New for ProSeries Professional tax year 2024: Crypto transaction import

by Intuit•4• Updated 1 year ago

Beginning with tax year 2024, ProSeries Professional now has the ability to import crypto transactions from a 1099-B into a 1040 return.

Before you start:

- This feature is only available in 1040 returns.

- This feature is not available in ProSeries Basic.

- To complete the import, you will need a CSV file from your crypto Service. For help downloading the CSV, contact your crypto Service Provider.

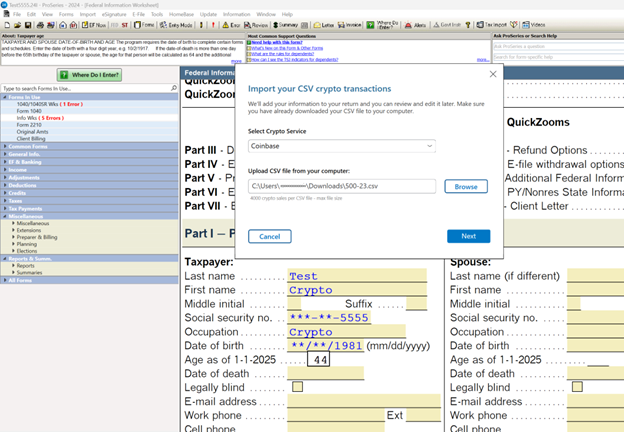

Follow the steps below to import crypto transactions

- Open the client's return.

- From the Import menu, select 1099B: Crypto Transactions Import.

- Choose the appropriate Crypto Service.

- Select the previously downloaded CSV file containing the transactions and select Next.

- Review the upload details and select Import.

- The transactions will be imported into a 1099-B Worksheet.

- Correct any errors on the 1099-B worksheet.