- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: How do you enter information in the Ark only col of the Ark NR return?

How do you enter information in the Ark only col of the Ark NR return?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The input is under State & Local > AR Income, within the section for Arkansas Miscellaneous, on the line Border city exemption (1=all income) (Form AR-TX). This is a bit unusual because similar adjustments would normally be found under State & Local > Modifications instead.

If you ever get lost in PTO, you can always use the search bar to find what you need by typing in the keywords. In this case, you would have gotten 3 results under Field description.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In this case all is not exempt. I can get the adjustment correct for each taxpayer, but it combines those to show in the Ark income only space. That is not correct because some of the Ark is taxable, and it is exempting way more than allowed. Also, the itemized deductions go totally to the spouse with some taxable income and that is not correct.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you code all the income correctly and enter the correct amount for border city exemption for each spouse? If so, you should see the respective amounts reported under each spouse's column on AR1000NR and AR1000ADJ.

So long as AR1000NR is correct, AR3 will ratably allocate the correct amount of I/D to each spouse based on their AR AGI (see Lines 31 to 35).

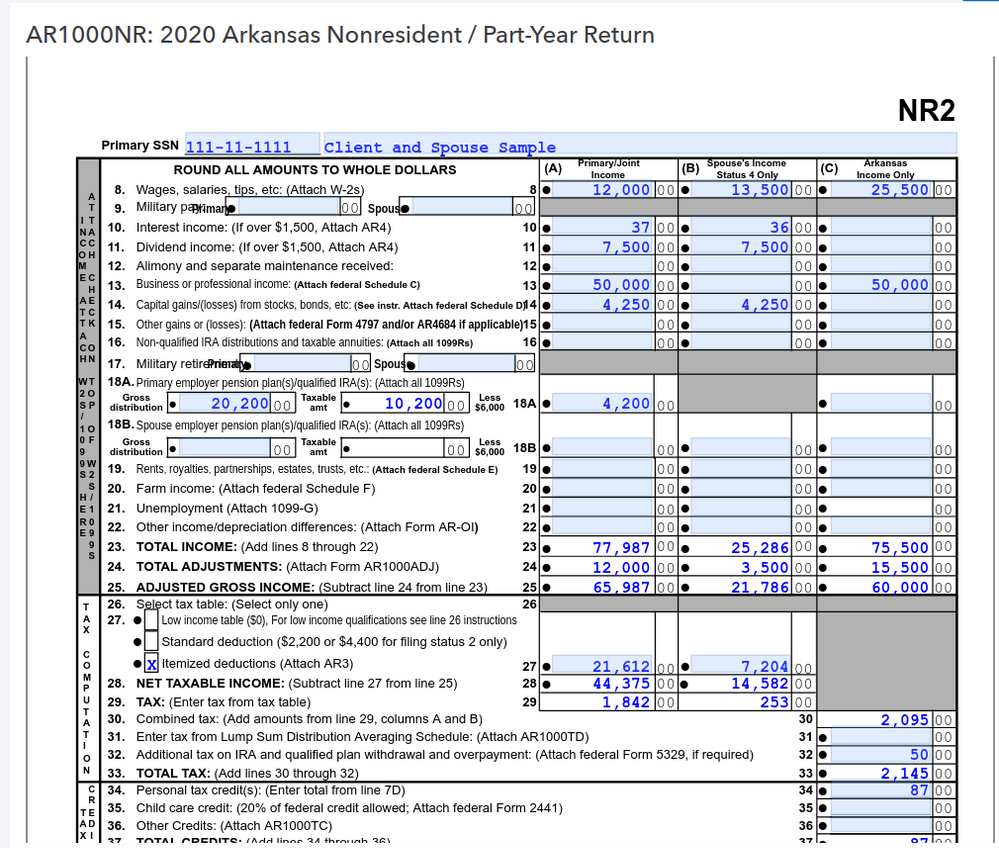

Here's a screenshot from a dummy return with border city exemptions and I/D reported to each spouse:

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

All of spouses income is exempt, all Texas, so is not in Ark col. It adds across on exemption line to include her total in exempt.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As you already see from the screenshot, you can exempt any amount you want. Check your input.

Still an AllStar