Using the E-file Estimated Payment Wizard in Lacerte

by Intuit•11• Updated 3 days ago

For more estimated tax resources, check out our Tax topics page on Estimated Tax payments where you'll find answers to the most commonly asked questions.

This article will help you:

- Determine which estimates can be e-filed separately from the tax return

- Verify the electronic payment date

- Transmit estimated tax payments

Disaster area tax relief available:

Filing deadlines and estimated tax due dates may be extended for taxpayers in parts of Alabama, Alaska, California, Florida, Georgia, Kentucky, North Carolina, South Carolina, Tennessee, Virginia, and IRS for taxpayers living abroad. See here for more details.

Follow these steps to e-file estimated tax payments:

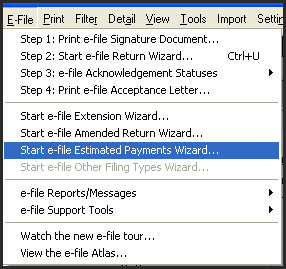

- Go to the Client list.

- Highlight the client(s) whose estimates you want to send.

- From the E-File menu, select Start e-file Estimated Payments Wizard.

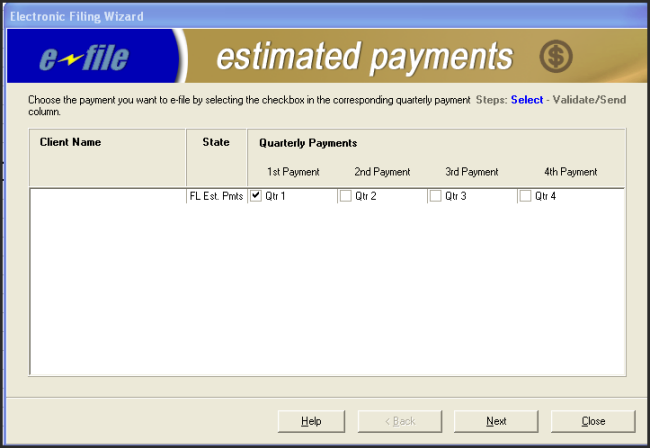

- If you receive a message that the "Client has no estimated payments that can be e-filed", the client may be able to set up estimates with the filing of their return, but can't transmit them separately. See Which estimates can I e-file? below.

- Under Quarterly Payments, select the payments you wish to transmit, and click Next.

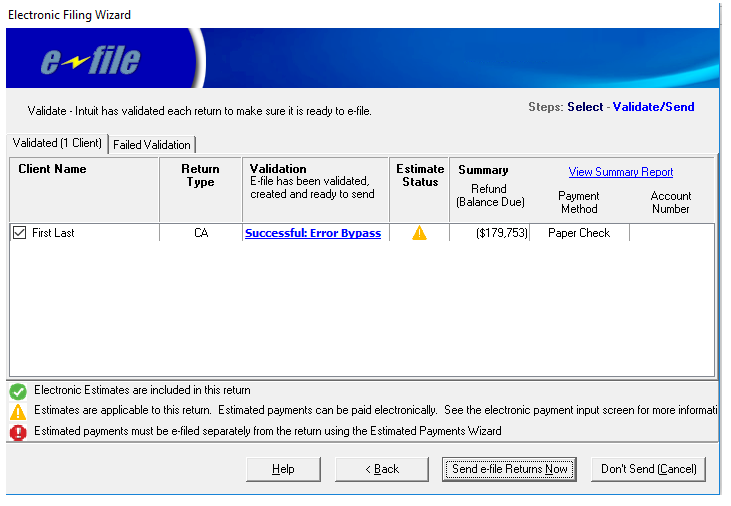

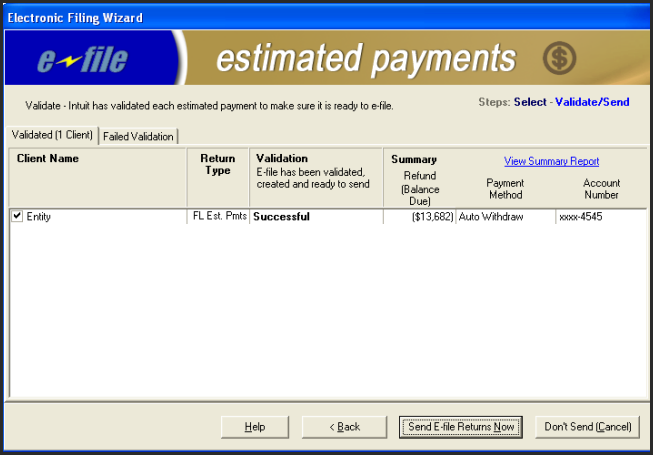

- Lacerte will check the payments for missing or incorrect information. If successful, the Summary will provide the details of the payment.

- Click Send E-file Returns Now to transmit the estimates.

If the validation found errors, you will see Error: Diagnostics under Validation. Click on the link to see the errors. Once corrected, follow the steps again to validate again.

To see details of the transmission, you can click View Summary Report. This will only be available if the validation was successful.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Common questions about federal and state individual estimated paymentsby Intuit

- Electronic payment of CA estimated tax for Individual and Fiduciary returns in Lacerteby Intuit

- How to View and Print the Contents of an E-File in Lacerteby Intuit

- Common questions about e-filing Form 8453 in Lacerteby Intuit