Importing documents from DMS to Lacerte or ProSeries with Tax Scan and Import.

by Intuit• Updated 1 year ago

Lacerte Tax Scan and Import and ProSeries Tax Scan and Import offer integration with Document Management System (DMS).

Before you start:

- Your DMS version must be 11.0.0 or higher to take advantage of this efficient combination.

- Your client must be exported to DMS before you submit a document for processing, even if you select a source document file from a folder outside DMS. In the event that your new client isn't in DMS yet, Tax Import will remind you when you select the client and choose Submit Source Documents from the Import menu.

To submit the scanned document:

- Open the tax return.

- From the Import menu, select Tax Import, then Import Client Data from Scanned PDF.

- On the Import From Scanned PDF wizard, select Continue.

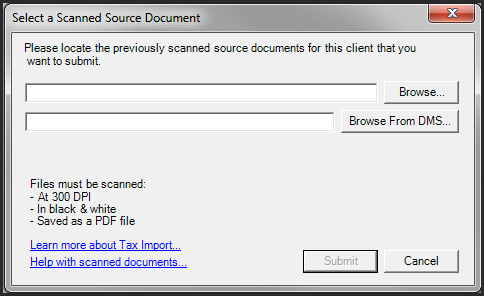

- Select the Browse From DMS button.

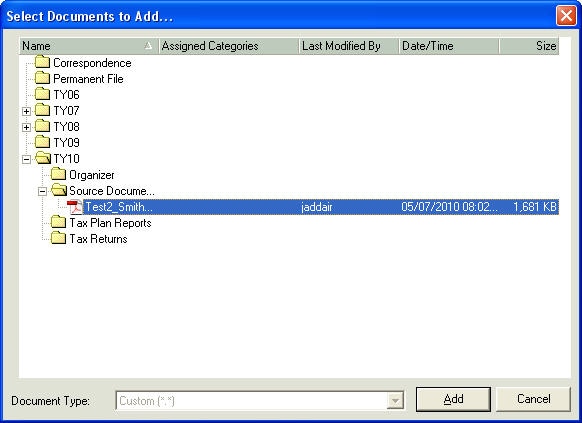

- When selecting Browse From DMS, a window will open directly to the selected client's DMS folder.

- Select the file to be submitted to Tax Import and select Add.

- Select Send to submit the data.

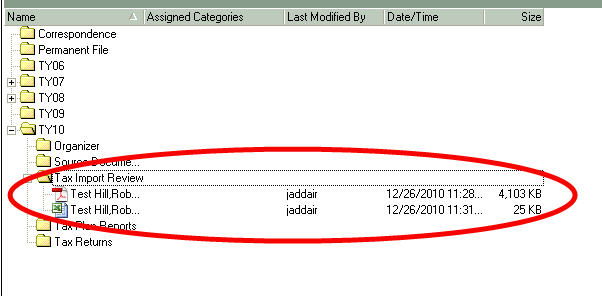

When Lacerte Tax Import or ProSeries Tax Import processing is completed, and you import the data into your client's return, Tax Import will automatically write the PDF and XLS review files directly to your clients DMS folder. The review files will remain in a folder labeled Tax Import Review.

All of your client's information can now be located within their DMS folder, giving you the ability to quickly and efficiently manage all related tax information.