Sync your Lacerte clients to Intuit Tax Advisor

by Intuit•6• Updated a day ago

This article will help you learn:

- How to sync a client and start planning

- How to use a client's 2023 tax return

- How do I update an existing plan?

- How do I get to view all my plans onIntuit Tax Advisor?

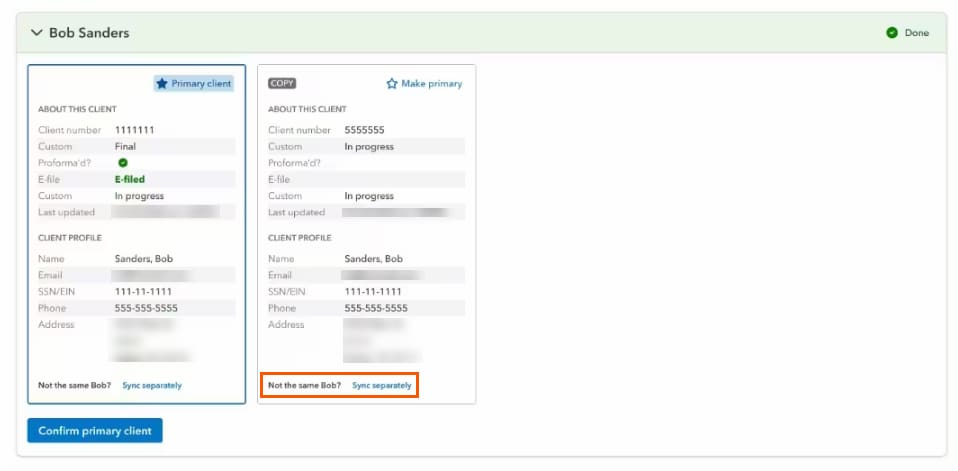

