- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: How do I enter the 2020 Ohio pass-through entity credit without using the Override option?

How do I enter the 2020 Ohio pass-through entity credit without using the Override option?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

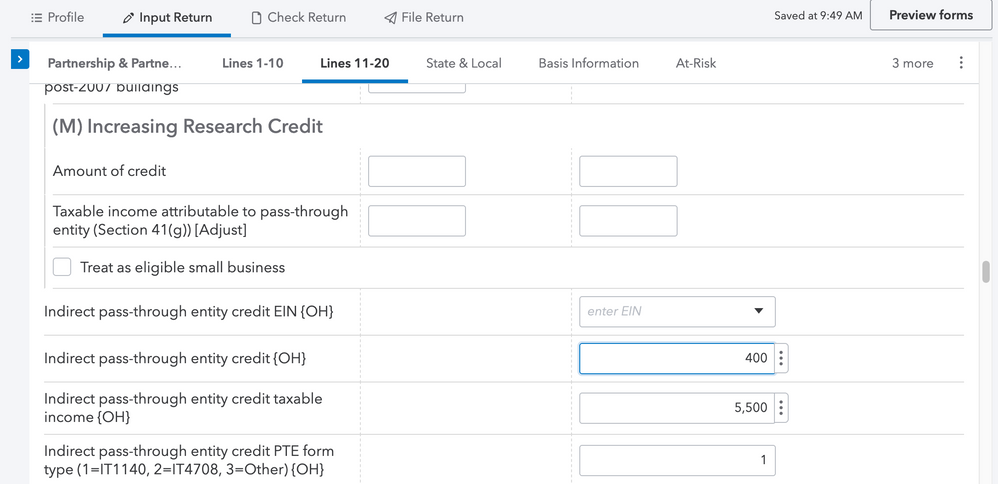

You can enter the OH PTE credit info on the Schedule K-1 input, under the "Credits" heading. For partnerships, this is in the "Lines 11-20" section:

(If the credit is from a different activity besides a partnership, just search "PTE" on the Input Return tab to find a list of other relevant fields)

If you remove the override entry and generate the credit this way, your current diagnostic should go away, and you'll see one telling you to attach the form (or indicate you're going to fax it). Once you attach the form as a PDF to the Ohio return, you should be all set.

- Rebecca