- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Hello.For a C-Corp with a Sept19' y/e, should I be using 2018, or 2019 ProConnect? Thank you so much.

Hello. For a C-Corp with a Sept19' y/e, should I be using 2018, or 2019 ProConnect? Thank you so much.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You use the 2018 program, just like last year you would have used the 2017 program.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You use the 2018 program, just like last year you would have used the 2017 program.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

use the beginning of the fiscal year to determine which tax year you will be preparing.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yep.... but the issue at hand is that there will be TWO years beginning in 2019. The short year (beginning AND ending in 2019, and then the full twelve month year beginning in 2019, ending in 2020.

Only one of those can be efiled.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I must have missed where the post mentions anything about a short tax year

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

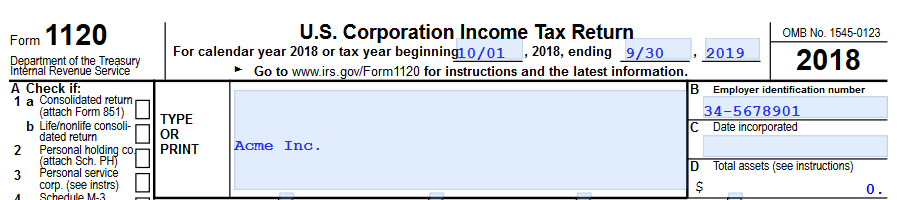

Hello again. I am now using the 2018 return to file tax year 10/1/18 through 09/30/19 and the top of the 1120 form shows 10/01/2018 through 09/30/18. Where exactly is the input field for this? Thanks so much for your help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you very much sir. I did have a 9 in there and I still get 9/2018 as the end date. I think I will just print it out, and use a PDF editor to change the dates. Again, I thank you and everyone else who has responded. Happy New Year.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@mdamato wrote:

Thank you very much sir. I did have a 9 in there and I still get 9/2018 as the end date.

Happy new year to you too!

Something is not right. I just tried and it's working fine (see attached).

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I must have missed where the post mentions anything about a short tax year

And I must have missed the point that I was posting my response in the wrong thread. Oops.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for trying. Maybe it's because I re-used the 2018 tax return, the one I filed last year with a 9/30/18 ending date? I saved a copy and re-used it.