- How do I resolve Lacerteduplicate client copies

Video walkthrough

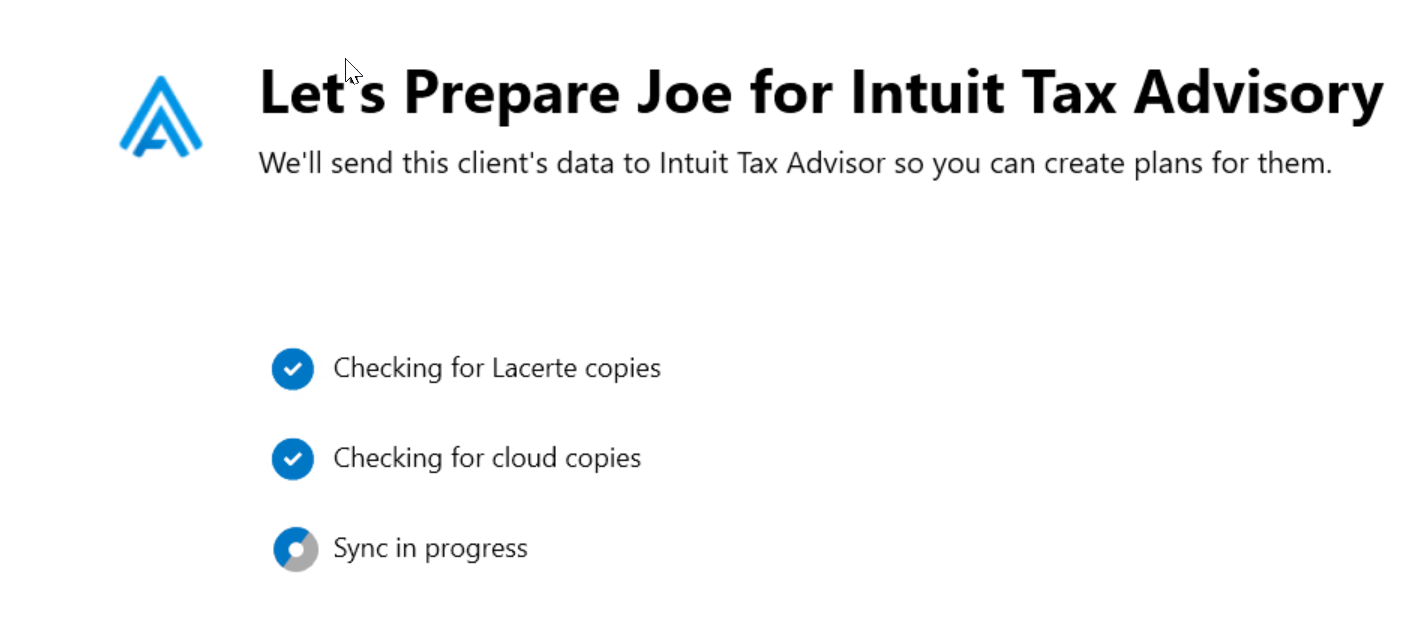

To sync a client and start planning:

- Sign in to Lacerte 2024.

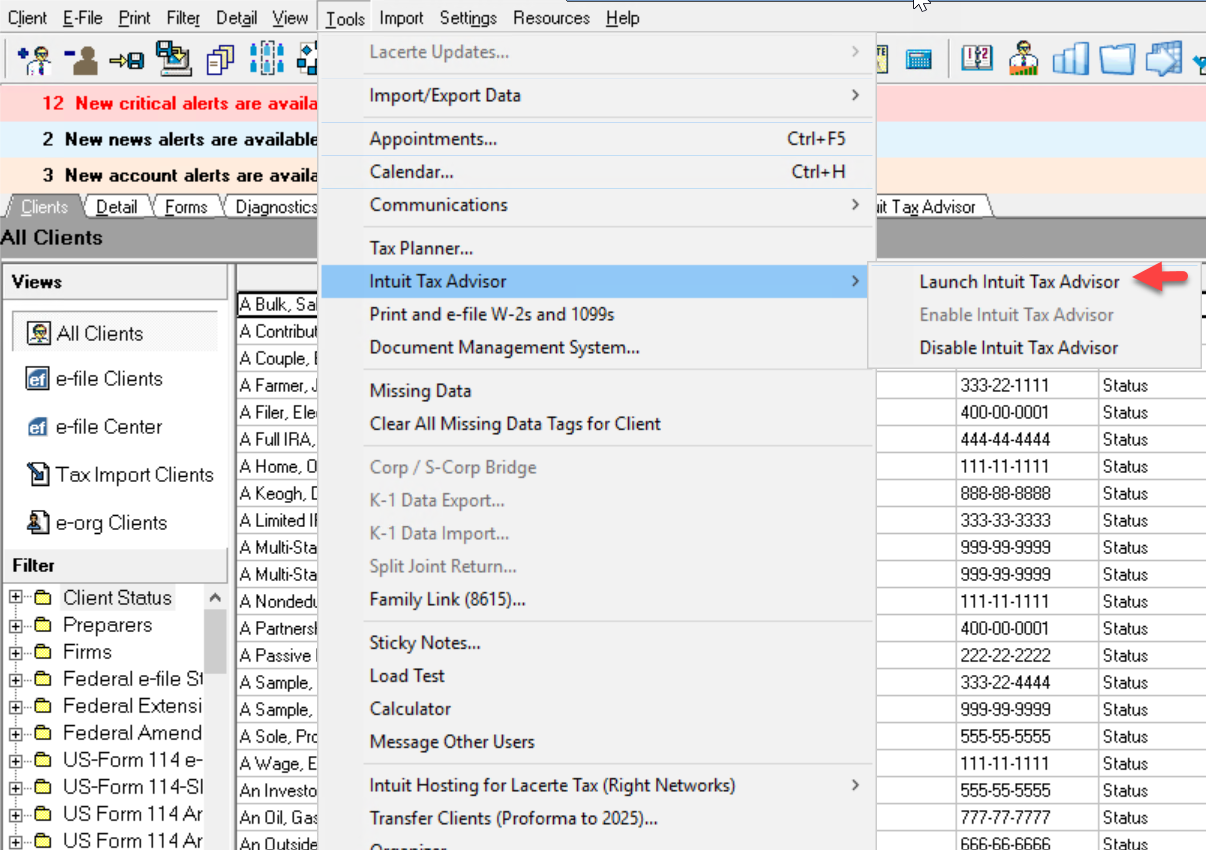

- From the Tools menu, select Lacerte Updates. Install any available updates and reopen Lacerte, if applicable.

