How to activate and e-file the NJ CBT-1065 in ProSeries

by Intuit•2• Updated 5 months ago

Before you start:

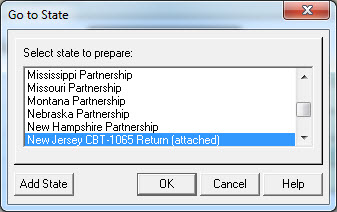

- Data entry and calculations for the NJ-CBT-1065 are done within the NJ Partnership Formset, the New Jersey CBT Return is simply for e-file data to be transmitted to the state taxing authority.

- If you make changes to the New Jersey Partnership return be sure to open and save the NJ-CBT formset again.

- Electronic Funds Withdrawal is available for the return and/or the extension. Use Part V on the NJ CBT-1065 Information Worksheet.

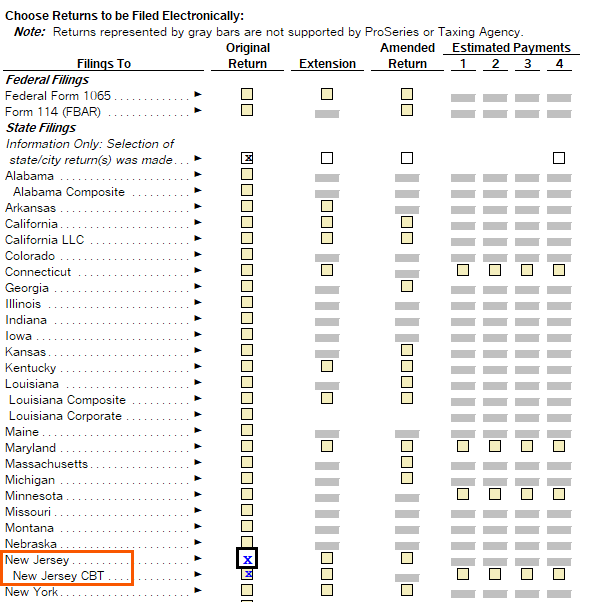

How do I e-file the NJ-CBT-1065 return, extension or estimated payments?

Before attempting to e-file the return be sure to open the New Jersey CBT-1065 Return and review the form as well as set up Electronic Funds Withdrawal as needed.

- Close the tax return.

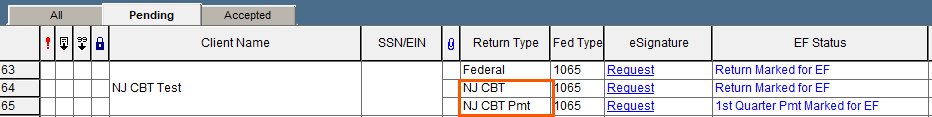

- Open the EF Center HomeBase view.

- Find the client and look for the line that shows NJ CBT as the return type (or NJ CBT Pmt for estimated tax payments).

- Highlight the line that you need to e-file.

- From the E-File menu, choose Electronic Filing, then Convert/Transmit Returns/Extensions/Payments...

- Choose the Convert and Transmit selected returns/extensions/payments and click OK.