Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- I created a tax return for a client from last year through prior year tax year, Create Return. Form 114

I created a tax return for a client from last year through prior year tax year, Create Return. Form 114

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

T-Town-CPA

Level 4

04-09-2023

06:33 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I created a tax return for a client from last year through prior year tax year, Create Return. On the opening Q&A by ProConnect asked to provide Form 114 for taxpayer and Spouse and inadvertently selected for both. They do not have foreign income tax. Processed the return and a Critical Error is identified because they don't have Foreign Income. How do I unselect that check box to make the critical error go away? Thank you in advance.

Best Answer Click here

Labels

1 Best Answer

Accepted Solutions

T-Town-CPA

Level 4

04-10-2023

05:26 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found the resolution -- Client Profile>Uncheck Form 114.

Complete. Thank you

3 Comments 3

George4Tacks

Level 15

04-09-2023

09:31 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

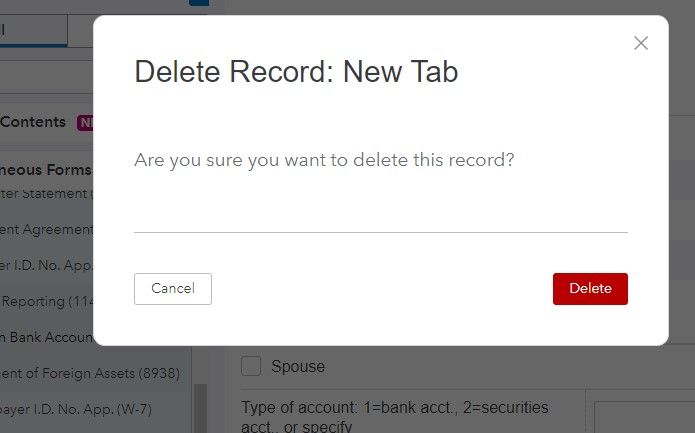

You have a 114 that you want to disappear? Find that tab and look at the tab. There is a faded x sitting there. What happens when you click that x?

Answers are easy. Questions are hard!

T-Town-CPA

Level 4

04-10-2023

05:13 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for your quick response! That is what I was expecting, but did not see on the Form 114 for my clients -- The form screens are completely blank and I don't see a check mark to remove the form, or a way to change ProConnect from expecting something that is not there. I would appreciate your next thought so that I can file my client's return.

Thank you,

T-Town-CPA

Level 4

04-10-2023

05:26 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I found the resolution -- Client Profile>Uncheck Form 114.

Complete. Thank you