Common questions about Individual Form 8965

by Intuit•1• Updated 3 months ago

Before you start:

- The Form 8965 applies to tax years 2014 through 2018.

- Beginning in Tax Year 2019, Form 1040 will not have the “full-year health care coverage or exempt” box and Form 8965, Health Coverage Exemptions, will no longer be used. You need not make a shared responsibility payment or file Form 8965, Health Coverage Exemptions, with your tax return if you don’t have a minimum essential coverage for part or all of 2019.

See Individual Shared Responsibility Provision on IRS.gov for more details.

Coverage is considered unaffordable - Was the amount you would have paid for employer-sponsored coverage or a bronze level health plan (depending on your circumstances) more than eight percent (8.05%) of your actual household income for the year as computed on your tax return?

Lacerte can calculate if healthcare is affordable based upon a few additional inputs. To use the in-program calculator, take the steps listed below.

Step 1. Enter tax information as you normally would in the Lacerte program, for example, Wages in Screen 10 and other information provided by the client. Note: Enter the total of all nontaxable social security benefits received by you, spouse and each claimed dependent who must file a tax return.

Step 2. If your client indicates that they did not purchase insurance because it was unaffordable and they had no access to employer-based insurance, you will need to determine what the 2015 Bronze Plan and Second Lowest Cost Silver Plan premiums for the client were. If they do not have that information, you can obtain this from the Healthcare.gov website using the Claim an Affordability Exemption link.

Step 3. Enter the requested information in the Healthcare Coverage Tax Tool link above and this will provide you with the Bronze Plan and SLCSP premiums for the household.

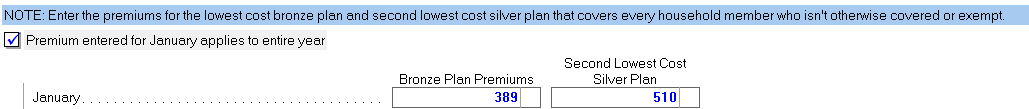

Step 4. In the Lacerte program in Screen 39.1, Health Coverage, Exemptions, & Misc. in the section labeled Coverage Considered Unaffordable (Exemption Code A), enter the Bronze Plan Premium and Second Lowest Cost Silver Plan (SLCSP) in the January input field The screenshot below shows an example of healthcare plan input.

Step 5. Note: If the Healthcare tool provided the same plan premium amount for all 12 months, you need enter only the January amounts, then check the "Premium entered for January applies to entire year".

Step 6. You can click the Forms tab to view the Marketplace Coverage Affordability results in the Worksheets section. The program calculates the 8.05% household income amount at the bottom of the worksheet. Compare the Line 13 amount to the threshold value.

Example 1: Single taxpayer with $35,000 household income who did not have coverage for the entire year and did not have access to employer-based coverage. Using the premium amounts in the screenshot above, Marketplace coverage total premiums would be $1,884 for the entire year. Based upon program input the 8.05% threshold is $2,818. Since $1,884 is below $2,818, coverage is considered affordable and the taxpayer is subject to the Individual Penalty.

Example 2: Single taxpayer with $48.000 household income who did not have coverage for the entire year and no access to employer based coverage. In this scenario, the taxpayer exceeds the 400% Poverty Threshold and so does not qualify for premium assistance. As a result, the full cost of the Bronze Plan premiums of $4,668 exceeds the 8.05% threshold of 3,864 so coverage is considered unaffordable. The program automatically generates a Form 8965 with the Exemption Code A.

Follow these steps to enter a Marketplace-Granted Coverage Exemption and generate From 8965, Part I:

- Go to Screen 39, Affordable Care Act Subsidy/Penalty.

- Click on Health Coverage, Exemptions, and Miscellaneous from the left navigation panel (this will take you to Screen 39.1).

- Scroll down to the Market Place-Granted Coverage Exemptions (Form 8965, Part I) section.

- Enter the Name of Individual.

- Enter the SSN.

- Enter the Exemption Certificate Number. (The ECN should be at least 6 or 7 digits.)

Note: If household or gross income is below the filing threshold, Part I will be blank.

Lacerte will automatically generate Form 8965, Part II, lines 7a and 7b automatically based on the Taxpayers/Spouse income.

Follow these steps to enter a Coverage Exemption and generate Form 8965, Part III:

- Go to Screen 39, Affordable Care Act Subsidy/Penalty.

- Click on Health Coverage, Exemptions, and Miscellaneous from the left navigation panel (this will take you to Screen 39.1).

- Scroll down to the Coverage Exemptions for Individuals Claimed on Returns (Form 8965, Part III) section.

- Enter the Name of Individual.

- Enter the SSN.

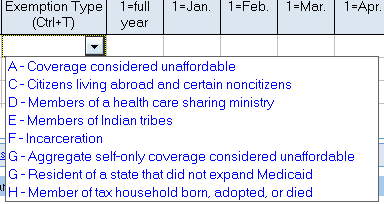

- Select the Exemption Type (Ctrl+T) from the drop down menu.

Note: Code B, Short coverage gap, is no longer listed on the drop down menu. Instead Lacerte will generate the exemption code B automatically based on the months indicated for coverage. (If the taxpayer went without coverage for less than 3 consecutive months during the year)

Note: Code B, Short coverage gap, is no longer listed on the drop down menu. Instead Lacerte will generate the exemption code B automatically based on the months indicated for coverage. (If the taxpayer went without coverage for less than 3 consecutive months during the year) - Enter a 1 in 1= full year or enter a 1 for each month that the exemption was good for.

Per the 8965 instructions,

To enter the dependent's AGI for Form 8965:

- Go to Screen 39.1, Health Coverage, Exemptions, & Misc.

- Scroll down to the Share Responsibility Payment Worksheet (Form 8965) section.

- Enter the Dependents' modified AGI.

Additional Information - Dependent's Modified AGI:

The household income used in determining the exemption on Form 8965, line 7a, and in calculations on the Shared Payment Responsibility Worksheet is the taxpayer's modified adjusted gross income (MAGI) plus the MAGI from the separately prepared tax return of each individual in the tax household claimed as a dependent by the taxpayer and who is required to file his or her own tax return.

- Dependent filing Form 1040: If the dependent filed Form 1040, calculate the MAGI by adding the amounts reported on Form 1040, lines 8b and 37. If the foreign earned income exclusion, housing exclusion, or housing deduction are claimed, add the amount from Form 2555, line 45 and 50, or Form 2555-EZ, line 18.

- Dependent filing Form 1040A: If the dependent filed Form 1040A, calculate the MAGI by adding the amounts on Form 1040A, lines 8b and 21.

- Dependent filing Form 1040EZ: If the dependent filed Form 1040EZ, calculate the MAGI by adding Form 1040EZ, line 4 and any tax-exempt interest reported in the space to the left of line 2.

If no entry is present in this field, but an entry is present in Dependents' modified AGI in the Premium Tax Credit section of this screen, the entry in that field will be included in the household income calculations.

More like this

- Common questions about individual Form 8965 in ProConnect Taxby Intuit

- Common questions about Form 8903 and domestic production activities deductions in ProConnect Taxby Intuit

- Common questions on Georgia Form 500 for part-year nonresidentsby Intuit

- Entering Form 1125-A, Cost of Goods Sold in ProConnect Taxby Intuit

- Common questions about e-filing Form 8453 in Lacerteby Intuit