- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: How do I report partnership Schedule K-1 box 13 code W on an individual return Form 1040 in ProConnect Tax Online?

How do I report partnership Schedule K-1 box 13 code W on an individual return Form 1040 in ProConnect Tax Online?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

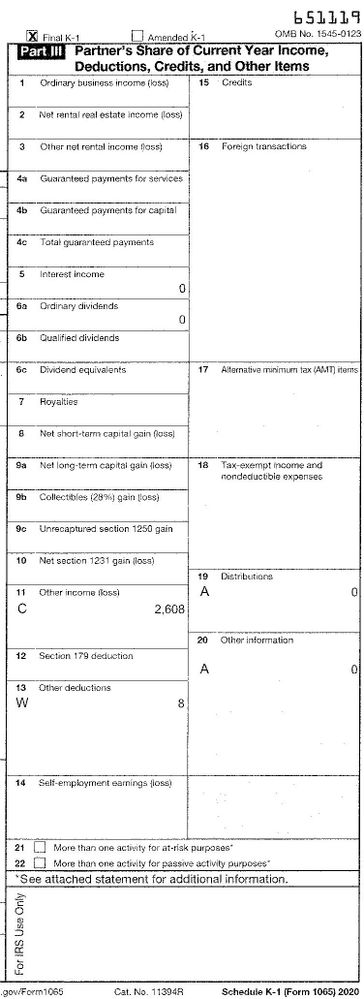

How do I report partnership Schedule K-1 box 13 code W on an individual return Form 1040 in ProConnect Tax Online? See attached photo of Schedule K-1 (Form 1065) Part III.

The general instructions with this Schedule K-1 says:

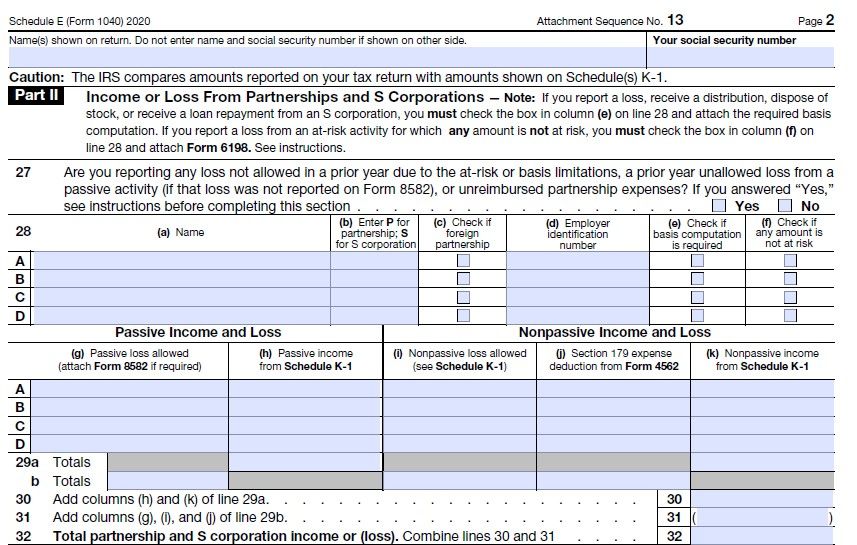

Line 13w Other deductions - Trader expenses. For individuals, combine the values from lines 11i and 13w to determine whether you have a nonpassive income or loss. Reported on Schedule E, Line 28, (i) or (k)

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Her is link for IRS instructions:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I've read the IRS instructions. The IRS instructions don't tell me where/how to input partnership Schedule K-1 box 13 code W on an individual return in ProConnect Tax.

The Intuit Accountant's Community Help Articles tells how to do it in Lacerte, but I have not found anything telling how to do it in ProConnect Tax. This is the link for Lacerte: https://proconnect.intuit.com/community/schedule-k-1/help/reporting-partnership-schedule-k-1-line-13...

