- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Only partial payment can be made with this return. How can I request only a specific amount be paid from the bank account for each return, fed and state? Thanks,

Only partial payment can be made with this return. How can I request only a specific amount be paid from the bank account for each return, fed and state? Thanks,

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

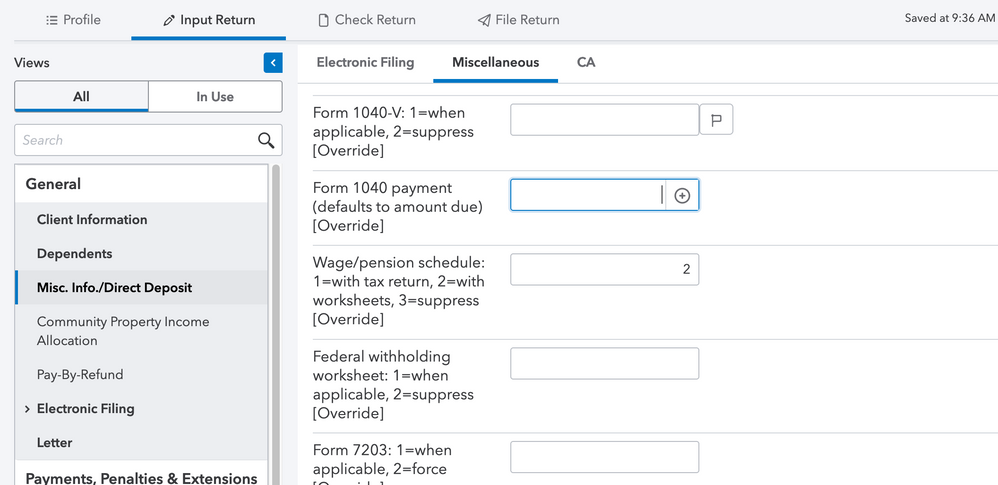

For federal, you can enter the amount your client is paying on Misc. Info./Direct Deposit > Miscellaneous, in "Form 1040 payment (defaults to amount due) [Override]"

Not all states will have a similar option, but if your state does, it will be found on the same screen by selecting the state's abbreviation along the top. If not, the client may need to pay online or by mail.

Rebecca

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Any idea how to set up a payment plan for a client who cannot pay the full amount due?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

https://www.irs.gov/payments/payment-plans-installment-agreements

OR

Just make whatever payment they can do, wait for a bill, pay what they can, wait for a bill, pay what they can, .... (This works and is simpler, especially if they can pay it off in a few billing cycles)

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Will this work for a partial electronic debit?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

❤

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

THere is no option to enter an amount on my system

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you using ProConnect or which software ?