- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Can I force the bank routing and bank account number to print on the 1040 when no tax is owed and no refund is due to taxpayer?

Can I force the bank routing and bank account number to print on the 1040 when no tax is owed and no refund is due to taxpayer?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Doesnt print on the return when tax is owed either.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No

1,111,111

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Doesnt print on the return when tax is owed either.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you must, file a paper return. It appears from IRM 3.11.3.14.3.2 the IRS will process the account details so long as they are on the form. But then, by the time the paper return is processed, the check might have already gone out.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you! You obviously know why I was attempting to file a "No tax due, no tax to be refunded" 1040 for 2018. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

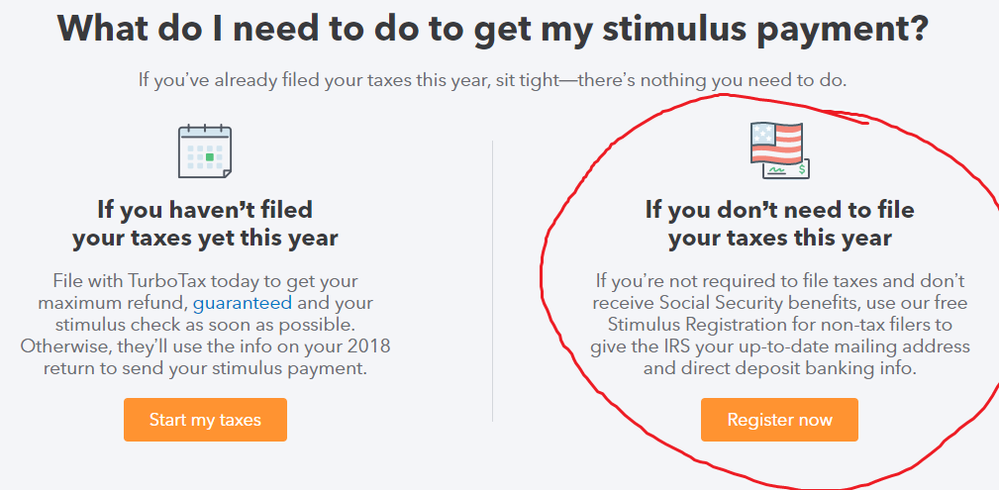

Give them this website and look for the Stimulus registration link

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's interesting that the blurb from Intuit seems to imply that the tool should only be used by folks who have no filing requirements that they should otherwise sign up for Turbo Tax .

If you don’t need to file

your taxes this yearIf you’re not required to file taxes and don’t

receive Social Security benefits, use our free

Stimulus Registration for non-tax filers to

give the IRS your up-to-date mailing address

and direct deposit banking info.What if I'm not sure if I need to file a tax return?You’re only required to file a tax return if you made over a certain income in 2019 and did not file a return in 2018. For single taxpayers under 65, the cutoff is $12,200, and for married couples filing jointly, it’s $24,400. It’s higher for people 65 and older, as well as those who qualify as head of household. See here for full details. Social Security beneficiaries who usually do not need to file a tax return, still will not need to file a tax return.

Otherwise, if your income was under the cutoff for your situation, you don’t need to file a full tax return this year. However, you still qualify for a stimulus check—use our Stimulus Registration for non-filers to ensure the IRS has your most up-to-date info.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

what that mean?

so if I have no income I will receive the stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That means if your client, who needs to file a return but just hasn't yet, uses Turbo Tax Stimulus Registration, he/she may unwittingly be filing a nil return (see https://proconnect.intuit.com/community/proseries-discussions/discussion/re-direct-deposit-for-stimu...). Intuit should be more transparent about what it is and is not. If they can say that $1 is added here and there in the submission, why can't they say whether that amounts to filing a return (or not)? Hope it is not but if it is, I see trouble brewing...

In case your client is due a refund on the 2019 return and it is e-filed now, the direct deposit will get to the IRS. Otherwise, your client is probably better off waiting for the IRS to roll out its own portal for direct deposit submission.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client never worked in 2018 or 2019 and he wants me to file his return with $0 income to get the stimulus check.

can i do that? how?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you don't have a filing requirement (and dont get Social Security) you can wait for IRS to open their registration portal for people without a filing requirement to sign up for the economic recovery payment.....or register now through the Turbotax registration portal. Once IRS opens their portal Intuit will funnel the registration info to them, since the IRS portal will be slammed and wont be able to handle the traffic.

Scroll down to the Register now button:

https://turbotax.intuit.com/stimulus-check/

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can you clarify if the bank info is submitted if e-filed on a nil/$1 return? Obviously when printing its XXXXX'd.

Using the IRS/free efile is not an option for our client.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, banking info would not be submitted if youre filing a zero return.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for your reply. The bank information does not go to the IRS for a zero balance due, zero refund due tax return. In the end, it did not matter; the taxpayer did not qualify to receive the stimulus check as he was over eighteen and claimed as a dependent on another taxpayer's return.