Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Tax year 2025 individual e-filing is now open. For resources to help start your tax season check out Hot Topics for ProSeries | Lacerte | ProConnect

Tax year 2025 individual e-filing is now open. For resources to help start your tax season check out Hot Topics for ProSeries | Lacerte | ProConnect

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Re: IRS Generosity

IRS Generosity

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

BobKamman

Level 15

03-27-2024

11:06 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

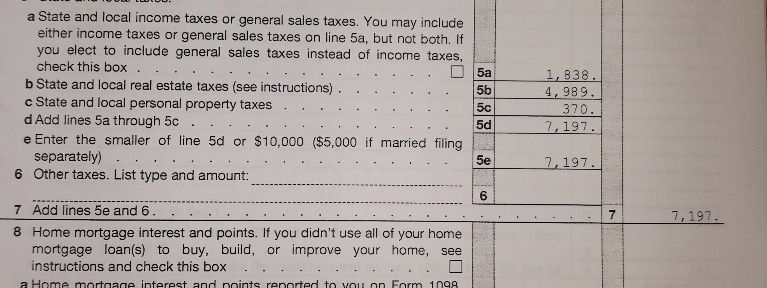

Client received a letter that they had made a mistake on “taxes” part of last year’s Schedule A. This is what they filed:

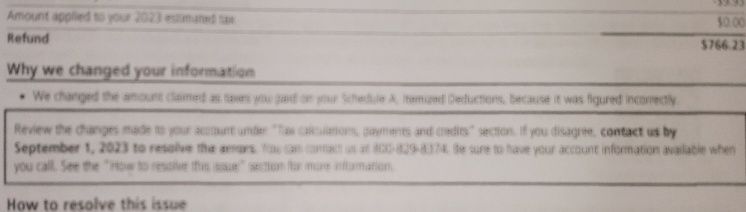

This is what the IRS notice said:

What they did, was allow $10,000 for total taxes, because that’s what most people claimed, and didn’t look at the numbers that added up to less. They reduced taxable income by exactly $2,803, resulting in a refund of $766 including interest.

This return has everything – Schedules A, B, C, D, and donation of publicly traded stock. This year’s fee came out to $750. But basically it’s free, because paper filing last year resulted in an unexpected refund.

4 Comments 4