Importing scanned source documents with ProSeries Scan and Import

by Intuit•6• Updated 11 months ago

Before you start:

- Intuit ProSeries has two methods of importing tax data; see Understanding the differences between Tax Import and Tax Scan and Import to review the differences.

- For best results scan documents at 300DPI in Black and White.

- This feature isn't available in ProSeries Basic.

- This feature is only available in the Form 1040 Individual module.

- Make sure the PDF is saved to the computer and you know where it's saved.

- Jobs with large documents (200+ pages) aren't supported for data extraction and would need to be split into multiple jobs.

- To learn more, refer to ProSeries Data Import.

To begin the process:

- Open ProSeries to the Form 1040 Individual HomeBase View.

- Select the client.

- From the Import menu, select Tax Import, then Import Client Data from Scanned PDF.

- On the Import From Scanned PDF wizard select Continue.

- Use Browse to locate and select a PDF saved on your computer, or Browse from DMS if the PDF is saved in DMS.

- Select Send.

What's next?

- Once you select Send you'll get a a confirmation screen will show Your Submission For this Client was Started in the Background.

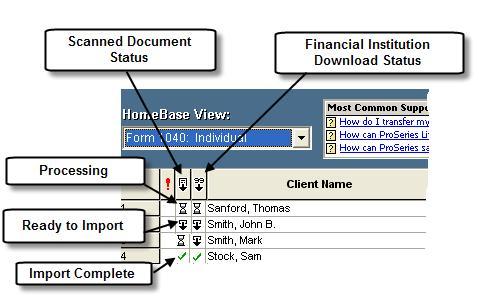

- ProSeries will periodically check the status of your submission and update the Scan Source Documents column in the HomeBase view.

- You can continue working in ProSeries as normal while the submission is processed.

- Your client's submitted source documents may take between 15- 30 minutes but may also take up to 12 hours to process depending on volume.

- When complete, your status will update to Ready to Import.

- To import the data into the client's return, open the return and the Pre-Import tool will be displayed.