- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Working on a 1031 exchange of land. I can't get the gain to show as deferred. What am I missing?

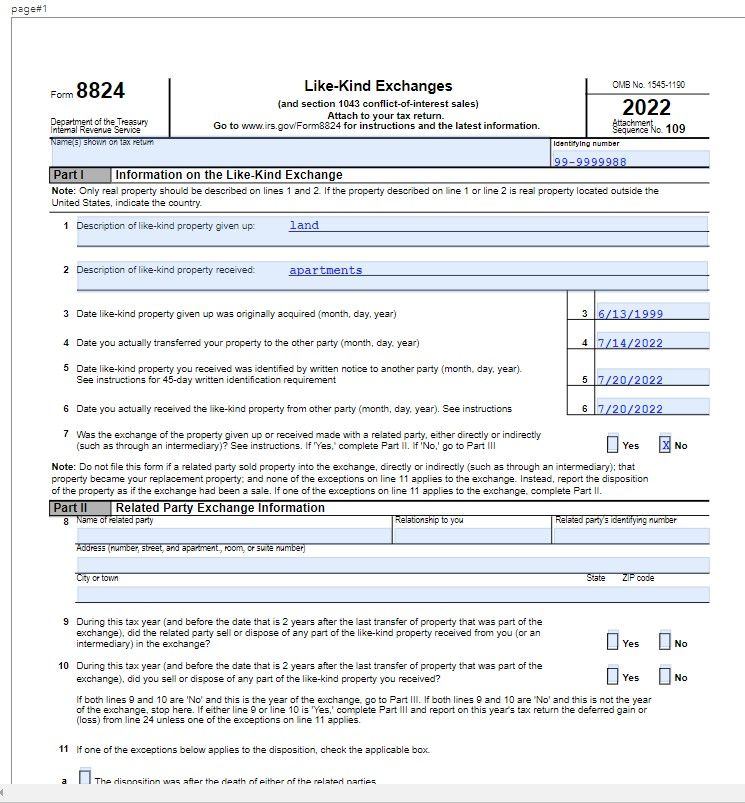

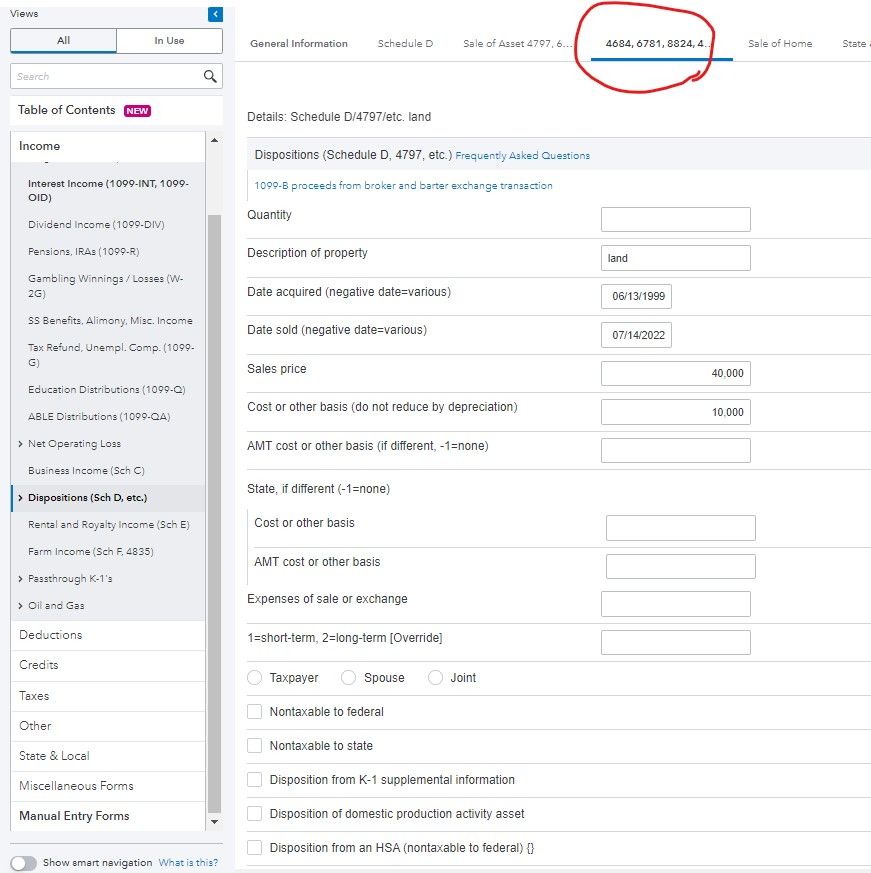

Working on a 1031 exchange of land. I can't get the gain to show as deferred. What am I missing?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, land sold was 40 with a cost of 10 and land purchased was 165.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I always have trouble with this form in the software.