Intuit Help Article for ProConnect Tax Partnership K-1 Input Box 13 has no help for code W. This is the link for ProConnect Tax: https://proconnect.intuit.com/community/schedule-k-1/help/partnership-k-1-input-box-13/00/4779

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You need to ask the partnership what it is for, as it could be for a whole host of stuff. I wouldn't lose a lot of sleep over 8 bucks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The partnership general instructions with this Schedule K-1 says:

Line 13w Other deductions - Trader expenses. For individuals, combine the values from lines 11i and 13w to determine whether you have a nonpassive income or loss. Reported on Schedule E, Line 28, (i) or (k)

For this taxpayer, yes it is only $8, but if it were $800 ProConnect Tax does not have instructions for handling this whereas Lacerte has detailed instructions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"For individuals, combine the values from lines 11i and 13w to determine whether you have a nonpassive income or loss." wins the prize for grammatically correct but uncommunicative sentence of the year. What does "combine" mean -- "add"? How does the result "determine whether you have a nonpassive income or loss"? I'll take a guess: if the sum of 11i and 13w is nonzero, you have a nonpassive loss or income to report on Schedule E, Line 28, (i) or (k), respectively. Am I right, or not?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Combine the values from lines 11i and 13w is clear to me if you also know that the partnership Schedule K-1 general instructions provided state:

Line 11i Other income - For individuals, combine the values from lines 11 i and 13w to determine whether you have a nonpassive income or loss. Reported on Schedule E, Line 28, (i) or (k).

Line 13w Other deductions - Trader expenses. For individuals, combine the values from lines 11i and 13w to determine whether you have a nonpassive income or loss. Reported on Schedule E, Line 28, (i) or (k).

