- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- ProConnect How to enter Maryland Form 502 505

ProConnect How to enter Maryland Form 502 505

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

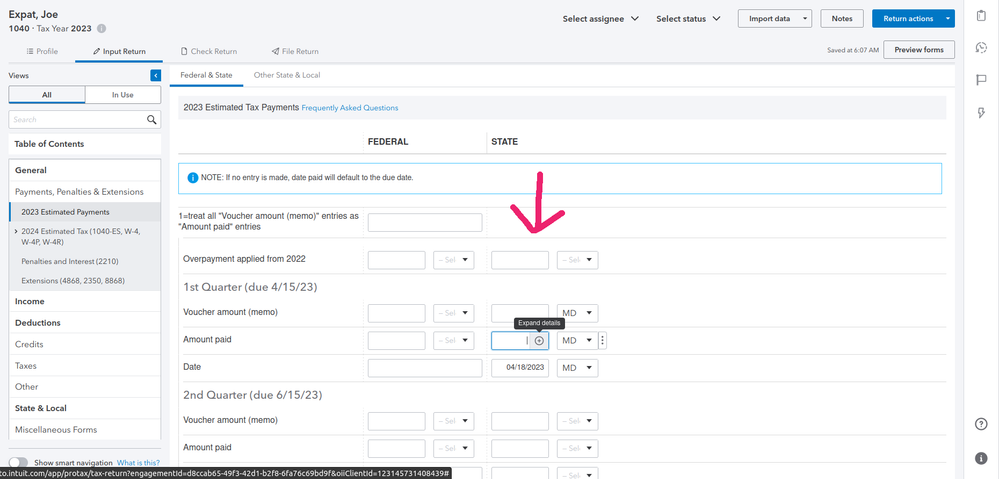

Clients have four estimate quarter MD state tax vouchers https://www.marylandtaxes.gov/forms/current_forms/PV.pdf

How to enter them in ProConnect? Thank you!

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You enter the details for ES-tax payments under General > 2023 Estimated Payments. This is the input screen you use for both federal and state payments.

If your client has multiple states or had made multiple ES-tax payments for the same quarter on different dates, you can click on the + sign on the right of the field (where you see Expand Details prompt in the screenshot below) to open the pop-up that will allow you to make entries on multiple lines.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Short cut - shall I just add to a fake W-2 as withheld state tax?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You enter the details for ES-tax payments under General > 2023 Estimated Payments. This is the input screen you use for both federal and state payments.

If your client has multiple states or had made multiple ES-tax payments for the same quarter on different dates, you can click on the + sign on the right of the field (where you see Expand Details prompt in the screenshot below) to open the pop-up that will allow you to make entries on multiple lines.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As always - THANK YOU Yoda master!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

NP, @TaxPandaCPA!

Still an AllStar