Generating Form 1045 Application for Tentative Refund

by Intuit•1• Updated 5 months ago

Form 1045 is used by an individual, estate, or trust to apply for a quick tax refund resulting from:

- The carryback of a Net Operating Loss (NOL)

- The carryback of an unused general business credit

- The carryback of a net section 1256 contracts loss

- An overpayment of tax due to a claim of right adjustment under section 1341(b)(1)

For most taxpayers, NOLs arising in tax years ending after 2020 can only be carried forward. See Net operating losses for more information.

Table of contents:

To generate Form 1045

- Go to Screen 60, Tentative Refund (1045).

- Under the section Application for Tentative Refund (1045), enter any applicable information.

- A current year NOL will automatically be computed, if applicable.

- However, the NOL can be entered in the field Net operating loss [O], under the Carryback subsection.

- Scroll down to the Step 1 - Compute Schedule B (NOL Carryover) section.

- Column 1 is the 3rd preceding tax year. Column 2 is the 2nd preceding tax year. Column 3 is the 1st preceding tax year.

- To add more years, see the highlighted instructions at the bottom of this page.

- The fields in this section will be used to calculate the NOL carryover on Form 1045, pages 3 and 4.

- Column 1 is the 3rd preceding tax year. Column 2 is the 2nd preceding tax year. Column 3 is the 1st preceding tax year.

- Enter the appropriate amount in Taxable Income (before Carryback) (-1 = none) for the respective carryback years.

- This is the taxable income on the original return before applying any carryback amounts.

- Enter all other applicable amounts in:

- Net capital loss deduction

- Section 1202 exclusion

- Domestic production activities deduction

- Adjustments to AGI

- Scroll down to the Adjustment to Itemized Deductions subsection and make any necessary entries.

- These inputs are only required for years in which the taxpayer had, and itemized, a net capital loss deduction, Section 1202 exclusion, or Domestic Production Activities Deduction (DPAD).