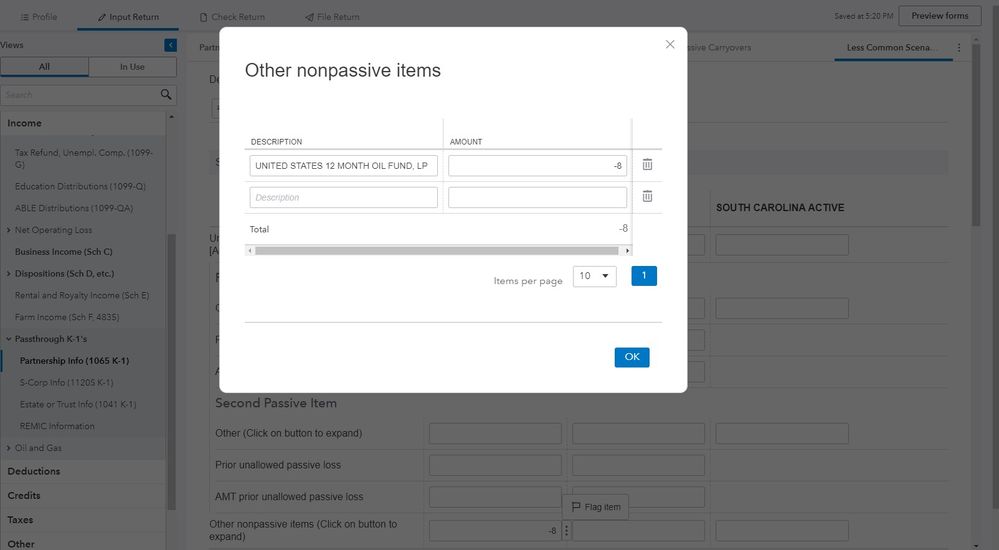

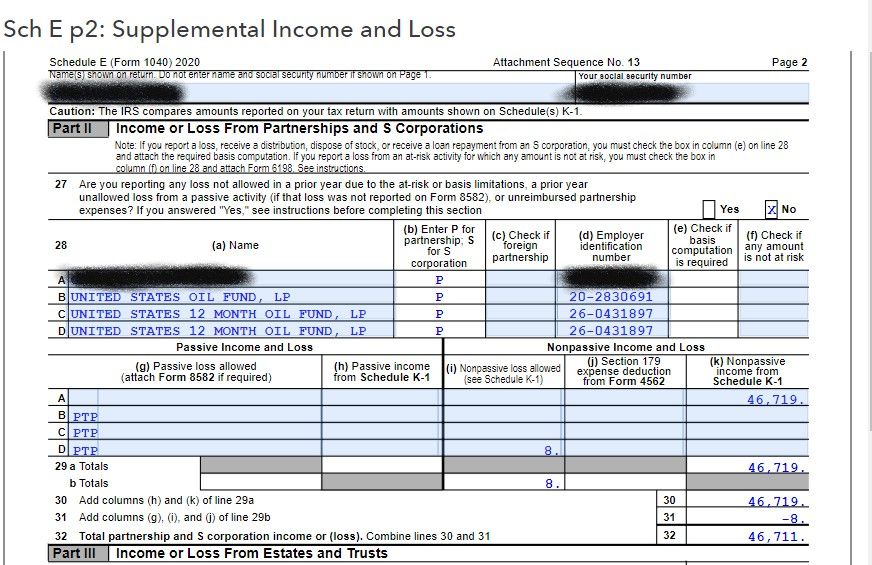

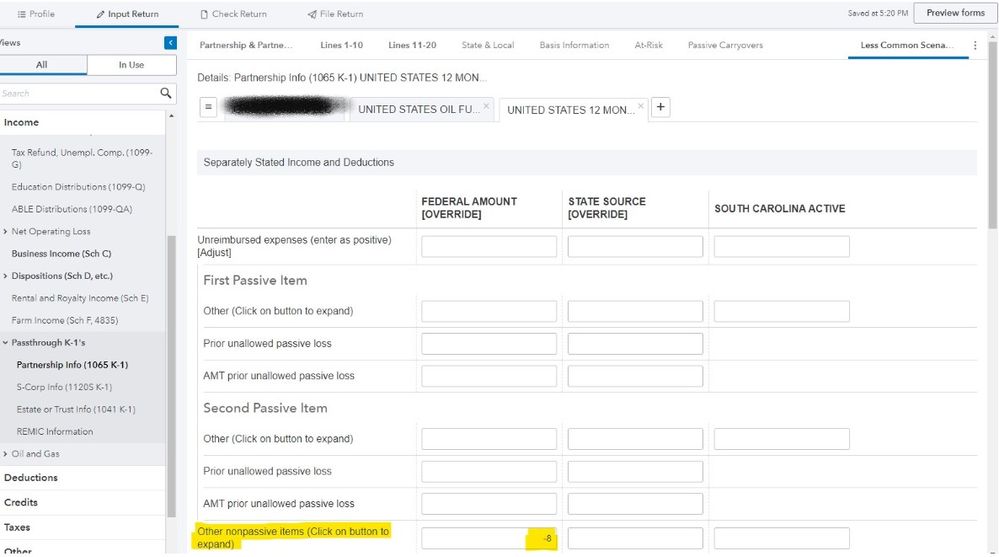

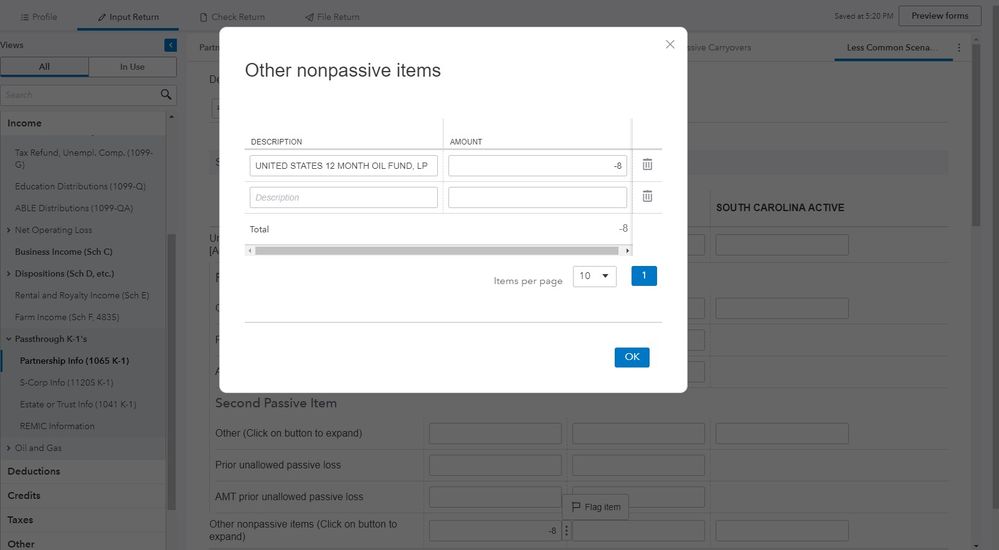

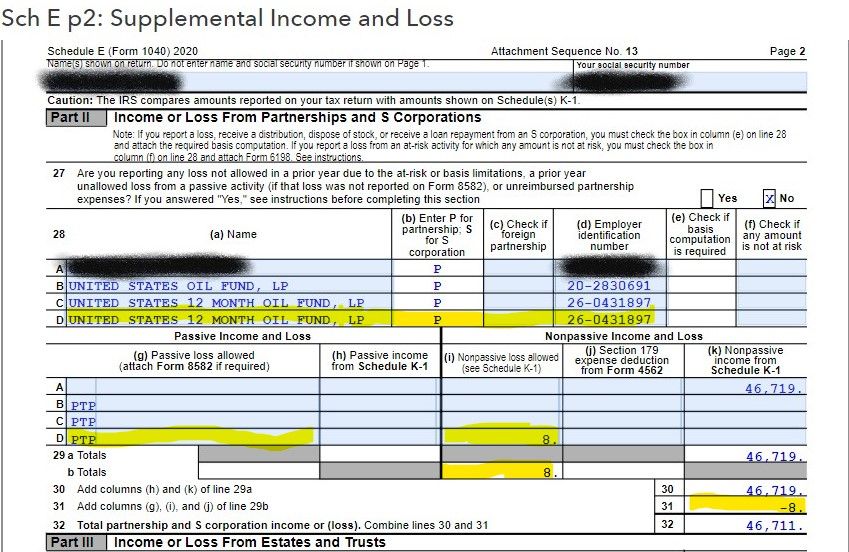

In my individual's case, when you combine zero income from line 11i and a deduction/expense of 8 from line 13w, the result is a nonpassive loss of 8 that should be reported on Schedule E, Line 28 (i).

My question is not how to determine what should be reported, but how do I enter the information in ProConnect Tax so that it is reported correctly. I found instructions on how to do this in Lacerte, but I cannot find any instructions on how to do this in ProConnect Tax.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am also looking for this info in Proconnect

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you ever figure this out? I have 158 from 13W - can't figure out the entry field that maps to 28 i or k. Any help is much appreciated. BD