I fill it out by hand, then go back to the software and fiddle around with the input til it's correct.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you figure this out? I have a 1031 exchange where raw land was sold in exchange for a rental. Where did you enter this? I keep receiving a critical diagnostic error to check and make sure that it qualifies as a 1031.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have not **bleep** ProConnect for this filing and mail in the return. I am disappointed as it seems there should simply be a checkbox that confirms that it qualifies for 1031 exchange.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That was strange. I didn't say bleep. I said I may not use ProConnect for this filing. hmmmm

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Intuit censors the weirdest words. If you want to use one you need to be sneaky to say C R A P and not get it bleeped. On the other hand you put too many letters in but and it it gets to be butt and the inevitable happens.

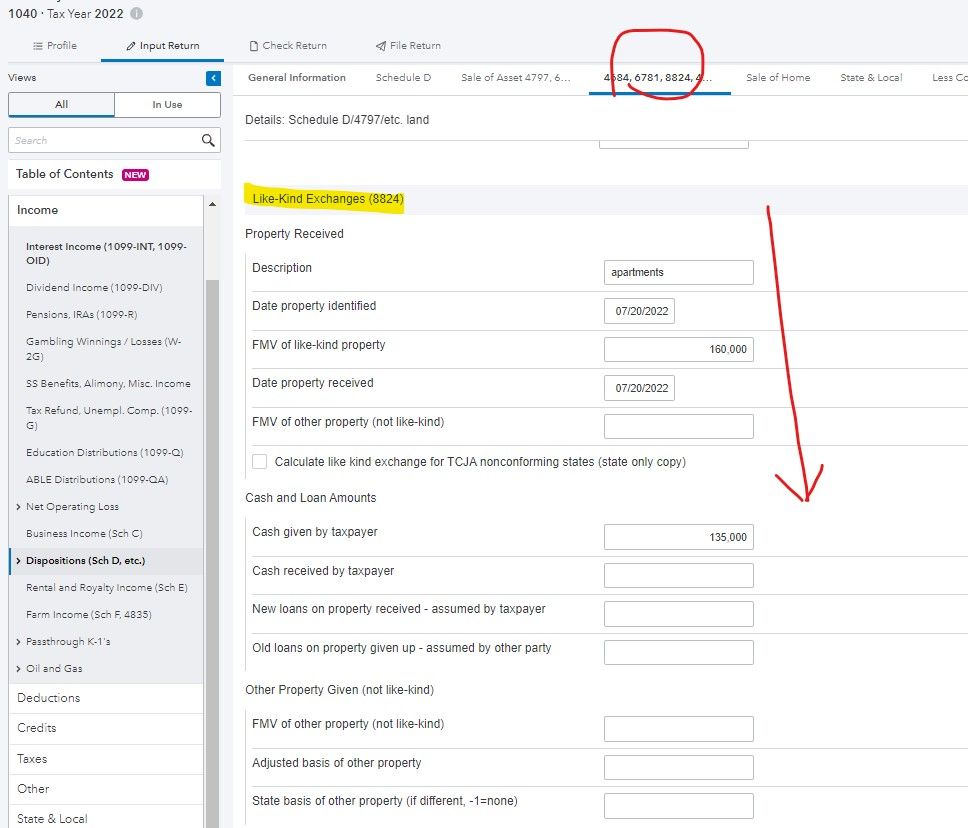

Form 6252 can be gotten - I like to show in pictures

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you - I will pick through in a few minutes, as I must be missing something simple. I have completed as you have shown. I am certain to find some little thing I did wrong that throws it into gain instead of deferred gain. Thanks again.