- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: 1099-R Ohio return

1099-R Ohio return

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

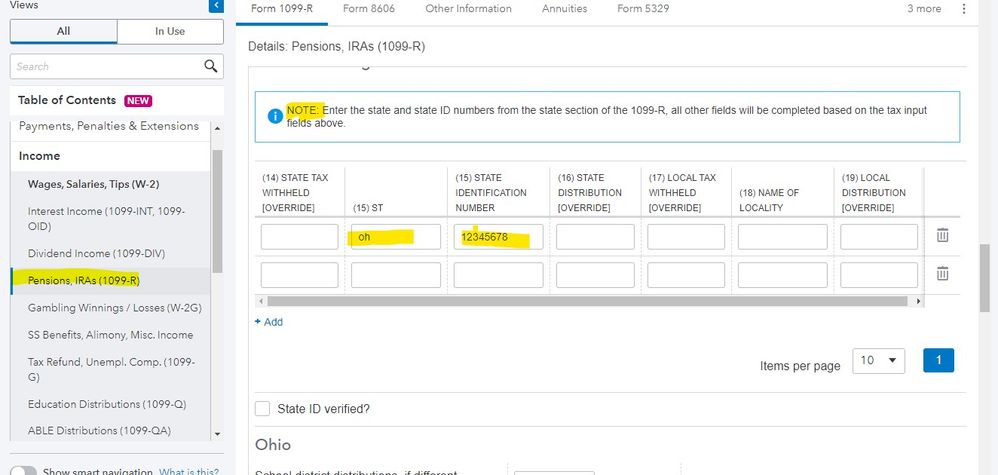

1099-R information entered is not flowing into my client's Ohio IT WH Schedule of Ohio Withholding. It appears in the IT1040 totals for tax liability. This is creating a diagnostic error preventing me from efiling the return. I have checked everything 20 times and all the state information is entered properly in the 1099-R section. Error reads: 1099-R #1 : For electronic filing purposes, when there is an Ohio State Abbreviation entered,the following fields must be present: Ohio withholding,State ID, and state distribution amount.

Anyone out there have a resolution? Could it be a programming error in the system?

Any help would be greatly appreciated.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@RMP wrote:

1099-R information entered is not flowing into my client's Ohio IT WH Schedule of Ohio Withholding. It appears in the IT1040 totals for tax liability.

The SIT will flow to IT WH so long as you code the amount to OH under the "State and Local" section for (14) State tax withholding. You may like to check your entries again.

This is creating a diagnostic error preventing me from efiling the return. I have checked everything 20 times and all the state information is entered properly in the 1099-R section. Error reads: 1099-R #1 : For electronic filing purposes, when there is an Ohio State Abbreviation entered,the following fields must be present: Ohio withholding,State ID, and state distribution amount.

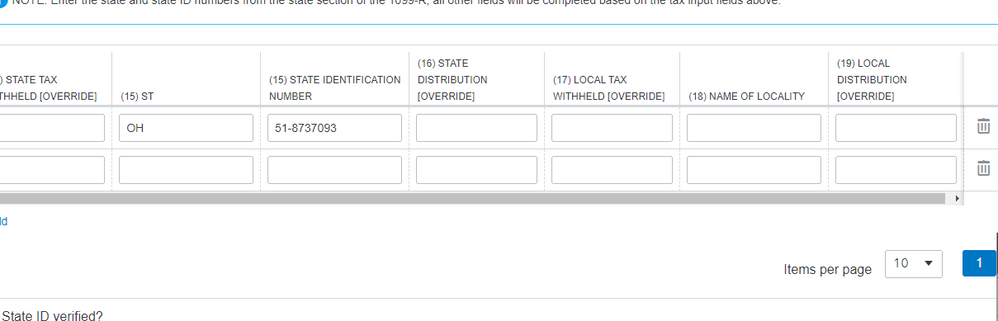

You need to make your entries exactly as the diagnostic instructs you to do. Once you input the following under the "Electronic Filing" section, refresh the diagnostic and you will find it cleared:

(15) ST: Enter OH

(15) State Identification Number: Enter exactly that

(16) State Distribution [Override]: There is no need to make any input so long as you have coded (1) Gross distribution to OH and you have no reason to override that amount.

Have check that it's working fine. If you still have problems, please come back with more details. Provided this solves your problem, please mark this a solution to help others who may have similar questions.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have entered entered #15 exactly as shown on the 1099-R with OH and the state ID number. I did not override the the gross distribution as it was the same as the federal. There was no state tax taken out so I entered 0 in box #14. I still receive the "critical diagnostic" code after refreshing. I tried deleting and reentering and that did not work. I have done many 1099-R for other states and never had this problem.

Any other suggestions would be greatly appreciated.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can you upload redacted screenshots of your input?

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just to be sure = When you click details, this is the ONLY entry you have made

.DO NOT ENTER ZERO

FYI:Zero is a nothing and totally worthless in ProConnect. If you really need a ZERO then use negative one (-1). Weird, but it works

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

See the screenshot ... I deleted the 0 and refreshed and I still get the message and it doesn't flow over.

I will try tech support.