- Go to the Individual (1040) module.

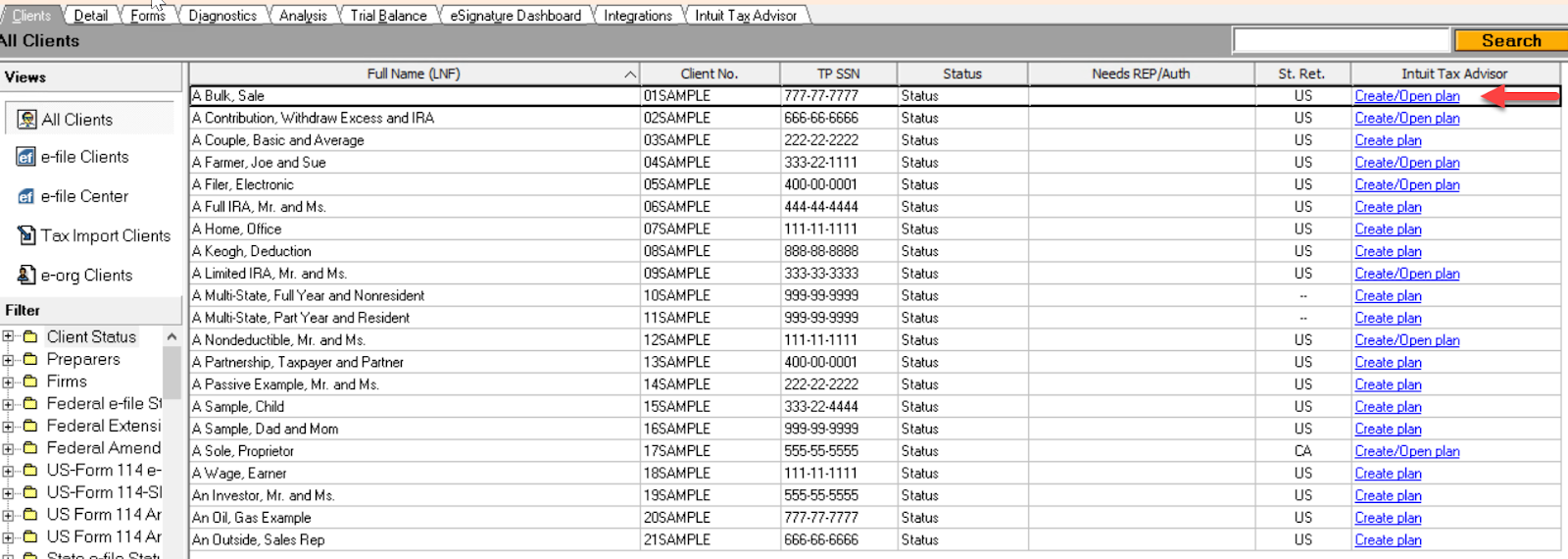

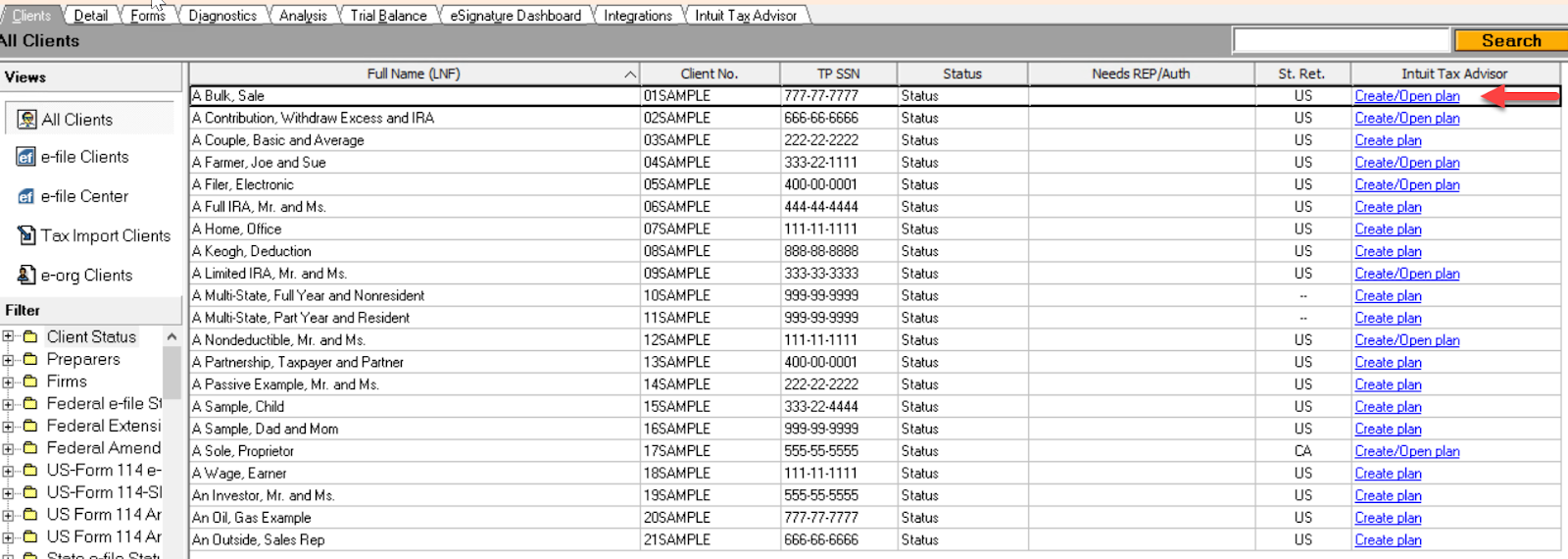

- On the client grid, find the client you want to create a plan for.

- Select Create plan from the Intuit Tax Advisor column in Lacerte which will begin syncing the client's data to the cloud:

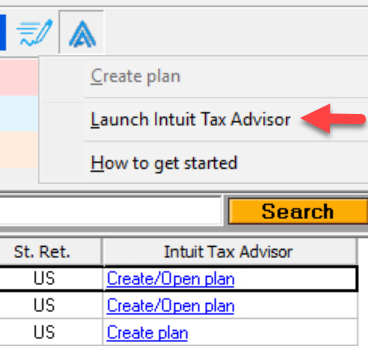

