- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Where is the input for Qualified business net (loss) carryforward from prior years for Form 8995-A Sch C

Where is the input for Qualified business net (loss) carryforward from prior years for Form 8995-A Sch C

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Client converted to PTO. Where is the input field for line 2 (Qualified business net (loss) carryforward from prior years) on Schedule C of Form 8995-A

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

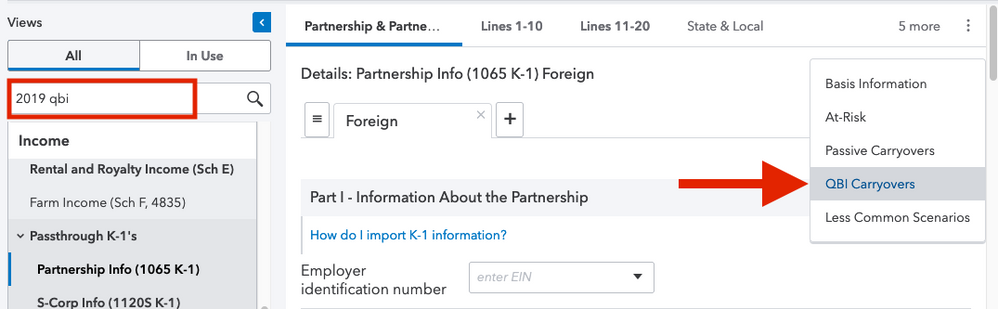

QBI carryovers are tracked by activity in PTO, so the input will vary based on the type of income the carryover is associated with. If the carryforward is from a partnership K-1, the entry is on the "Partnership Info (1065 K-1)" screen, under the section for "QBI Carryovers":

On some other types of activities like a Sch C, it's grouped with prior year unallowed passive losses under "Less Common Scenarios". The fastest way to find the right spot is to search for "QBI" or "2019 QBI" on Input Return, which will let you jump right to wherever the field is for various types of income.

If you're seeing an amount on the 8995-A Sch C line 2 already, and want to find where it was entered, click the "In Use" button right above the search, and type in the dollar amount you're trying to hunt down.

- Rebecca