- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Q5 of Recovery Rebate Worksheet - Is this Accurate?

Q5 of Recovery Rebate Worksheet - Is this Accurate?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

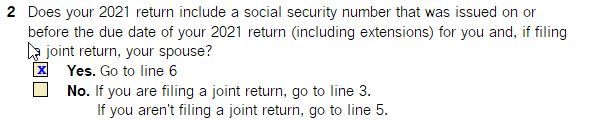

Can someone help me understand why for question 5 of the recovery rebate worksheet, the taxpayer with SSN, who lived in the US entire year will not qualify to claim the rebate if he/she has dependents with no SSN. When I check "No" to this question, all figures disappear. In fact, it says "stop, you cannot take the credit".

My question is does stimulus check 3 require dependents to have SSN for taxpayers who have SSN to qualify to claim the rebate? That is what this question appears to suggest. Taxpayer has SS, but dependents are yet to apply for ITIN and when I answer no to this question, taxpayer loses the rebate. Is this accurate?

Also, spouse just arrived in the US in December, can the rebate be claimed for the spouse?

Any help will be greatly appreciated.

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You can google:

eip 3 irs

And then read all the IRS reference, FAQ, and even go through the interactive wizards for these things.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you so much for your response. Actually, I have read all of the FAQs and other legibility requirements and did not find any information on the scenario I am describing here.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You missed reading something on Line 2.