Intuit Tax Advisor may also be opened via the button at the top of Lacerte.

How do I update an existing plan or recreate a plan:

- Select Create/Open plan from the Intuit Tax Advisor column in Lacerte:

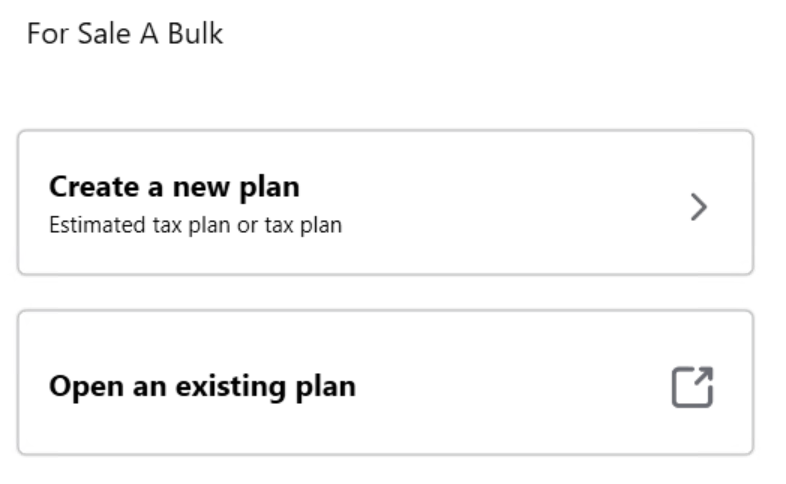

- Select Create a new plan or Open an existing plan:

- If you select Create a new plan, follow the same process as Option 1 or Option 2 above.

