- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

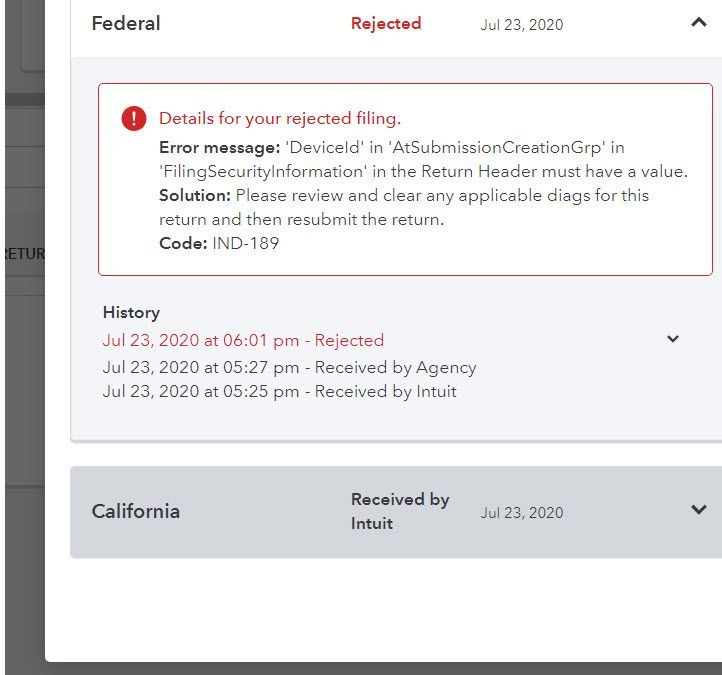

- Re: What is code: IND-189 for a 1040 IRS rejection?. I can't find that code anywhere and I don't understand the explanation in ITO.

What is code: IND-189 for a 1040 IRS rejection?. I can't find that code anywhere and I don't understand the explanation in ITO.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thats a hard one to dig up, youre sure 189 is the number? do you have a casualty loss in the return?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello Lisa

This is what I got

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From IRS Pub 1345 I believe it has something to do with IP address of the computer

Internet Protocol Information

Internet Protocol (IP) information of the computer the ERO uses to prepare the return (or originate the

electronic submission of collected returns) must be included in all individual income tax returns. The

required Internet Protocol information includes:

• Public/routable IP address

• IP date

• IP time

• IP time zone

With many different ERO e-filing business models, the computer used to prepare (or originate the

electronic submission of collected returns) may not have a public/routable IP address. If the computer used for preparation (or origination of the electronic submission of collected returns) is on an internal reserved IP network, then the IP address should be the public/routable IP address of the computer used to submit the return. If the computer used for preparation (or origination of the electronic submission of collected returns) is used to transmit the return to the IRS, then the IP address should be the public/routable IP address of that computer. If it is not possible to capture the public/routable IP address, then the ERO or software may have to hard code the IP address into each return.

The IRS will reject individual income tax returns e-filed without the required IP address. Any return received by the IRS containing a private/non-routable IP address will be flagged in the acknowledgment File with an “R” in the Reserved IP Address Code field of the ACK key record indicating that a reserved IP address is present for the return.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!