How to check the box for "If treat nonresident or dual-status alien spouse as a US resident" in Lacerte

by Intuit•3• Updated 11 months ago

On the 2024 Form 1040, a new checkbox has been added to the Filing Status section of the form. The new checkbox states:

- If treating a nonresident alien or dual-status alien spouse as a U.S. resident for the entire tax year, check the box and enter their name (see instructions and attach statement if required)

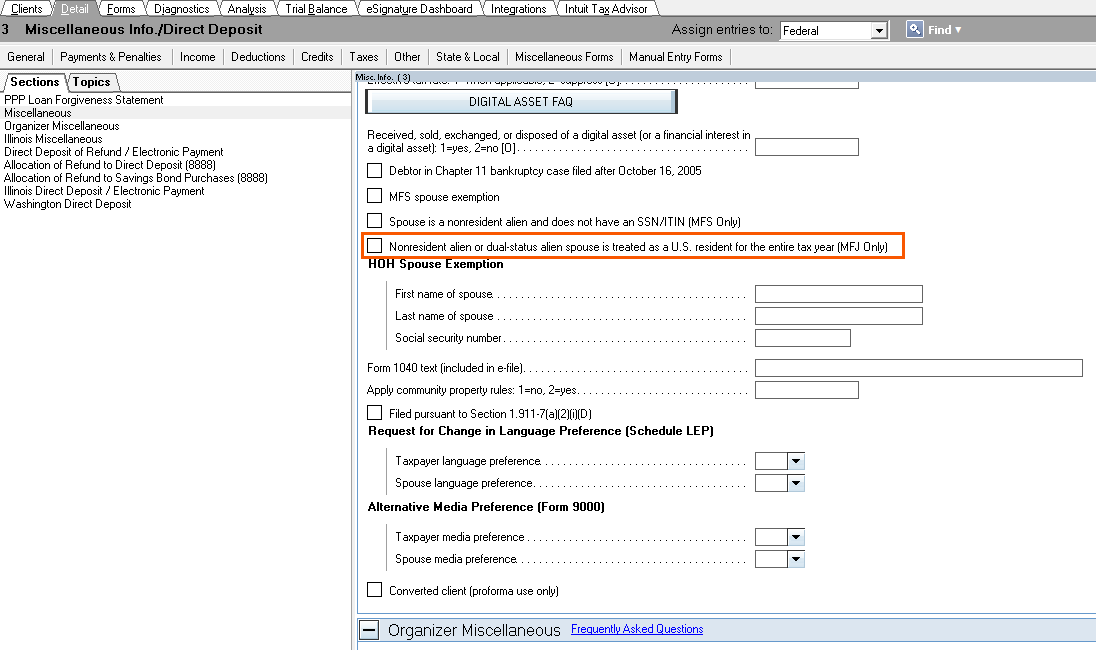

A checkbox has been added to the Miscellaneous screen that will mark this checkbox and populate the spouse's name:

- Open the client to the Detail tab

- Select Screen 3, Miscellaneous Information/Direct Deposit

- Go to the Miscellaneous section

- Scroll down until you see the checkboxes

- Check the box for Nonresident alient or dual-status alient spouse is treated as a U.S. resident for the entire tax year (MFJ Only)

More like this

- Locating the 6013(g) Election Fields in ProConnect Taxby Intuit

- How to check the box for "If treat nonresident or dual-status alien spouse as a US resident" in ProSeriesby Intuit

- How to resolve MFJ status diagnostics on Form 1040NR in ProConnect Taxby Intuit

- Troubleshooting Lacerte diagnostic ref. 3443 - defining part-year/non-resident time periodsby Intuit