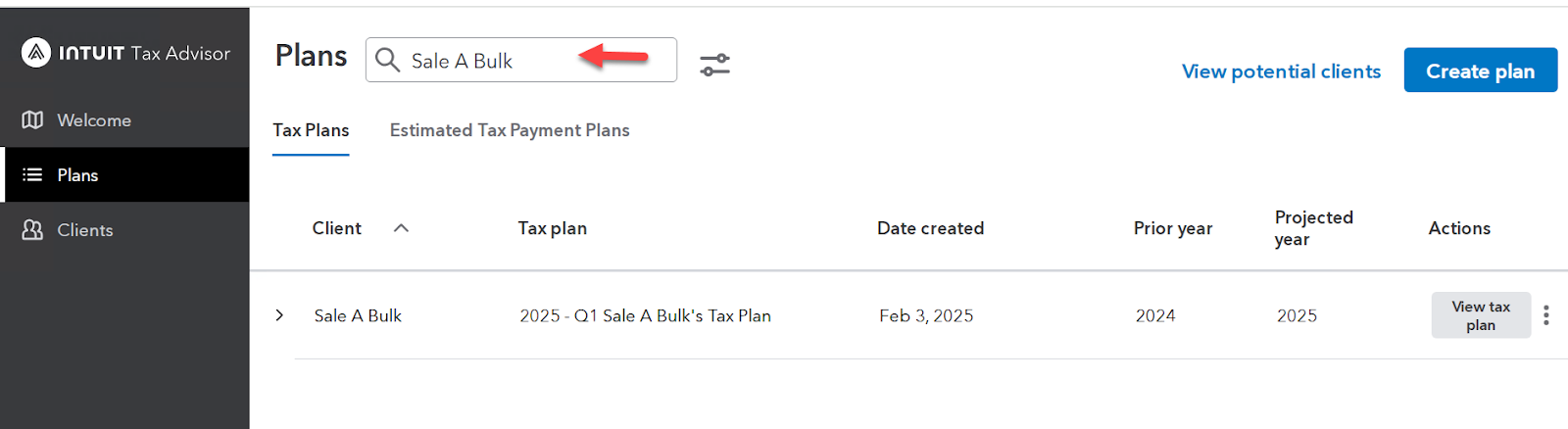

- If you select Open an existing plan, you'll be taken to the Plans screen in Intuit Tax Advisor where exiting plans reside with the filter set for that specific taxpayer:

- Removing the filter will allow all plans to be shown.

How do I go to Intuit Tax advisor to view all my plans, or how do I get to Intuit Tax Advisor without having to create a plan for my client?

If you want to go to Intuit Tax Advisor, and not necessarily create or modify plans for client, then select on the Intuit Tax Advisor icon in the Tool Bar.

I am in Lacerte 2023 and I do not see Intuit Tax Advisor columns or the “A” icon. How do I get to Intuit Tax Advisor?

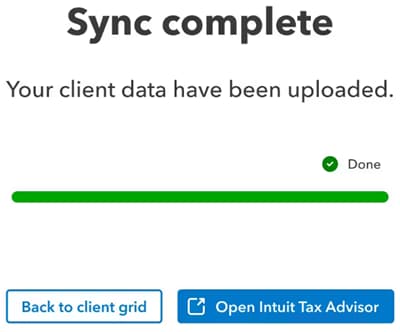

Start advising

Now that you've synced a client, you can dive in and create your first plan in minutes.

Ready to sync more clients?

Once you're ready to start planning for another client, follow the steps above to sync additional clients right from your Clients list in Lacerte.