- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Line 8 form 8606 is blank even though I have entered the amount under "Conversions to Roth IRA". Help! What am I doing wrong :(. No tax on the conversion too.

Line 8 form 8606 is blank even though I have entered the amount under "Conversions to Roth IRA". Help! What am I doing wrong :(. No tax on the conversion too.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

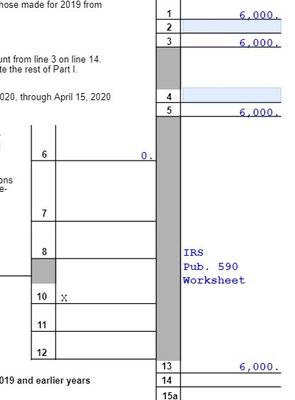

In the Pensions screen for the distribution, did you check the box for Line 7 (IRA)?

Was there any prior year IRA basis?

Assuming yes to 1st question and No to second, you should get something like this

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In the Pensions screen for the distribution, did you check the box for Line 7 (IRA)?

Was there any prior year IRA basis?

Assuming yes to 1st question and No to second, you should get something like this

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You are awesome and I am an idiot! Yes, I checked the box for Line 7 and there was no basis. My return looks exactly like yours. I just read the instructions wrong and thought the amount converted to a Roth IRA via a backdoor conversion was reported on line 8. Thank you so much and sorry to take up time being a dummy!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There would be no tax on conversion, because that's the point of "backdoor Roth." It is, in fact, a regular conversion. The function works because all funds in Traditional IRA are only basis, and when that is converted before there was time for any earnings, there is no tax on that conversion. That's why it is allowed and that's why it is called backdoor.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Having similar issue- not sure where the line 7 in pension area is..

did you need to change anything or was the original setup correct?

first time doing backdoor roth and line 8 on 8606 is blank but think it should have something there based on language, no? Never had traditional Ira before the conversion happened- same month and year

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"not sure where the line 7 in pension area is"

Try these articles for reference:

"Having similar issue"

Based on what you told us, your taxpayer has a taxable conversion; not a backdoor conversion.

"Never had traditional Ira before the conversion happened- same month and year"

By definition, a conversion (even if backdoor) starts from funds in a Traditional. The issue comes from whether there is any "never taxed" amount in that Trad (Trad IRA, SEP IRA, SIMPLE IRA are aggregated). If so, you have a pro rata tax condition that has to be computed.

"first time doing backdoor roth and line 8 on 8606 is blank"

Backdoor Roth is when you have only nondeducted amounts, only as basis, in the pre-tax account type. The conversion is not taxable because those are post-tax funds, already. Any amounts (previous or current year deductible contributions, any earnings) that are still tax deferred create a pro rata conversion. That's not really a Backdoor. It's simply a conversion. That's why line 8 would have something in it. That section is to compute the percentage Basis to full value, and then that percentage gets applied to the conversion, to deduct previously taxed percentage and end with the taxable conversion percentage.

Don't yell at us; we're volunteers