- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Re: ROTH IRA

ROTH IRA

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

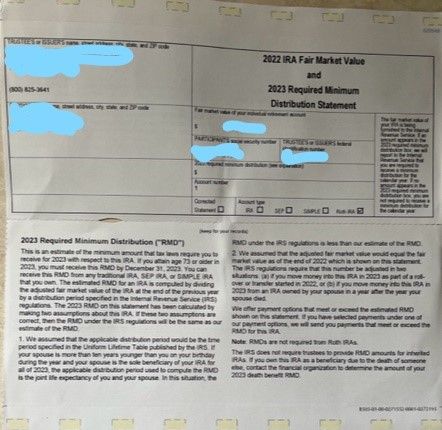

my client received this for her taxes (below). She puts money in this IRA with her self employment salary and say's she told the bank she would like to pay the taxes every year. Is there a certain place I need to add this? Do I need to remove this from her total income? How is she to pay the taxes on this or do I even need to add this?

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Self-employed don't get paid through payroll; it's not Salary.

"he told the bank she would like to pay the taxes every year"

There are no taxes. What is that in regards to? Is that Form 5498?

"Do I need to remove this from her total income? How is she to pay the taxes on this or do I even need to add this?"

What are you asking about: RMD? How old is your client in 2022? There is no Roth RMD rule.

Perhaps you need to read about the differences in retirement accounts and Required Minimum Distributions.

Roth IRA is where you put in after-tax money, and then distributions are tax free, as long as the various rules are being met (age, length of time there has been a Roth account in existence, amounts contributed vs converted, etc).

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have read on this and she doesn't have to report this on her tax return. Roth IRA are funded after tax dollars, means she pays the taxes as she deposits the money into the account, so when she is able she can withdrawal tax free if she qualifies to the RMD rules. Roth contributions aren't tax deductible, and qualified distributions aren't tax income.

thank you 🙂

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"I have read on this"

This, what? You never answered if that is Form 5498? When you ask in a discussion community, it helps to follow up with the people trying to be helpful.

If that is a Form 5498, it is only informational. It would be how you, the professional tax preparer, confirm (do your due diligence) that the taxpayer contributed what they told you, how they told, and to which account type that they told you, and you confirm they also are eligible to do what they did, or would need to take corrective action.

It's not a Tax Filing form. It's proof of activity.

Don't yell at us; we're volunteers