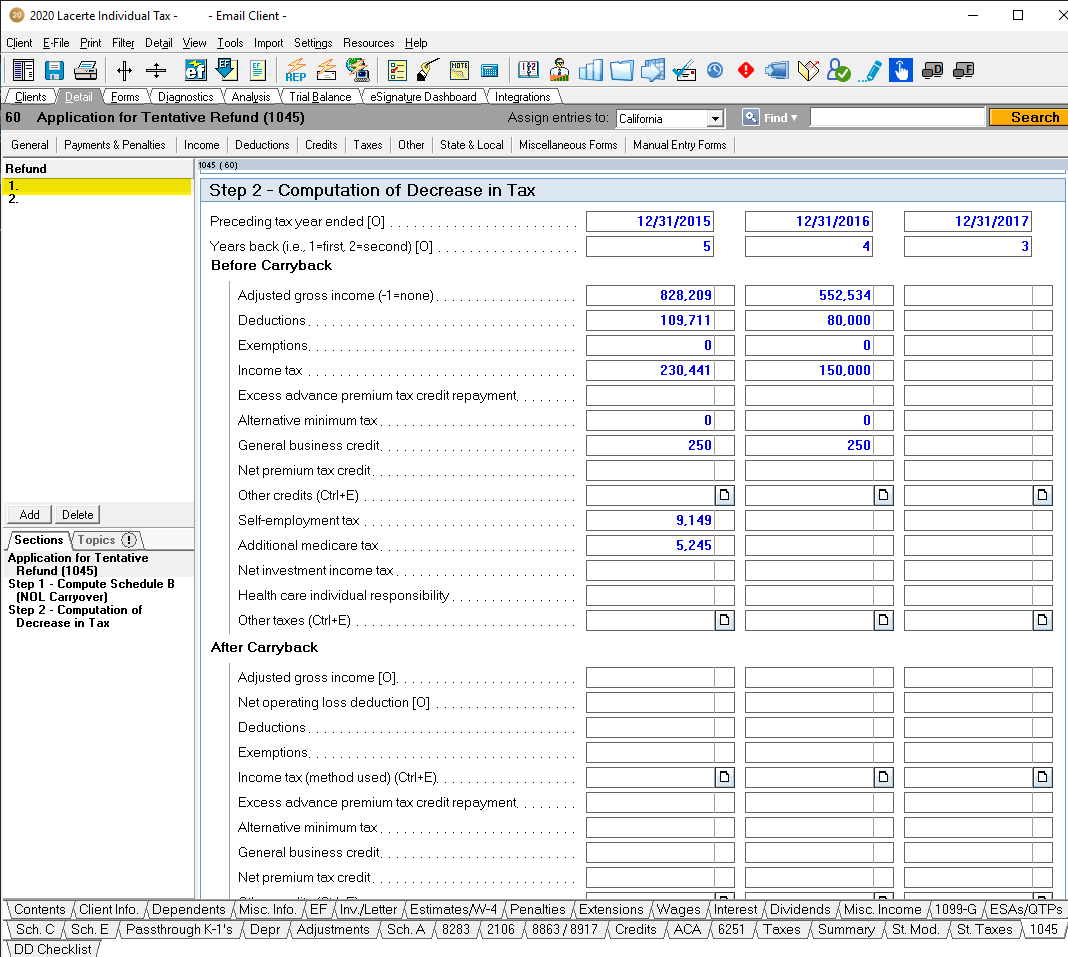

- Scroll down to the Step - 2 Computation of Decrease in Tax section.

- Enter all applicable amounts from prior year returns under the Before Carryback subsection.

- The information will show in Columns (A), (C), and (E) on Form 1045, Page 1.

- Enter all applicable amounts under the After Carryback subsection.

- The information will show in Columns (B), (D), and (F) on Form 1045, Page 1.

- You must calculate what the amounts would be after carrying back the NOL.

- You can do this by using the prior year programs.

- See Entering an NOL Carryback from a 1045 in Prior Years for more information.

- If necessary, enter the adjusted gross income after NOL loss carryback in the field, Adjusted gross income [O].

- The amount will override the program calculation of Form 1045, Page 1, Line 11, Columns (B), (D), and (F).

- If necessary, enter the appropriate amount in the field, Net operating loss deduction [O].

- The amount will override the net operating loss deduction reported on Form 1045, Page 1, Line 11 and Form 1045, Schedule B, Line 1.

