- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Does anyone know how to code a Form 1099-NEC as QBI? I don't see a way.

Does anyone know how to code a Form 1099-NEC as QBI? I don't see a way.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Skip the 1099-NEC input section and enter the amount on Schedule C.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you, but that doesn't solve the problem. That doesn't help because I am expressly trying to avoid filing a Schedule C for a single 1099-NEC. Schedule Cs are audit flags and it seems like overkill to generate a Schedule C for a single 1099. It seems that Intuit could easily fix this problem by adding a box on the input field for a 1099-NEC that says "QBI - yes or no."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's either a business or it's not a business. If it's a business, the income goes on Schedule C "Profit or Loss From Business" and the taxpayer may be eligible for a QBI deduction for "Qualified Business Income". If it's not a business it doesn't go on schedule C and is not eligible for QBID.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree it should be on Schedule C. If you don't have any business expenses and I do NOT understand why you would not, then you can use this feature. No loved by IRS or most of those that post on this community.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Schedule Cs are audit flags and it seems like overkill to generate a Schedule C for a single 1099."

Except, that's not what you are supposed to be doing with this. The 1099-NEC was only issued because at least this one customer directly paid $600 or more for services. Your taxpayer should be reporting everything they made for their business activity, not just because of any 1099-NEC being issued. Your taxpayer could have earned $2 million, and as long as no one customer paid that directly as cash or checks to a total of $600 or more, then there would be no 1099-NEC. Does that mean your job is not to file any business activity at all? Of course not.

The 1099-NEC is called informational for a reason. That is not your taxpayer's business. That is your taxpayer's customer's piece of paper.

You're doing taxes wrong, if you really believe what you stated here.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

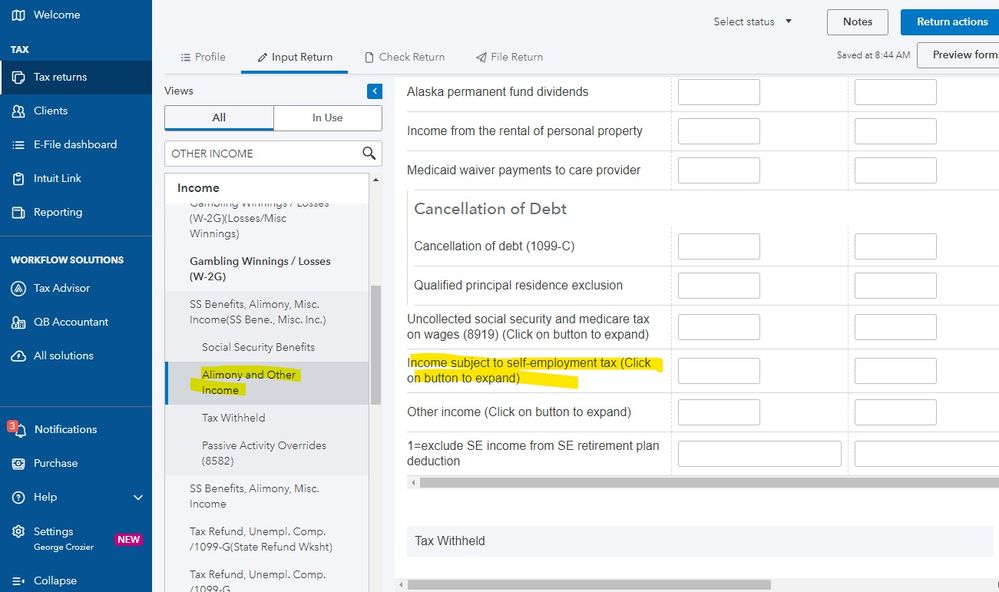

Thanks! IRS Instructions to Schedule 1 say not to report any 1099-NEC income on Schedule 1, unless it is not subject to SE tax. Intuit should probably remove the "1099-NEC subject to SE tax" from its "Other Income" input screen because you can enter numbers there, but they don't show up anywhere on the return. Kinda scary unless you have an eagle eye reviewer who catches it!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So, you are saying that the first response you received should be marked as the solution.

It is just fine to do a Schedule C with no expenses, if you can say "Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge"

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"say not to report any 1099-NEC income on Schedule 1, unless it is not subject to SE tax."

But only you know how to enter what applies to what you are doing. Your initial input described what you were trying to do is what is wrong; not the IRS or the program.

There are so many variables such as: someone helping sell something at a product show or premier event (casual labor) is not running a business for that event; clergy has various considerations; student/internship/graduate student placements; notary public and election judges; etc. Just like the Difficulty of Care W2 isn't a "real" W2. I can't even begin to list all the permutations.

If it walks like a duck, it seems to be Sched C time for you.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You are correct! So many variations. I completely agree that it is hard to generalize. Thank you for all your wise and thoughtful input.