How to resolve a Duplicate SSN error in ProSeries

by Intuit•13• Updated 4 months ago

The ProSeries EF Center only allows a Social Security Number (SSN) or Employer Identification Number (EIN) to be assigned to a single client file. If more than one client file is marked for electronic filing and shares the same SSN or EIN, a Return Duplicate SSN/EIN will be reported in the EF Status column.

Common causes for a Return Duplicate SSN/EIN status include, but aren't limited to:

- Using Save As to create a copy of a client's return, while that client is marked for electronic filing. This creates two e-file returns for the same client.

- Multiple copies of a single client file stored in different folders on the computer or network. This is typically associated with moving client files between computers or opening the files from removable media.

- Using the Split MFJ Return feature when the original return is marked for electronic filing. The taxpayer's split return will also be marked for e-file, creating a Duplicate SSN/EIN condition.

- Making a copy of a return to file an amended return.

Resolving duplicate SSN in ProSeries Professional 2020 and newer:

- ProSeries 2020 and newer won't require a Duplicate SSN record to be removed from the EF Center HomeBase to e-file. Instead, the software will allow duplicate records to coexist in the same HomeBase.

- It's advisable to make sure your EF Center HomeBase doesn't contain duplicate SSNs, so we recommend unmarking it for e-file (from the Federal Information Worksheet, Part VI) to avoid confusion and potentially e-filing the incorrect return.

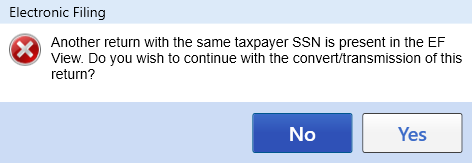

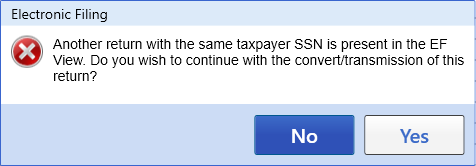

- The following window will be visible when a Duplicate SSN record is present and you try to e-file it:

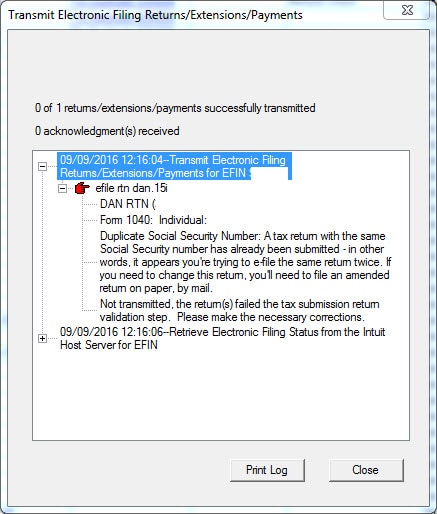

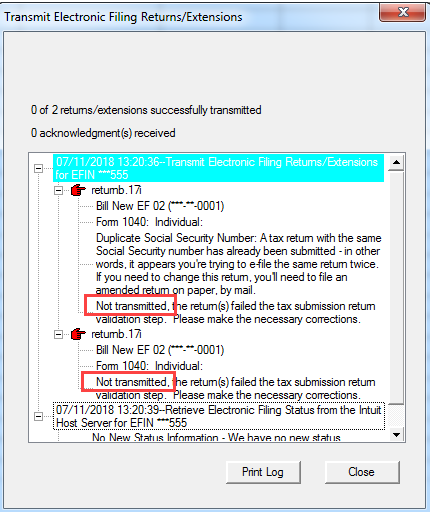

- Transmitting a return with the same Social Security number as one that has already been e-filed through Intuit software will fail, and the transmission log will specify it was due to a duplicate Social Security number. An exception to this would be a state return that wasn't previously e-filed; it can be transmitted even when it's attached to a previously accepted federal return.

More like this

- Resolving duplicate files in the ProSeries EF Centerby Intuit

- Resolving ProSeries Pay-Per-Return (PPR) errorsby Intuit

- DMS creates duplicate clients when importing or printing from tax programby Intuit

- Resolving "No valid EF Center Record Exists for this SSN/EIN" when receiving e-file acknowledgments in ProSeriesby Intuit