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

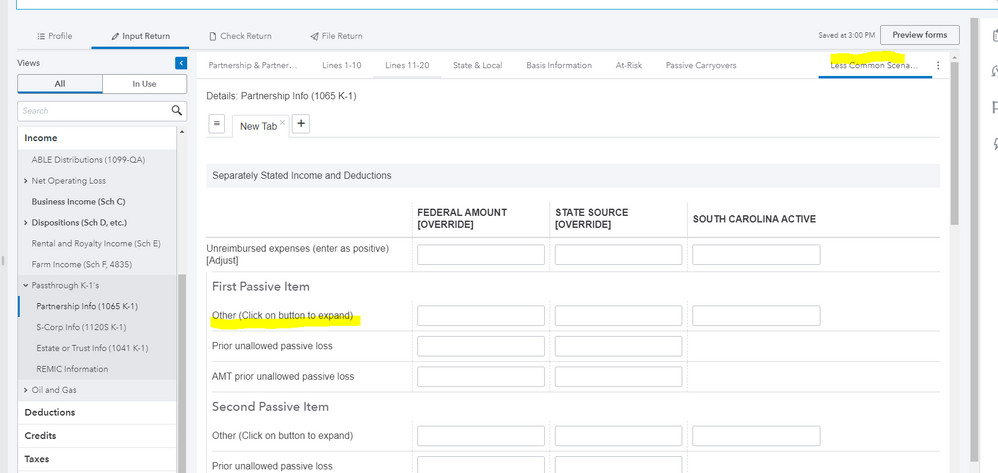

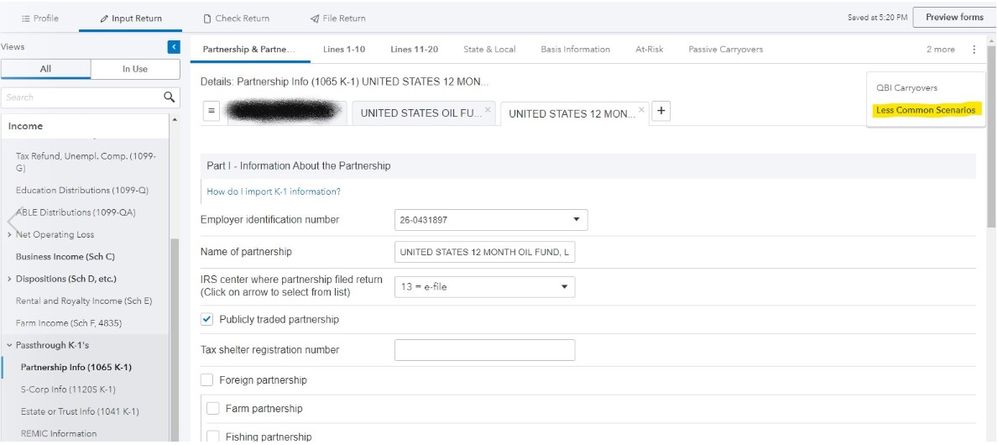

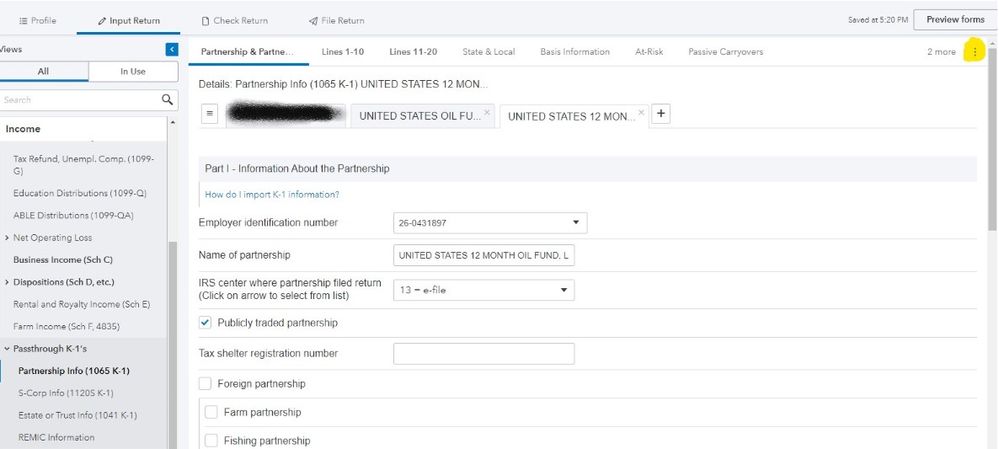

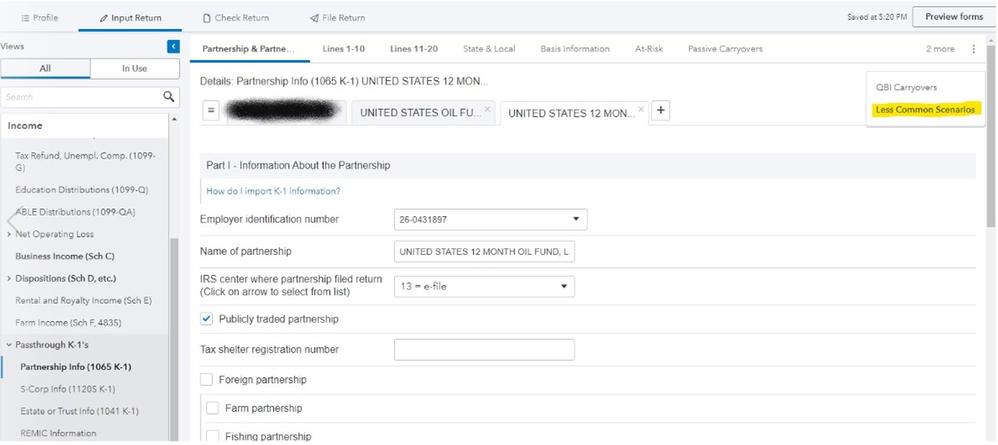

If you're looking for a similar input screen as Lacerte, this is found in "Less Common Scenarios" in PTO.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

