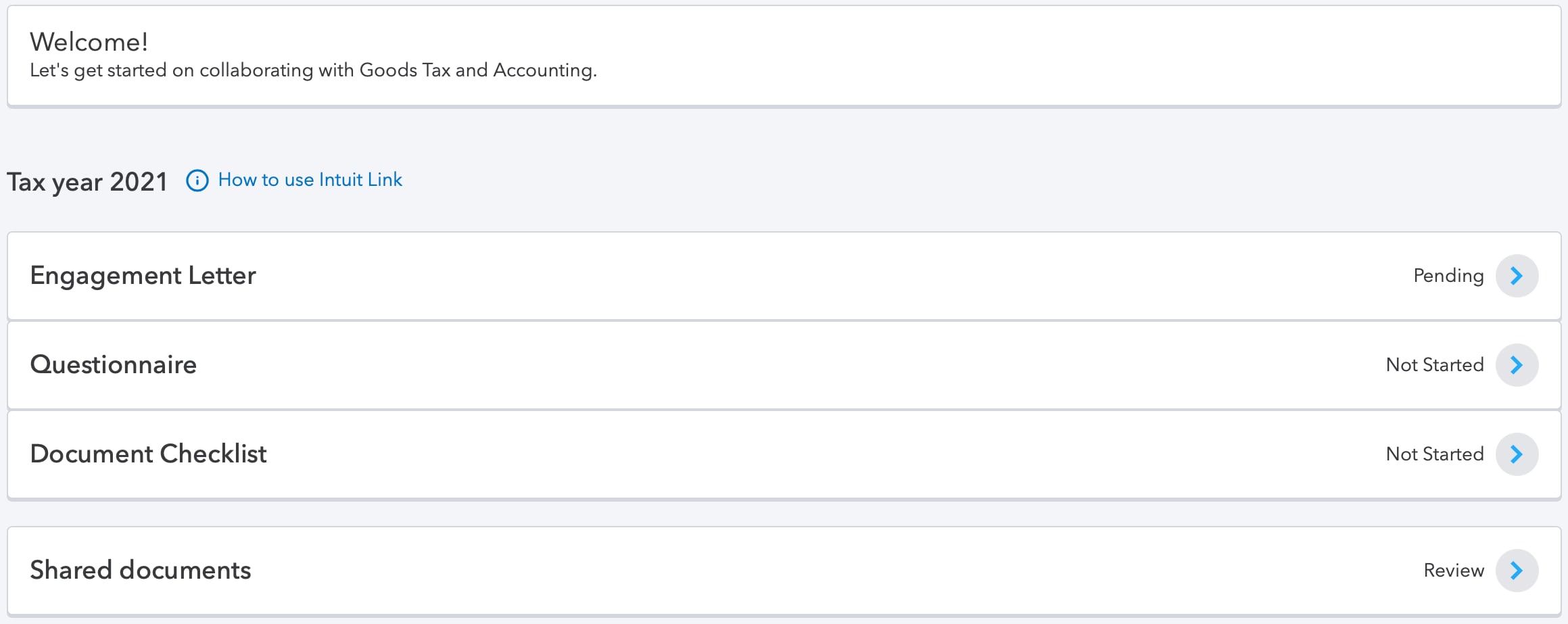

Intuit Link is an online portal for you and your accountant to connect and share tax documents to complete your tax return. No more bulky tax packets or piles of paper. Now you can deliver your information simply and securely online.

Getting started with Intuit Link

Use the steps below to get started with Intuit Link so that you can securely send your preparer tax documents.