Common questions about using Intuit Tax Advisor

by Intuit•8• Updated 4 months ago

This article answers frequently asked questions about using Intuit Tax Advisor. To learn more about Intuit Tax Advisor, click here.

Beginning in 2025 (TY24), Intuit Tax Advisor will be included with Lacerte and ProConnect Tax with Advanced User access permissions. See here to learn more.

Table of contents:

Have an idea or feedback about Intuit Tax Advisor? Head over to the Intuit Tax Advisor Idea Exchange to vote on or enter your great idea.

If you haven't use Intuit Idea Exchange, check out this guide on getting started.

Which tax returns can I import?

Intuit Tax Advisor imports Lacerte and ProConnect Tax individual returns for the current and prior tax return.

Business related strategies are planned from the individual return, using information from K-1's and schedules.

Will password-protected or locked returns sync from Lacerte?

Password-protected returns won't sync from Lacerte to Intuit Tax Advisor; however locked files will. Remove the password to be able to sync the return.

Can I create plans from scratch without importing a tax return?

No.

At this time, Intuit Tax Advisor is only available for clients whose returns you create in Lacerte or ProConnect Tax.

You must have an active current year license for Lacerte or ProConnect Tax in order to use Intuit Tax Advisor.

ProSeries Basic and ProSeries Professional don’t currently integrate with Intuit Tax Advisor.

If you don't use Lacerte or ProConnect Tax and would like to try out Intuit Tax Advisor see this article.

Which strategies will the program automatically check for?

Intuit Tax Advisor searches potential triggers in the tax data to create tax insights. For example, if your client was near the threshold for itemizing deductions, Intuit Tax Advisor may suggest bunching itemized deductions in even years and taking the standard deduction in odd years.

Does Intuit Tax Advisor work for business owners who are partial shareholders?

Yes!

Tax planning is always done at the business owner level. The allocable income of the business will automatically be calculated on the K-1’s that are imported for the 1040 return and Intuit Tax Advisor. Insights and strategies apply to the K-1 activity and you decide the strategy change amount based on the taxpayer's allocable share.

Does Intuit Tax Advisor handle state tax planning?

Yes!

Intuit Tax Advisor supports all calculations for the PRIMARY state of residence including:

• State specific strategies using custom strategies

• Projected taxable income

• Federal and state liability calculation

• Estimated payments

Does not include (yet):

• Multi-state tax liabilities

Can I adjust state withholding amounts?

Yes!

To adjust state withholding amounts:

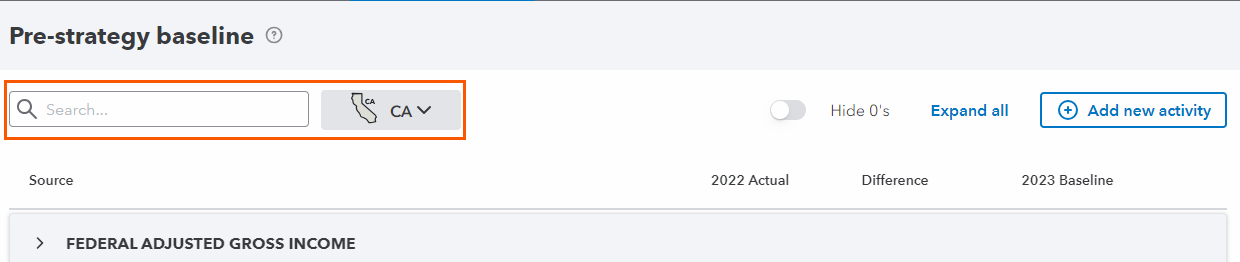

- Select the state from the dropdown next to the Search box on the Pre-strategy baseline tab.

- In the Search box, type the word adjust.

- Press Enter to search.

- This will find all fields that have the word adjust in the description.

- In the applicable field enter the adjustment for the state.

Why doesn't the Strategy tax savings total on the Strategies tab match Federal Balance Due or Refund on the Review plan tab?

The Strategy change amount on the Review plan tab will rarely, if ever, match the amounts seen on the Strategies and Client Report tabs in Intuit Tax Advisor for a few reasons:

- Strategies and Client Report tabs are calculated using marginal rates from the Pre-strategy baseline. The Review Plan amounts use updated marginal rates using the strategies implemented.

- Strategies and Client Reports tabs only use direct impacts however the Review plan tab calculates indirect amounts as well.

- Not every strategy applies to the tax plan. Some apply to the strategy taken into account on the Review plan tab only and are not carried back to the Pre-strategy baseline/Strategies/Client Report tabs.

Do returns have to be e-filed in order to sync?

No.

Tax returns don't have to be e-filed to sync to Intuit Tax Advisor.

Are tax plans visible to all users? Can I restrict users?

Tax plans are visible to all users unless client permissions are set. Client permissions provide the ability to restrict access to certain clients per user in your firm.

Users who don't have access to a client won't see that client listed as available when creating plans in Intuit Tax Advisor.

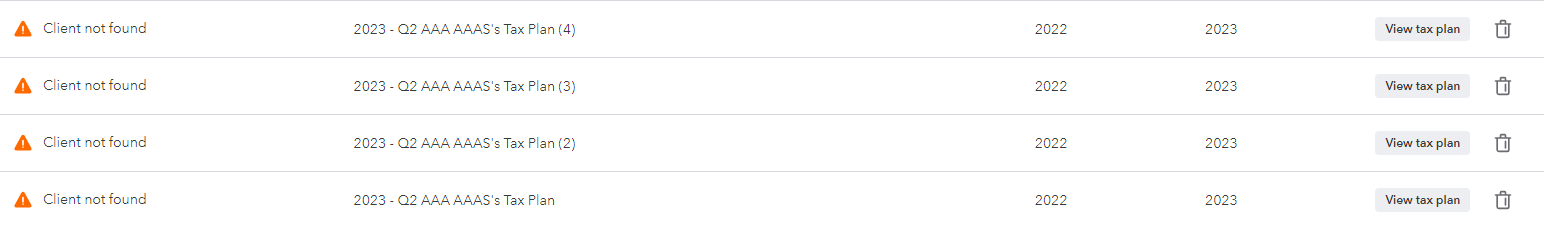

The plans for those restricted clients will appear as Client not found and can be deleted by users without access. See this article for steps to set permissions for your users.

If I update the return for my client, will my Intuit Tax Advisor plan update too?

No.

You'll need to create a new plan for the client.

Will I be charged again if I make multiple plans for one client?

No.

One credit is used when you create the client’s first plan. After that, you can create as many plans as you like for the same client without needing to use an additional credit in that calendar year.

What happens if I don’t use all the plans I bought? Will my unused credits roll over to next year?

No.

Tax plan credits expire at the end of the calendar year. We recommend you only purchase the credits you need.

Intuit won’t refund all, or part of, the purchase price for unused Intuit Tax Advisor credits.