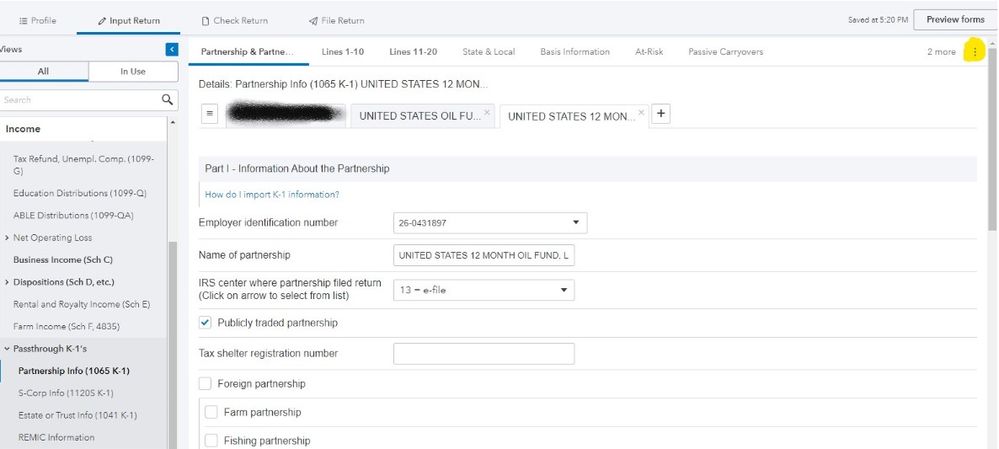

To follow the instructions referred to for Lacerte https://proconnect.intuit.com/community/schedule-k-1/help/reporting-partnership-schedule-k-1-line-13... do as @dfrycpa73 says to use the Less Common Scenarios - Try to match up this screen with the one given for Lacerte.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

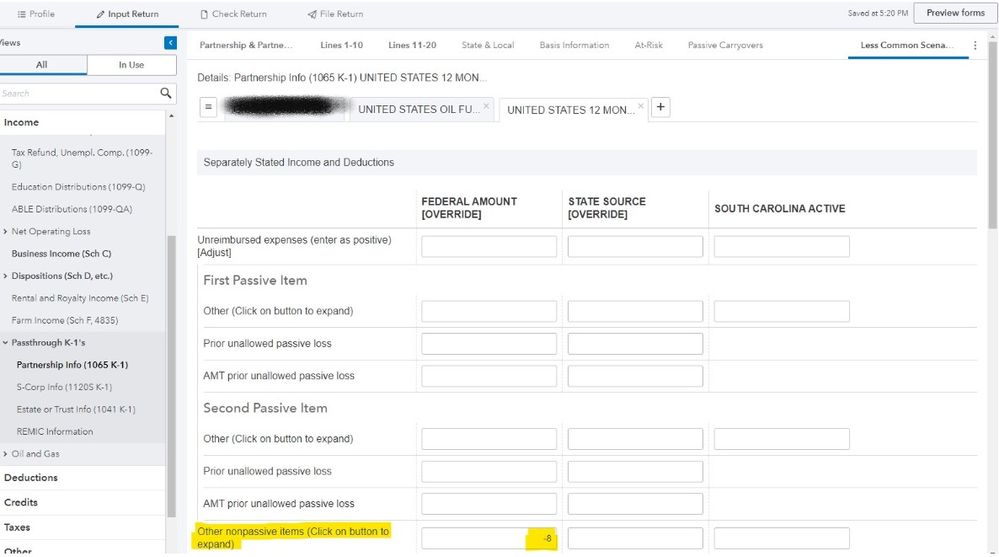

These are the steps to do this and the result on Schedule E, Line 28 (i) for my client:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

These are the steps to do this and the result on Schedule E, Line 28 (i) for my client: