- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Where is $3,000 health insurance premium exclusion related to the Pension Protection Act of 2006 entered for public safety officials? TIA!

Where is $3,000 health insurance premium exclusion related to the Pension Protection Act of 2006 entered for public safety officials? TIA!

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ooh, here's a nice pdf:

https://www.socxfbi.org/common/Uploaded%20files/Membership/TaxDeductionForPSOs.pdf

"The distribution must be from a retirement plan maintained by the

employer from which the taxpayer retired as a public safety officer and

cannot be from some other retirement plan."

https://www.irs.gov/pub/irs-pdf/p721.pdf

Go to "Distributions Used To Pay Insurance

Premiums for Public Safety Officers"

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

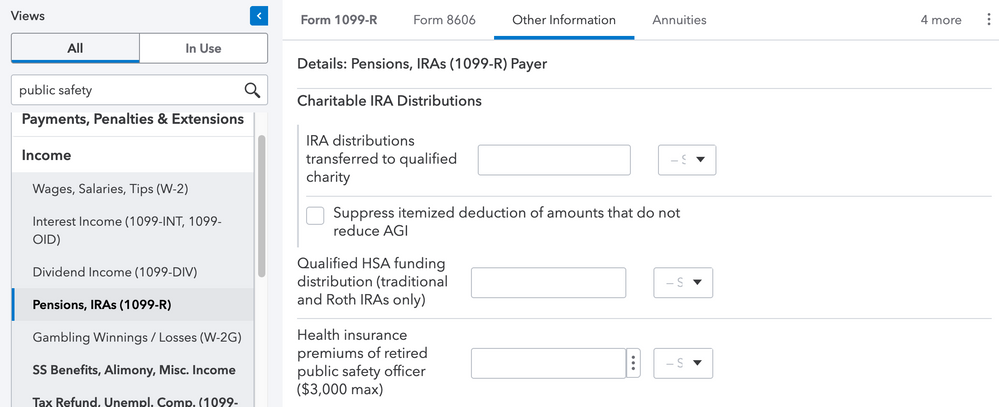

You can enter that on the 1099-R screen. Select the "Other Information" section along the top, and scroll down a bit until you see this field:

- Rebecca

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client who was a firefighter. Here's the situation:

1) He's getting a pensions from that job, but no health insurance premiums are being paid out of that pension.

2) However he also worked for the TX Highways dept and insurance premiums were paid out of that pension.

Even though it's not the related pension that is paying his health insurance premiums, can he make use of that credit because he was a Public Safety Officer?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are the payments being made pre tax or post tax?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's part of his taxable pension income.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Pub 575:

"you can elect to exclude

from income distributions made from your eligible retire-

ment plan that are used to pay the premiums for accident

or health insurance or long-term care insurance. The pre-

miums can be for coverage for you, your spouse, or de-

pendents. The distribution must be made directly from the

plan to the insurance provider."

So, no. Doesn't qualify.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ooh, here's a nice pdf:

https://www.socxfbi.org/common/Uploaded%20files/Membership/TaxDeductionForPSOs.pdf

"The distribution must be from a retirement plan maintained by the

employer from which the taxpayer retired as a public safety officer and

cannot be from some other retirement plan."

https://www.irs.gov/pub/irs-pdf/p721.pdf

Go to "Distributions Used To Pay Insurance

Premiums for Public Safety Officers"

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you. That certainly clears it up.