How to resolve an activity total error on the 199A Supplemental Worksheet in ProSeries

by Intuit• Updated 1 year ago

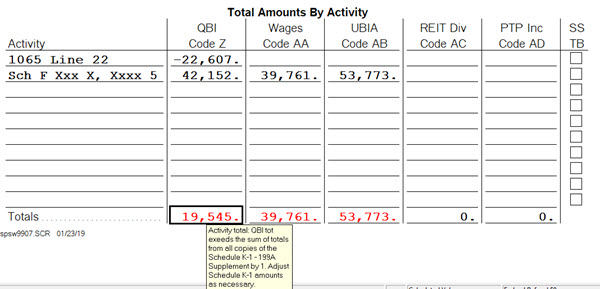

While completing a partnership, S-corporation, or fiduciary return, you may see an error on the 199A Summary Worksheet stating:

"Activity total: (Activity) total exceeds the sum of totals from all copies of the Schedule K-1 - 199A Supplement by (amount). Adjust Schedule K-1 amounts as necessary."

or

"Activity total: (Activity) total is less than the sum of totals from all copies of the Schedule K-1 - 199A Supplement by (amount). Adjust Schedule K-1 amounts as necessary."

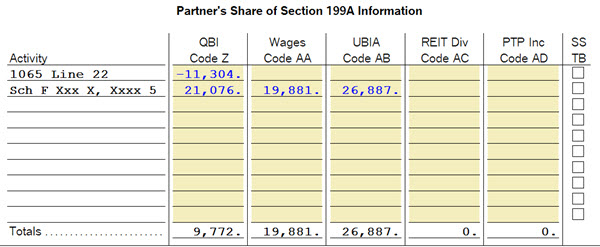

This is often caused by the way the amounts distributed to each Schedule K-1 199A Statement are rounded. To resolve the error, manually change the amounts on the Schedule K-1 199A Statement for the affected activity to reconcile with the totals on the 199A Summary Worksheet.

In the example screenshots, each partner is receiving $19,881 share of Wages Code AA, which totals to $39,762 ($1 more than the total on the 199A Summary Worksheet). Adjusting the amount of a partner's 199A Statement by the difference will reconcile the total on the 199A Summary Worksheet.

More like this

- How to enter and calculate the qualified business income deduction, section 199A, in ProSeries on Form 8895by Intuit

- "Section 179 on multiple activities being limited" error message on Individual returnby Intuit

- How to resolve ProSeries failure to license error code 4-1by Intuit

- How to Show Aggregation of Business Operations (Section 1.199A-4) in ProSeriesby Intuit