Generating and e-filing a single-member LLC in ProSeries

by Intuit•7• Updated 1 year ago

For more Schedule C resources, check out our Tax topics page for Schedule C where you'll find answers to the most commonly asked questions.

Before you start:

- ProSeries Basic doesn't support Single Member LLCs.

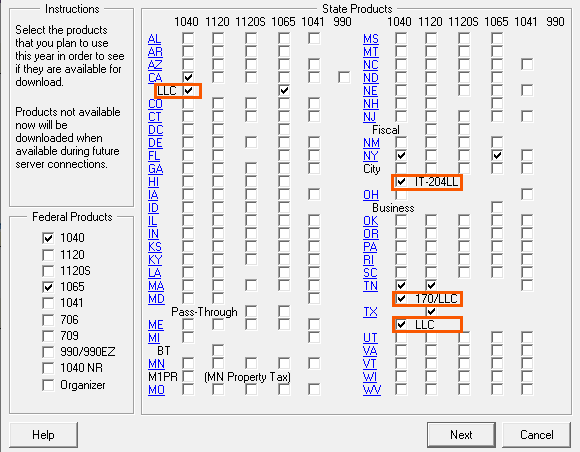

- Most states require the federal 1065 and state to be installed to access the SMLLC forms from the Individual Return.

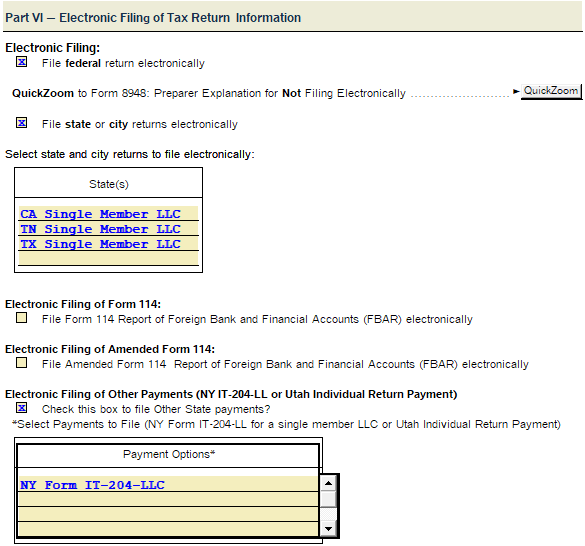

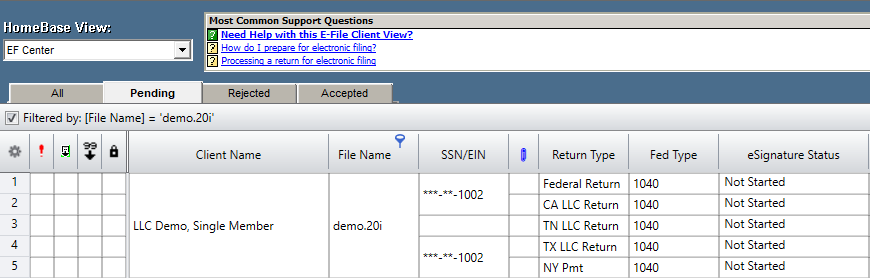

- You can only e-file one LLC per tax id number.

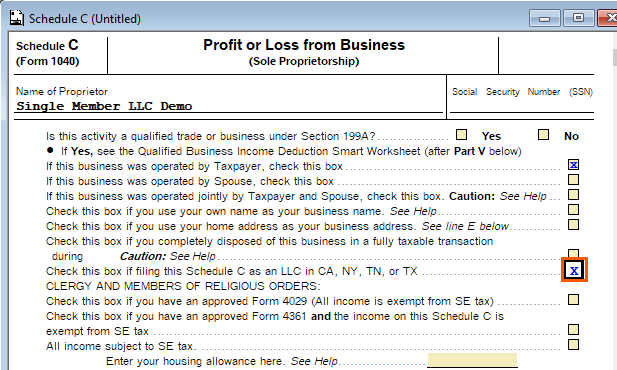

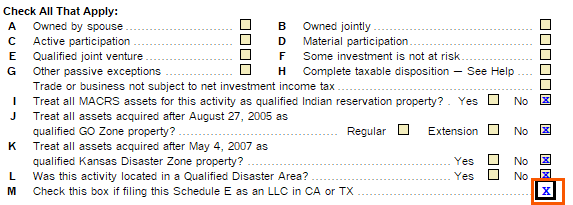

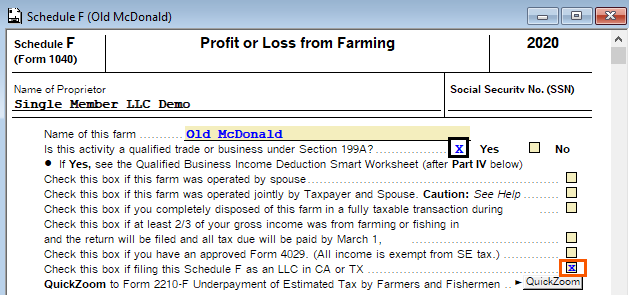

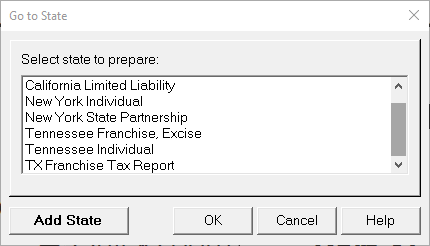

- California Form 568 can be generated from a federal Schedule C, Schedule E, or Schedule F.

- New York Form IT-204-LL can be generated from a federal Schedule C.

- Tennesee Form FAE 170 can be generated from a federal Schedule C.

- Texas Franchise tax returns can be generated from a federal Schedule C, Schedule E, or Schedule F.

- For taxpayers filing a return with multiple LLCs with unique EINs, only one LLC can be e-filed at a time, complete the steps for the first business activity then see E-filing multiple single member LLCs below.