Coverage is considered unaffordable - Was the amount you would have paid for employer-sponsored coverage or a bronze level health plan (depending on your circumstances) more than eight percent (8.05%) of your actual household income for the year as computed on your tax return?

Lacerte can calculate if healthcare is affordable based upon a few additional inputs. To use the in-program calculator, follow the steps listed below.

Step 1. Enter tax information as you normally would in ProConnect Tax. For example, wages in the Wages, Salaries, Tips (W-2) screen and other information provided by the client. Enter the total of all nontaxable social security benefits received by you, spouse and each claimed dependent who must file a tax return.

Step 2. If your client indicates that they didn't purchase insurance because it was unaffordable and they had no access to employer-based insurance, you'll need to determine what the 2015 Bronze Plan and Second Lowest Cost Silver Plan premiums for the client were. If they don't have that information, you can obtain this from the Healthcare.gov website using the Claim an Affordability Exemption link.

Step 3. Enter the requested information in the Healthcare Coverage Tax Tool link above and this will provide you with the Bronze Plan and SLCSP premiums for the household.

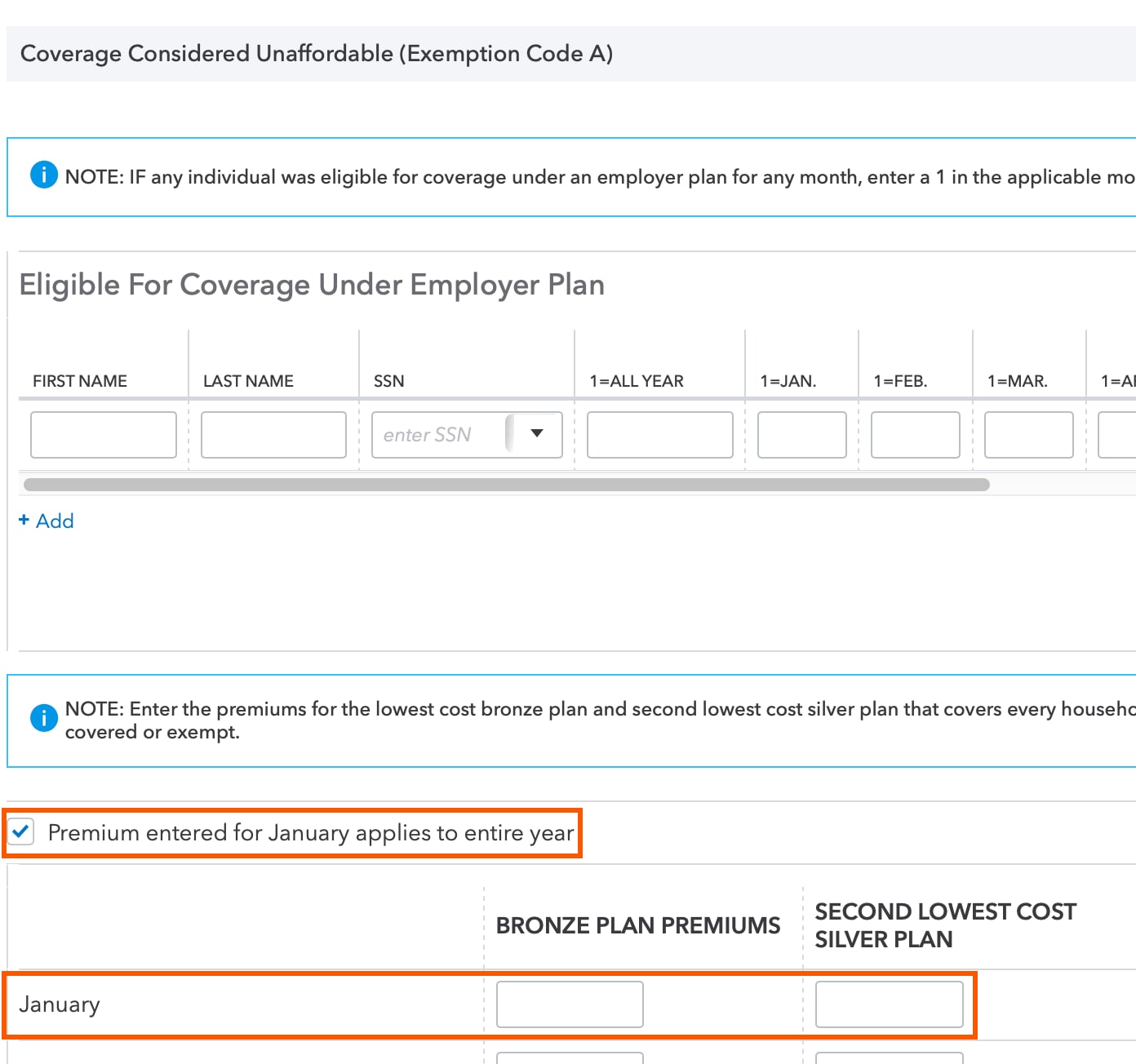

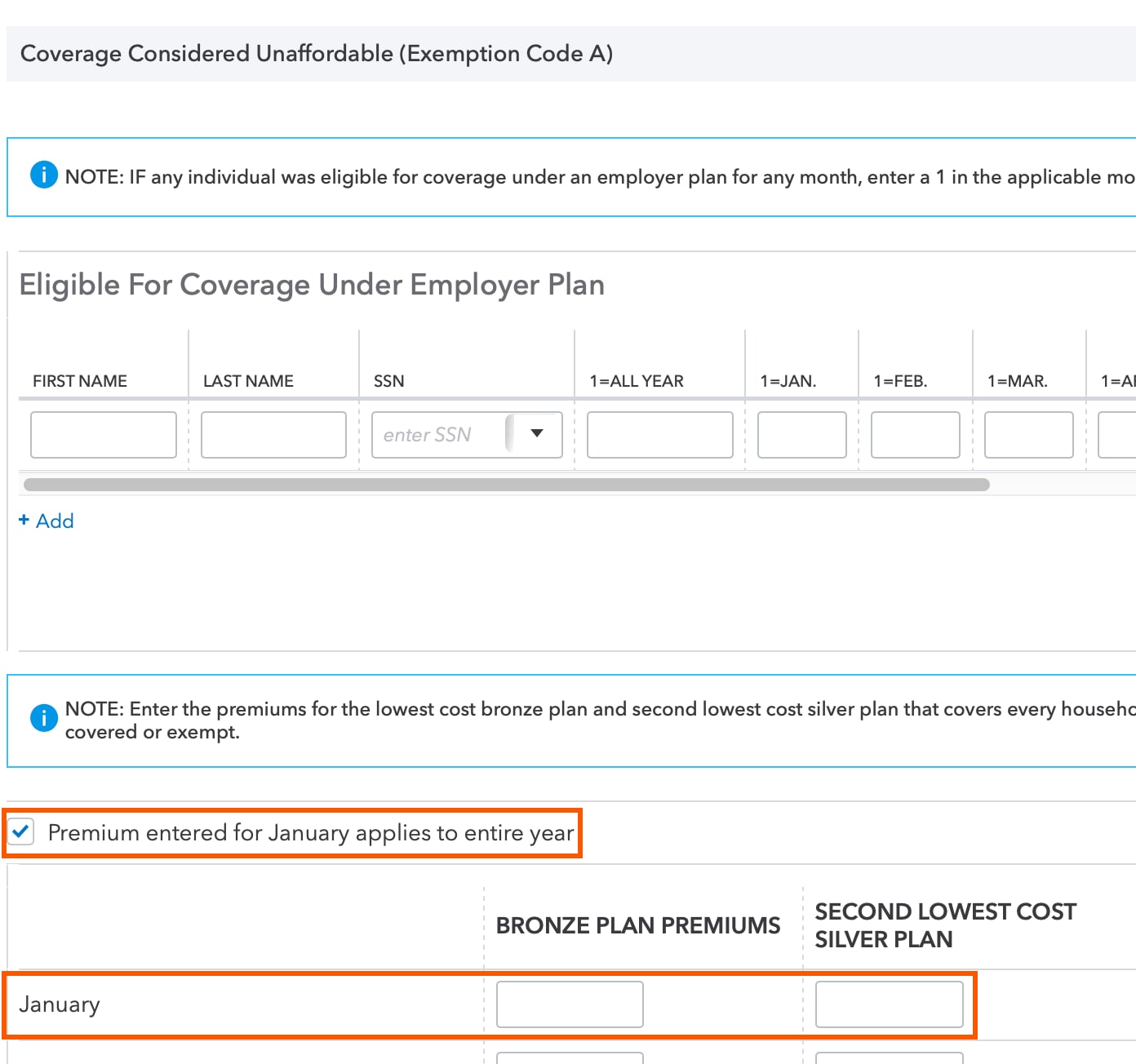

Step 4. In ProConnect Tax, go to the Credits > Health Coverage, Exemptions, & Miscellaneous screen. In the Coverage Considered Unaffordable (Exemption Code A) section, enter the January field under the Bronze Plan Premiums and Second Lowest Cost Silver Plan columns. The screenshot below shows an example of healthcare plan input.

Step 5. If the Healthcare tool provided the same plan premium amount for all 12 months, you only need to enter the January amounts, and then mark the checkbox labeled Premium entered for January applies to entire year.

Step 6. You can click the Check Return tab to view the Marketplace Coverage Affordability results in the Worksheets section. The program calculates the 8.05% household income amount at the bottom of the worksheet. Compare the line 13 amount to the threshold value.

Example 1:

Single taxpayer with $35,000 household income who didn't have coverage for the entire year and did not have access to employer-based coverage. Using the premium amounts in the screenshot above, Marketplace coverage total premiums would be $1,884 for the entire year. Based upon program input the 8.05% threshold is $2,818. Since $1,884 is below $2,818, coverage is considered affordable and the taxpayer is subject to the Individual Penalty.

Example 2:

Single taxpayer with $48.000 household income who didn't have coverage for the entire year and no access to employer based coverage. In this scenario, the taxpayer exceeds the 400% Poverty Threshold and so does not qualify for premium assistance. As a result, the full cost of the Bronze Plan premiums of $4,668 exceeds the 8.05% threshold of 3,864 so coverage is considered unaffordable. The program automatically generates a Form 8965 with the Exemption Code A.