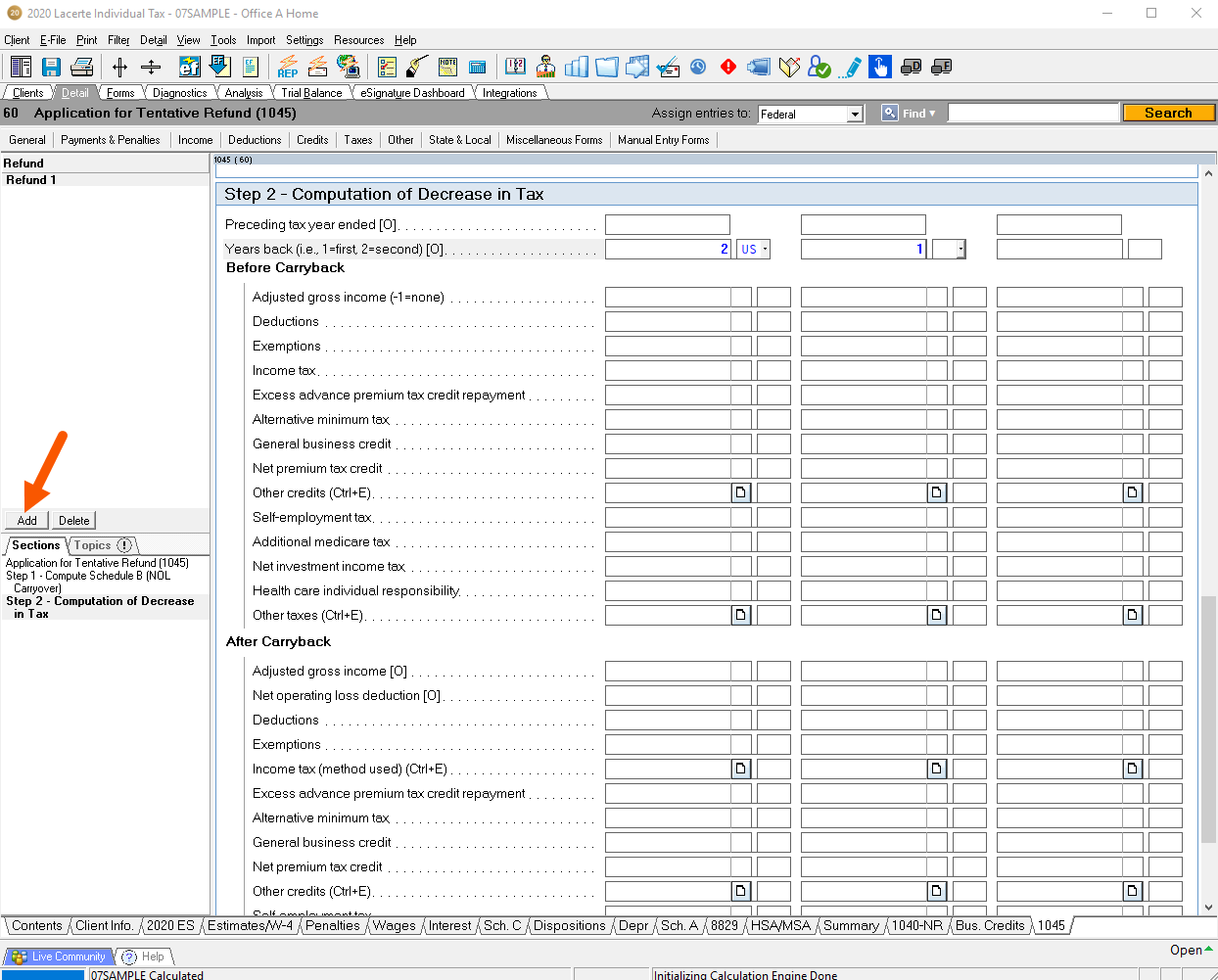

![]() To add additional years, a second 1045 will need to be created by selecting Add under the the Refund section in the left navigation panel.

To add additional years, a second 1045 will need to be created by selecting Add under the the Refund section in the left navigation panel.

See Form 1045 instructions for more information.

Calculate changes in tax (using prior year Lacerte program as a scratchpad):

- Open Lacerte for the first year of the carryback, (in this example: 2017).

- On Screen 59, Amended Return (1040X), marking the return as amended.

- On Screen 15, Net Operating Loss, Enter the Year of Loss, Initial Loss, AMT Initial Loss, Carryover available in 20YY

- Click on the Forms tab to calculate the return.

- Print the recalculated 1040 return. You will need these values for entry in the current year program.

- Repeat for each carryback year.

Where do I input data to generate amounts on Form 1045, Schedule B Line 8?

- Go to Screen 60, Application for Tentative Refund (1045).

- Scroll down to the Step 1 - Compute Schedule B (NOL Carryover) section.

- Enter the amount in Deduction for exemptions (under column 3, column 2, or column 1 depending on carryback year).

Client Letter does not reference Form 1045

When generating a 1045, the client letter will not reference filing information for this form. Filing instructions must be used by going into Screen 5.1 Invoice, Letter, Filing Instructions and putting a 1 in Filing instructions and checking the box Tentative Refund (1045).

Related topics:

More like this

- Entering individual Form 1045, Application for Tentative Refund in ProConnect Taxby Intuit

- Generating Form 1139, Application For Tentative Refund, for a 1120 return in ProConnect Taxby Intuit

- Generating Form 1139, Application For Tentative Refund, for a 1120 return in Lacerteby Intuit

- Generating Minnesota Form M1PR Property Tax Refund in ProConnect Taxby Intuit