Locating the 6013(g) Election Fields in ProConnect Tax

by Intuit• Updated 4 months ago

To enter the 6013(g) election:

If treating a nonresident alien or dual-status alien spouse as a U.S. resident for the entire tax year, follow these steps and enter their name (attach statement if required).

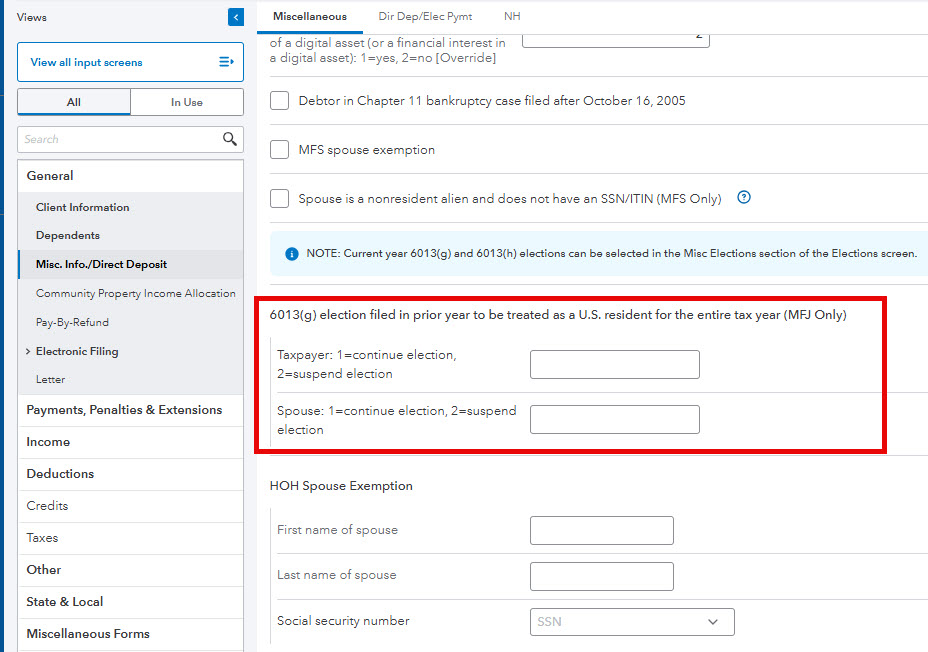

- Go to Input Return ⮕ General ⮕ Misc. Info./Direct Deposit

- Locate the input fields under 6013(g) election filed in prior year to be treated as a U.S resident for the entire tax year (MFJ Only).

- Fill out the both fields.